Oil Context Weekly (W3)

Crude prices continued to rally and term structure further strengthened amidst more precarious supply thanks to tighter sanctions, though frothy speculative inflows are a source of near-term concern.

Happy Friday, Oil Watchers!

Every week, I summarize and analyze developments in flat crude prices, calendar spreads, high-frequency inventories, refined products, and positioning data, as well as a taste of the themes I’ve been thinking about or following closely.

This week, I spoke with the Calgary Herald about the mounting threat of US tariffs on Canadian crude (here) and joined BNN Bloomberg to discuss the latest run-up in global crude prices on the back of tighter oil sanctions (here).

If you’re already subscribed and/or appreciate the free chart and summary, hitting the LIKE button is one of the best ways to support my ongoing research.

Summary

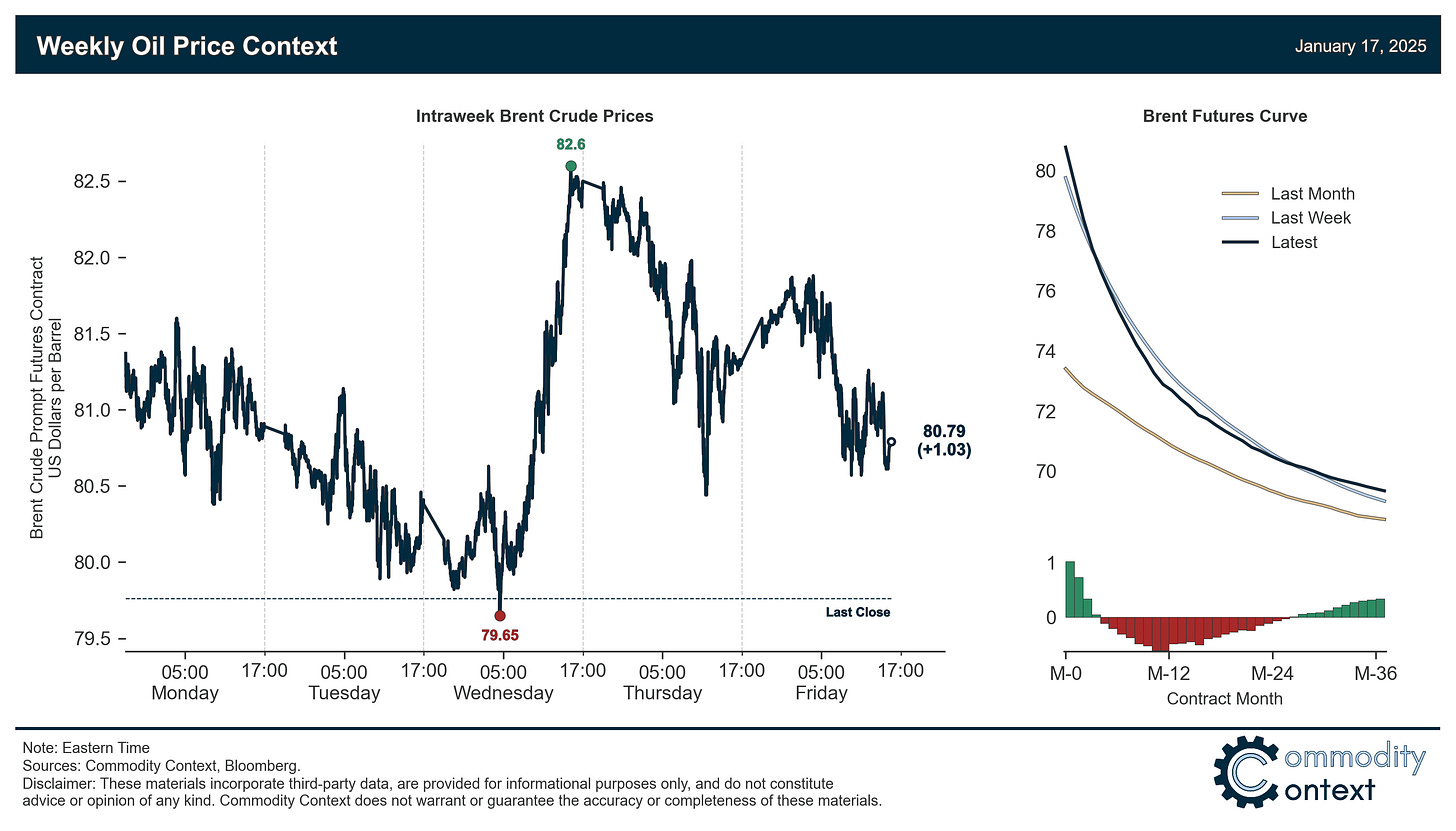

Flat Prices rose another buck and change as the barrel consolidated its position above $80 amidst tightening physical markets, a flood of hot money, and widespread concerns about supply following both actions taken by the outcoming Biden administration and anticipated under the incoming Trump administration.

Timespreads confirm ongoing fundamental support that underlies crude’s flat price rally: all key spreads gained on the week and the Brent curve is at its most backwardated (based on the more stable 2nd vs 3rd month spread) since October 2023.

Inventories data was split between crude- and NGL-driven draws in the US (blunted by builds in key road fuels), a modest draw in Singapore, and further builds in already-oversupplied ARA Europe.

Refined Products remain split between beleaguered gasoline margins, weighed down by lackluster demand and rising crude prices, and diesel crack spreads, which are rallying aggressively and sitting at a 10-month high thanks to concerns related to Russia sanctions (i.e., Russia continues to be one of the largest exporters of middle distillates like diesel and gasoil).

Market Positioning data confirmed that hedge funds and other money managers were again net purchasers of crude futures and options contracts over the past week through Tuesday, maintaining the net speculative position around its highest level since last April and presenting the single-largest near-term risk to crude prices should these overstretched positions take profits all at once, as we so often see; regardless, a rationalization of currently frothy sentiment will be necessary for the crude price rally to continue durably from here.

As Well As Alberta Premier’s oil tariff risk tone abruptly darkens following Trump visit and Canadian governments disagree over how best to respond to tariff threat.