Oil Context Weekly (W33)

Crude prices sank lower amidst bearish forecasts as market awaits outcome of Trump-Putin deal, though downside pressure driven by heavy speculative selling.

Happy Friday, Oil Watchers!

Every week, I summarize and analyze developments in flat crude prices, calendar spreads, high-frequency inventories, refined products, and positioning data, as well as a taste of the themes I’ve been thinking about or following closely.

If you’re already subscribed and/or appreciate the free chart and summary, hitting the LIKE button is one of the best ways to support my ongoing research.

Summary

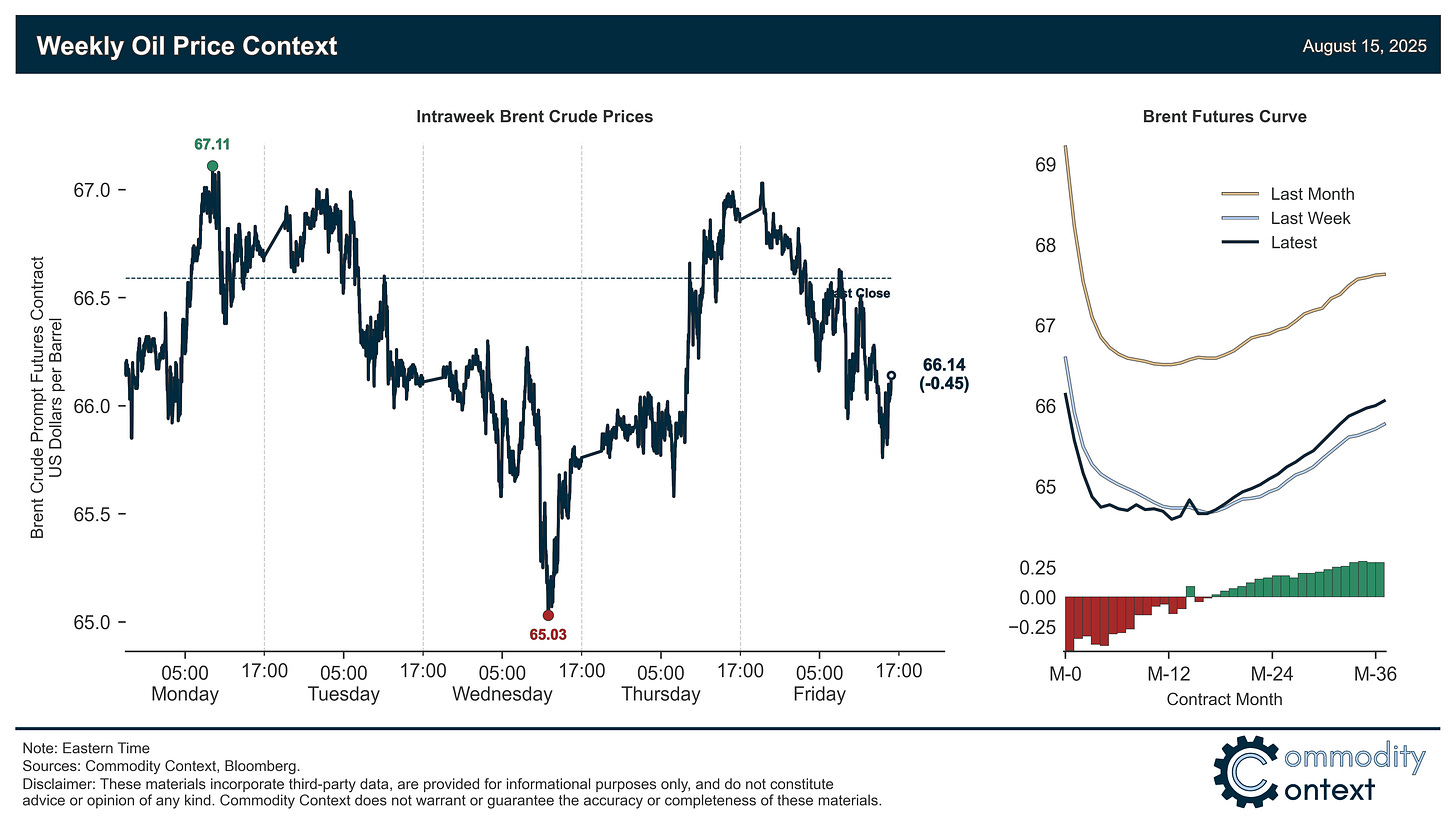

Flat Prices fell ~50c/bbl in a sideways week as the market awaited the outcome of today’s meeting between presidents Trump and Putin, while the IEA’s latest uber-bearish oil market outlook kicked crude while it was down.

Timespreads stabilized—and Dubai backwardation even strengthened—after easing last week and, while prompt calendar spreads remain durably backwardated, key forward spreads (e.g., Dec25/Dec26) are trending notably weaker over the past few months.

Inventories data revealed across-the-board builds in the US, ARA Europe, and Singapore and inventories remain broadly low but beginning to rise again (and counter-seasonally); diesel stocks, specifically, are low across all three hubs but appear to have turned a corner, now headed higher again.

Refined Products markets saw diesel crack spreads continue pulling back, but remain higher than the average so far this year, while gasoline margins gained slightly; Air Canada strike poses downside risk to North American jet fuel demand.

Market Positioning data confirmed that speculators were large net sellers of crude contracts, bringing their net position back to the ultra-bearish levels last seen in April-May and gross shorts to near multi-year highs, shifting positioning risk clearly to the upside; while last September shows us that positioning can still go lower, there’s far more upside than downside from these levels.

As Well As market awaits outcome of Trump-Putin talk, the IEA’s latest catastrophic oil market forecast kicks oil while it’s down, OPEC’s selective acknowledgement of members’ quota overproduction worsens data divergences, and heavy crude prices are beginning to weaken anew.