Oil Context Weekly (W40)

Crude cratered >$5/bbl, reversing last week’s strongest rally in months with the biggest rout in as long; visible exports are surging and OPEC denied rumours of even-faster production hikes.

Happy Friday, Oil Watchers!

Every week, I summarize and analyze developments in flat crude prices, calendar spreads, high-frequency inventories, refined products, and positioning data, as well as a taste of the themes I’ve been thinking about or following closely.

Shutdown Alert: Heads up to paid subscribers that the CFTC has suspended publication of the Commitments of Traders report due to the ongoing US federal government shutdown. As such, we won’t be publishing the Market Positioning Data Deck but instead, focusing on the smaller pool of information still being published by the European Intercontinental Exchange (ICE). This data, as included in this weekly round-up, will continue to provide a (partial) view of both crude, through Brent, and middle distillates, through the gasoil contracts. We will resume publication of the Positioning Data Deck when CFTC data is flowing again; based on the experience of past shutdowns, this will likely take a week or two (fingers crossed!) and then the CFTC will batch-publish the lagged data in the days following the reopening.

If you’re already subscribed and/or appreciate the free chart and summary, hitting the LIKE button is one of the best ways to support my ongoing research.

Summary

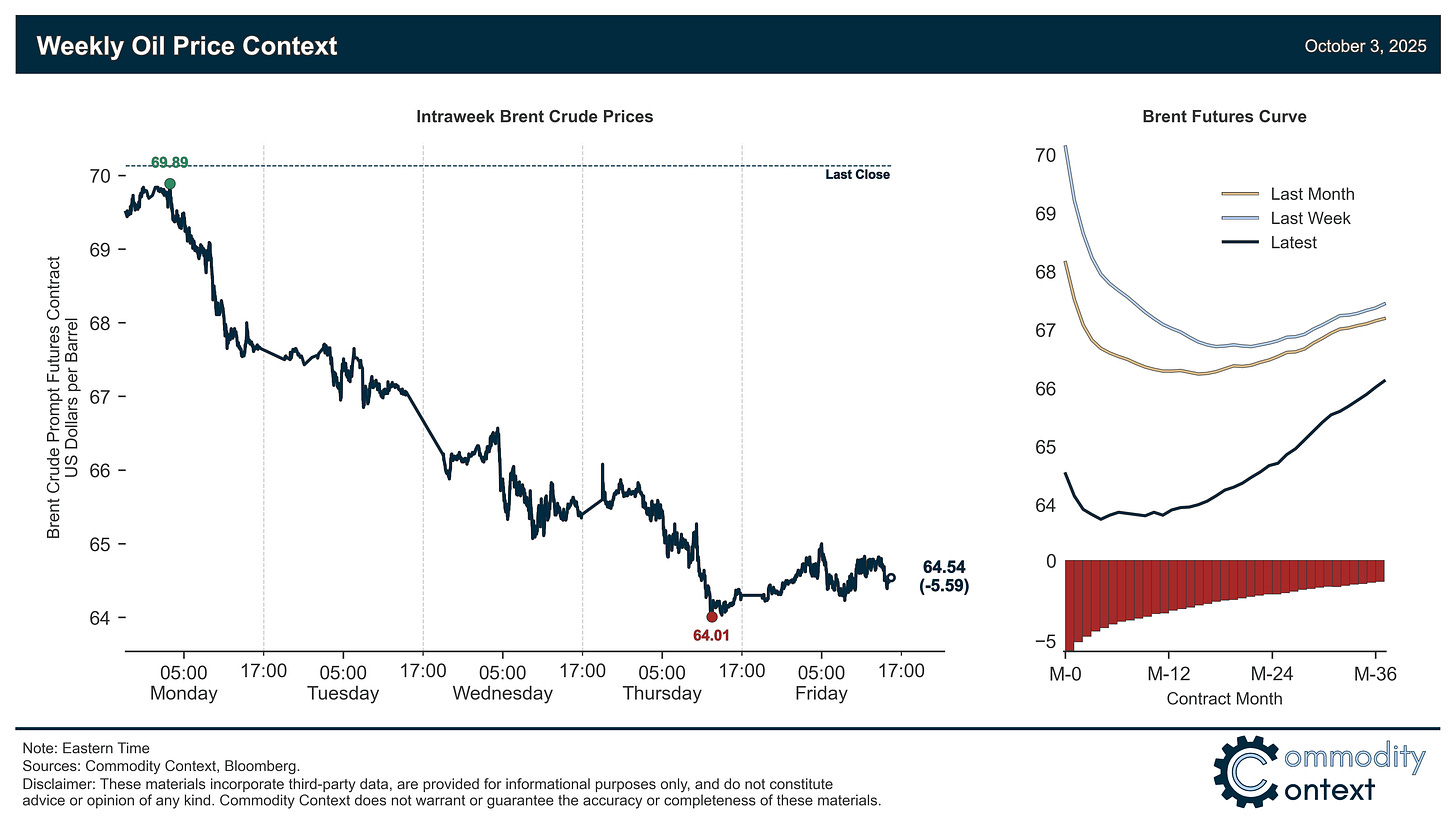

Flat Prices took a swan, collapsing more than $5/bbl for crude’s worst week since June, more than undoing last week’s rally and bringing prices back to their lowest levels since late-May. This rout ostensibly reflected mounting oversupply concerns but, even more simply, crude has, for months now, been stuck in a stubborn range and this is just a rapid reassertion of that same cycle.

Timespreads are again weakening, with all key global benchmarks shedding one-third to one-half of their prompt backwardation over the past week; this signals an end to the late-September expiration crunch and a return of looser supply conditions, with the curve under clear and growing downside pressure.

Inventories were mixed given across-the-board builds in the US, large crude-driven draws in ARA Europe, and a modest build in Singapore.

Refined Products have given up much of their recent strength as both gasoline and diesel crack spreads fell $3-4/bbl following larger than expected US product builds and despite recent high-profile refinery outages.

Market Positioning data is obscured by the US government shutdown-induced suspension of CFTC’s CoT publication but more limited ICE CoT data revealed a continued rollover in the net Brent position held by speculators and the maintenance of heavily overstretched gasoil length.

As Well As OPEC denies reports of another production hike acceleration, and Venezuela scrambles for non-American diluent, with Moscow answering the call.