Oil Context Weekly (W39)

Mounting geopolitical risk and renewed Russian supply concerns collide with overstretched bearish positioning to spark largest weekly crude price rally since June’s Israel-Iran war.

Happy Friday, Oil Watchers!

Every week, I summarize and analyze developments in flat crude prices, calendar spreads, high-frequency inventories, refined products, and positioning data, as well as a taste of the themes I’ve been thinking about or following closely.

At the end of this report you’ll also find my weekly, 40-page Oil Market Positioning Data Deck (PDF), tracking and contextualizing shifts across the most important paper petroleum contracts.

🎙️ In the latest episode of the Oil Ground Up podcast, I spoke with June Goh, Senior Oil Market Analyst at Sparta Commodities, about how oil market arbitrages between various products, diverse geographies, and facilitated by ever-shifting tanker availability provide the economic signals that direct barrels to and from every corner of the world. I also couldn’t let June go without getting her thoughts on some of the underlying trends driving China’s evolving role in the Asian oil market. Listen to our full conversation here: LINK

If you’re already subscribed and/or appreciate the free chart and summary, hitting the LIKE button is one of the best ways to support my ongoing research.

Summary

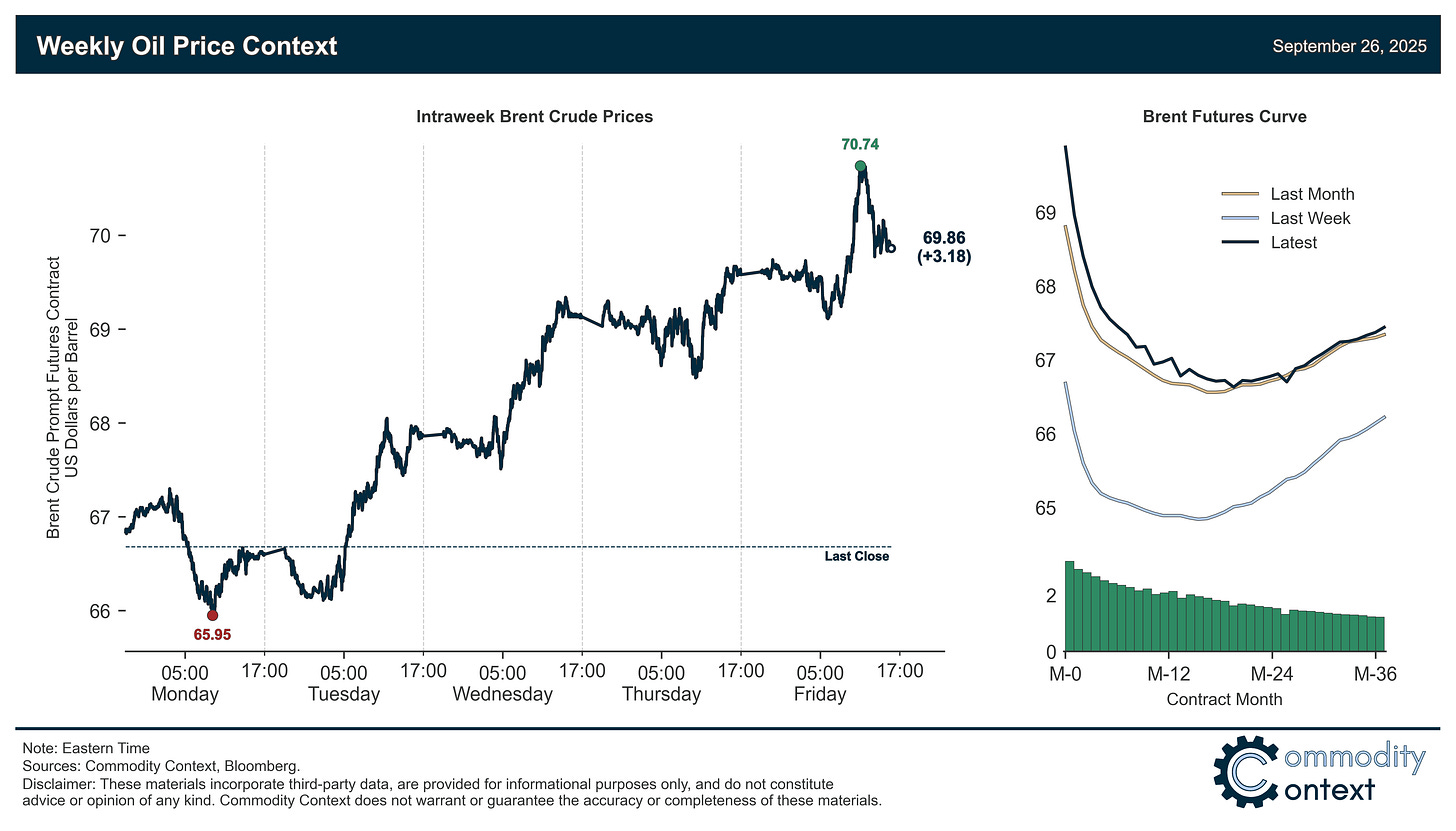

Flat Prices rose more than $3/bbl for the largest weekly rally since the Israel-Iran war in June and Brent broke above the $70/bbl mark—reaching a high of ~$70.80/bbl in Friday trading—for the first time since July, driven above all by intensifying concerns about Russian supply and European security.

Timespreads continued, and entrenched, the trend that picked up speed last week: prompt timespreads for both Brent and WTI rallied further and Dubai continued to shed its previously-exuberant prompt backwardation; while prompt spreads rallied most aggressively, the belly of the Brent curve also showed marked improvement on the week.

Inventories data confirmed draws across all three major tracked consumer hubs (US, ARA Europe, and Singapore) as the US marked another late-season crude draw and further faster-than-usual gasoline stock declines; US diesel stocks showed their first recent signs of rolling over after climbing back to more healthy levels.

Refined Products markets parted ways; after travelling together for most of the past month, diesel crack spreads rallied higher amidst the news of Russia’s [partial] diesel export ban while gasoline moved in the almost perfectly mirrored path lower.

Market Positioning data confirmed that speculators were net sellers of crude through this past Tuesday and net positions were still extremely overstretched short, providing the likely tinder that ignited amidst a jolt of renewed Russian geopolitical risk.

As Well As Russia-Ukraine-NATO tensions ratchet higher, Russia again tightens transportation fuel exports, Latest Dallas Fed Energy Survey reveals that US shale patch is sour on present moment but ever-optimistic about the future, and the Kirkuk-Ceyhan pipeline finally set to resume operations.