Oil Context Weekly (W41)

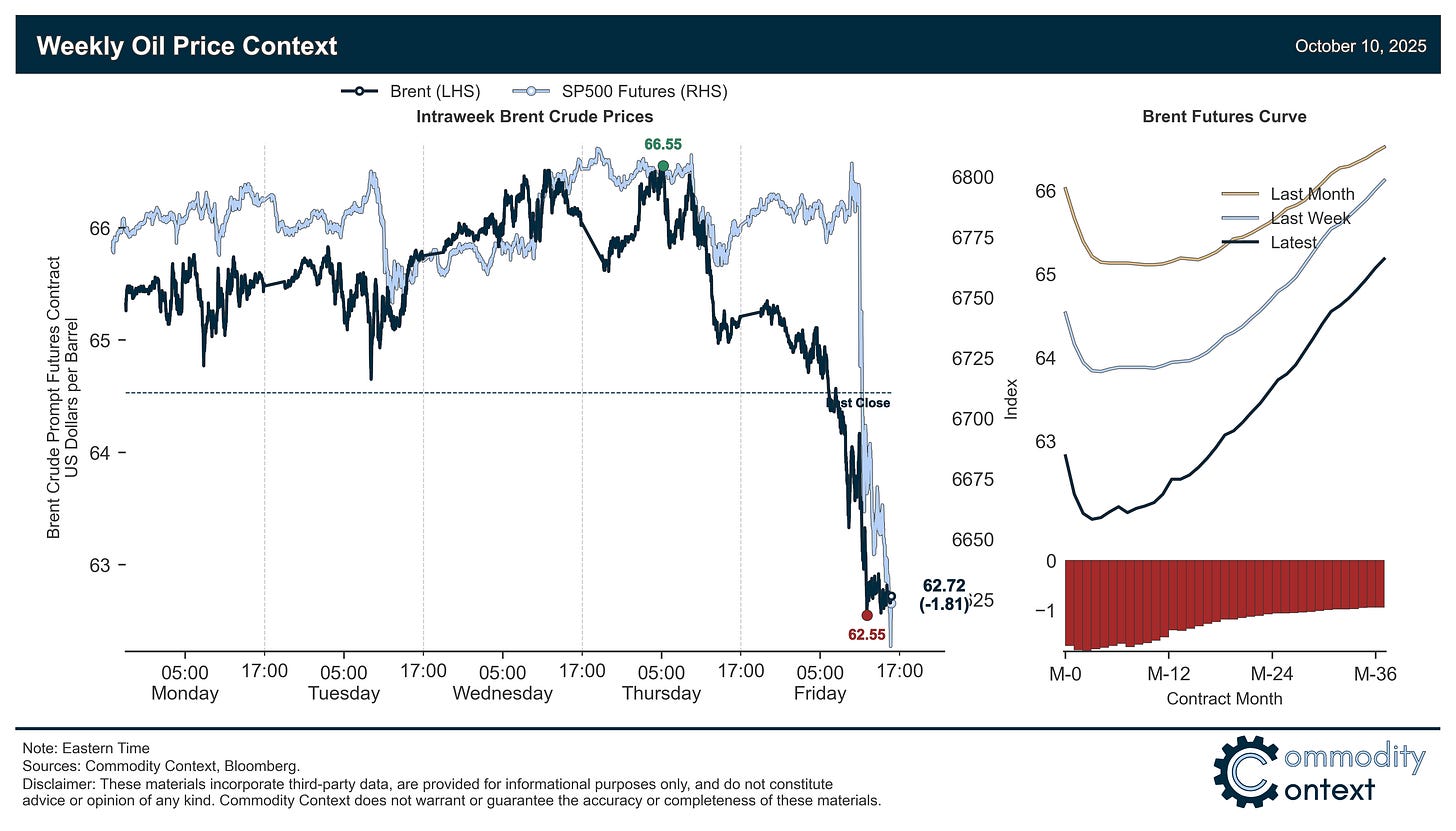

Crude prices crash to fresh half-year lows and the crude curve is on the edge of outright contango as geopolitical risk wanes and China balks at immediately sopping up emerging supply surplus.

Happy Friday, Oil Watchers!

🦃 And happy Thanksgiving to all of our Canadian subscribers—hope you all have a fantastic long weekend.

Every week, I summarize and analyze developments in flat crude prices, calendar spreads, high-frequency inventories, refined products, and positioning data, as well as a taste of the themes I’ve been thinking about or following closely.

Shutdown Alert: Reminder that the CFTC has suspended publication of the Commitments of Traders report due to the ongoing US federal government shutdown. As such, we won’t be publishing the Market Positioning Data Deck but instead, focusing on the smaller pool of information still being published by the European Intercontinental Exchange (ICE).

If you’re already subscribed and/or appreciate the free chart and summary, hitting the LIKE button is one of the best ways to support my ongoing research.

Summary

Flat Prices fell another ~$2/bbl to the lowest level since early May, walloped from multiple sides including an Israel-Hamas ceasefire, disappointing Saudi export allocations to China, and fresh tariff threats against China from the White House.

Timespreads spent the early week continuing to strengthen before abruptly reversing course on Friday, with Dubai prompt spreads, in particular, falling back to near their lowest levels this month.

Inventories data was mixed between draws across the US and Singapore and gains for ARA Europe; stocks of most key petroleum products remained around seasonal levels save low crude stocks in the US and high bunker fuel stocks in Singapore.

Refined Products took a backseat as both gasoline and diesel crack spreads remained rangebound and comparatively stable, especially when juxtaposed with more volatile downward moves in crude pricing.

Market Positioning data from ICE confirmed that speculative participants were large sellers of Brent crude over the past week, bringing the net spec position back to the lowest level since the April-May rout and gross short positions to their highest level since September 2024.

As Well As Israel approved the first phase of a ceasefire deal in Gaza, physical markets get rattled by weak Saudi crude export allocation to China, and Trump threatens new “massive” wave of tariffs on China.