Oil Context Weekly (W35)

Crude prices post small gain through final week of summer while diesel slipped into prompt contango for the first time this year and gasoline posted a final bout of strength to send driving season off

Happy Friday, Oil Watchers!

Every week, I summarize and analyze developments in flat crude prices, calendar spreads, high-frequency inventories, refined products, and positioning data, as well as a taste of the themes I’ve been thinking about or following closely.

At the end of this report you’ll also find my weekly, 40-page Oil Market Positioning Data Deck, tracking and contextualizing shifts across the most important paper petroleum contracts.

🎙️ In the latest episode of the Oil Ground Up podcast, I spoke with Brandon Myers, Head of Intelligence at Novi Labs, about the current state and future trajectory of the US shale patch. Are we peaking, how much oil is truly left, and—most importantly—at what price?

If you’re already subscribed and/or appreciate the free chart and summary, hitting the LIKE button is one of the best ways to support my ongoing research.

Summary

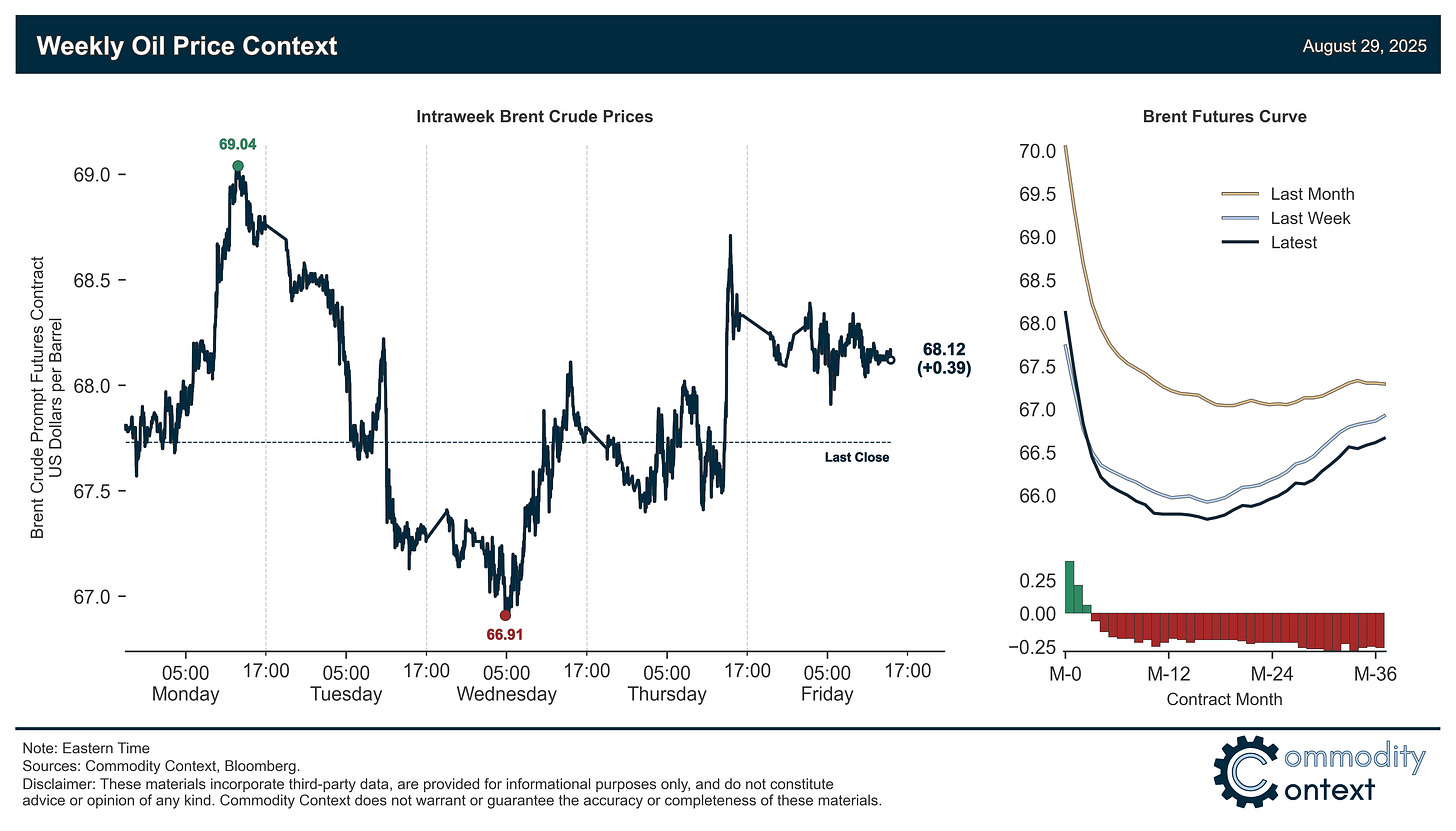

Flat Prices eked out a small, ~40c/bbl gain through the final, sleepy week of summer, with most of the intrigue occurring in cross-grade shifts and refined products.

Timespreads broadly improved and Dubai crude, in particular, saw prompt backwardation rocket to exceptionally strong levels of near $2/bbl, 3-4x the backwardation seen across the other major crude grades.

Inventories drew across all three major tracked hubs, with crude stocks down, diesel stocks broadly rising, and gasoline stocks falling.

Refined Products markets saw a further reversal of the relative fortunes of diesel and gasoline, with diesel pulling back and even dipping into prompt contango this week for the first time this year, while gasoline experienced a late-season surge of relative strength.

Market Positioning data showed that speculators returned to crude-buying this week, lifting off the excruciatingly low net levels reached last week; however, this net gain came despite ongoing growth in gross short positions held by Managed Money participants, which this week set a fresh highest level since 2017.

As Well As Much-anticipated peak in US crude production delayed yet again in June, European UN sanctions snapback further strains Iran’s oil trade, and Guyana ships first crude from its fourth FPSO.