Oil Context Weekly (W32)

Crude prices pulled back to their weakest level in months as US policy disposition—both tariffs and sanctions—shifts from supply-side tailwind to demand-side headwind for the oil market.

Happy Friday, Oil Watchers!

Every week, I summarize and analyze developments in flat crude prices, calendar spreads, high-frequency inventories, refined products, and positioning data, as well as a taste of the themes I’ve been thinking about or following closely.

🎙️ In the latest episode of the Oil Ground Up podcast, I spoke with Gregory Brew, Senior Analyst covering Energy and Iran at Eurasia Group about President Trump's threatened secondary tariffs against India in response to continued purchases of Russian oil, the broader India-Russia trade relationship, whether this is an oil-market story or just a pretext for additional leverage in the trade negotiations between Washington and New Deli, and where the flow of Russian oil is headed in a market increasingly defined by sanctions, tariffs, and other means of policy bifurcation.

If you’re already subscribed and/or appreciate the free chart and summary, hitting the LIKE button is one of the best ways to support my ongoing research.

Summary

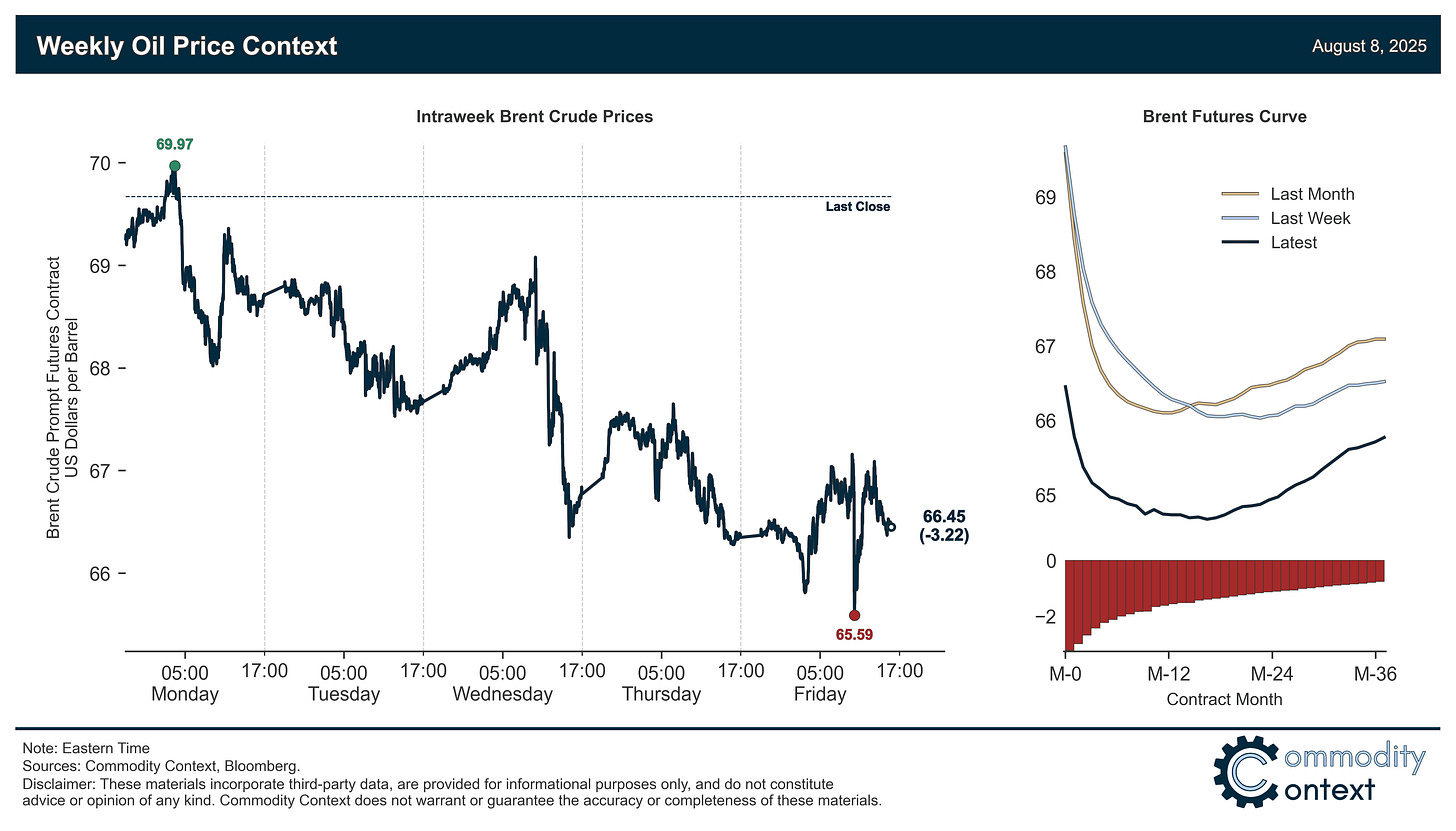

Flat Prices fell back by more than $3/bbl this week for Brent to end today’s session around $66.50/bbl, around its lowest close in more than two months, on the back of easing Russian supply concerns and mounting wariness regarding the negative impact of tariffs on many key sources of expected oil demand growth.

Timespreads reversed as all major benchmarks shed a third to a half of their prompt backwardation, signaling an abruptly looser spot market; if last week’s steepening backwardation was driven by the prospect of New Delhi shifting away from Russian barrels, this week reflects the growing likelihood that that won’t happen.

Inventories data was mixed as builds in the US and Singapore were juxtaposed with declines in ARA Europe; crude and middle distillates stocks remain low while Singaporean stocks of heavy bunker fuels continue to rapidly rise.

Refined Products markets saw a recovery in diesel crack spreads following the end of a $10/bbl rout that came alongside the popping of a speculative bubble in diesel markets; gasoline margins continue to track normal seasonal levels.

Market Positioning data confirmed that speculators returned as sellers of the barrel, but at current levels positioning risk is roughly neutral; however, recent price declines will likely maintain modest trend-following selling pressure to the downside over the coming week.

As Well As India’s transition from the oil market’s supply-side risk to demand-side drag, emerging outline of a US-Russia deal pushes off threats of broadening Russian oil secondary tariffs, and yet more positive oil supply surprises in Brazil and Guyana.