Oil Context Weekly (W31)

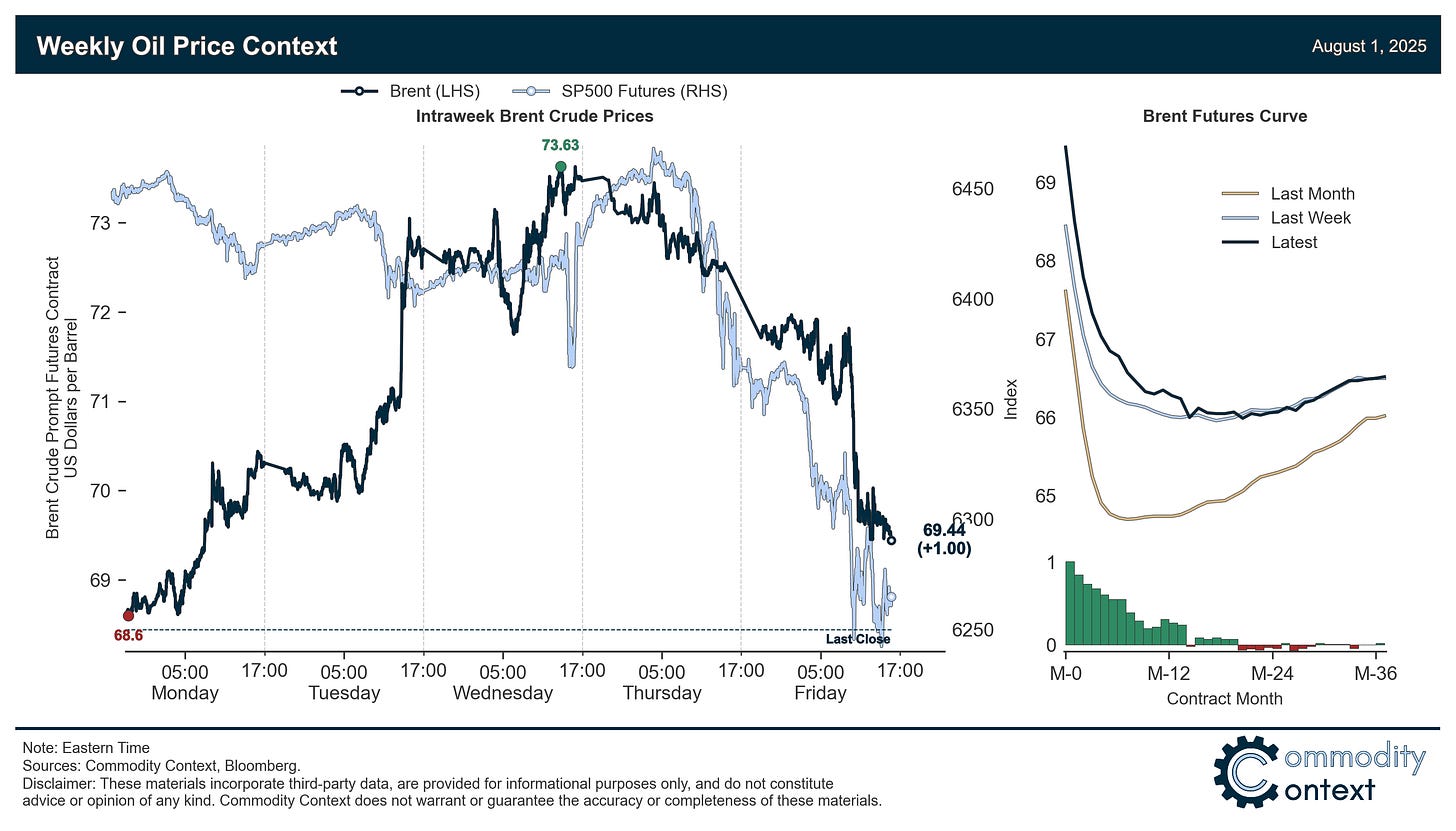

Crude prices rose on sanctions risks before collapsing again on tariffs risk and weak economic data, while backwardation strengthened more durably and the diesel bubble finally burst.

Happy Friday, Oil Watchers!

Every week, I summarize and analyze developments in flat crude prices, calendar spreads, high-frequency inventories, refined products, and positioning data, as well as a taste of the themes I’ve been thinking about or following closely.

🎙️ On the latest episode of the Oil Ground Up Podcast, I spoke with Michael Spyker, principal analyst at HTM Energy Partners and one of my favourite people to speak to about the nitty gritty of Canadian oil and gas. We discussed the recent growth and future potential of Canada’s non-oilsands sector and his view on how best to understand the recent competition to acquire MEG Energy. Let me know what you think!

If you’re already subscribed and/or appreciate the free chart and summary, hitting the LIKE button is one of the best ways to support my ongoing research.

Summary

Flat Prices rallied through the first half of the week on renewed sanctions risks before pulling back on Thursday and collapsing, alongside a broader rout in risk assets, on Friday following a torrent of tariff announcements and terrible US jobs data.

Timespreads bounced back and prompt backwardation rallied notably this week, pointing to tighter spot markets amidst a likely scramble for non-Russian barrels, while backwardation also now extends through 2027, pushing out the “market bet” on the arrival of materially looser balances.

Inventories data confirmed across-the-board builds following unanimous draws the prior week; middle distillates stocks are still-low but potentially beginning to turn a corner.

Refined Products markets saw previously lofty middle distillates margins collapse following a bounceback in stocks and evidence of looser balances, which together likely triggered a retreat from overstretched speculative positions in diesel and gasoil contracts.

Market Positioning data confirmed that speculators were, unsurprisingly, buyers of crude through the first half of the week as prices were rising; following the pullback in prices, we likely today stand very slightly oversold, but positioning risk is modest given that we’re skill far from the extremes in either direction.

As Well As all eyes on India as US threatens secondary tariffs on purchases of Russian energy, the US-EU trade deal sets an implausibly high bar for EU imports of US energy commodities, and OPEC+ expected to announce a September completion of its 2.5 MMbpd cut unwind