Oil Context Weekly (W30)

Crude prices grinded lower amidst a second consecutive week of term structure weakening, yet more trade policy headline ping pong, and a move by the Trump admin to loosen Venezuelan oil sanctions.

Happy Friday, Oil Watchers!

Every week, I summarize and analyze developments in flat crude prices, calendar spreads, high-frequency inventories, refined products, and positioning data, as well as a taste of the themes I’ve been thinking about or following closely.

🎙️ On the latest episode(s) of the Oil Ground Up Podcast, I spoke with:

Arnab Datta, Managing Director of Policy Implementation at Employ America, about the history and evolving role of the U.S. Strategic Petroleum Reserve as well as the political, legal, and physical constraints of this unique energy security asset and its future under the Trump admin. Listen to my conversation with Arnab here. 🎧

Rachel Ziemba, founder of Ziemba Insights and writer of the Weaponized Economy Substack, about the current state of sanctions against key oil exporters including Russia, Iran, and Venezuela as well as how these sanctions regimes have evolved and their likely directional effect on oil market pricing going forward. Listen to my conversation with Rachel here. 🎧

If you’re already subscribed and/or appreciate the free chart and summary, hitting the LIKE button is one of the best ways to support my ongoing research.

Summary

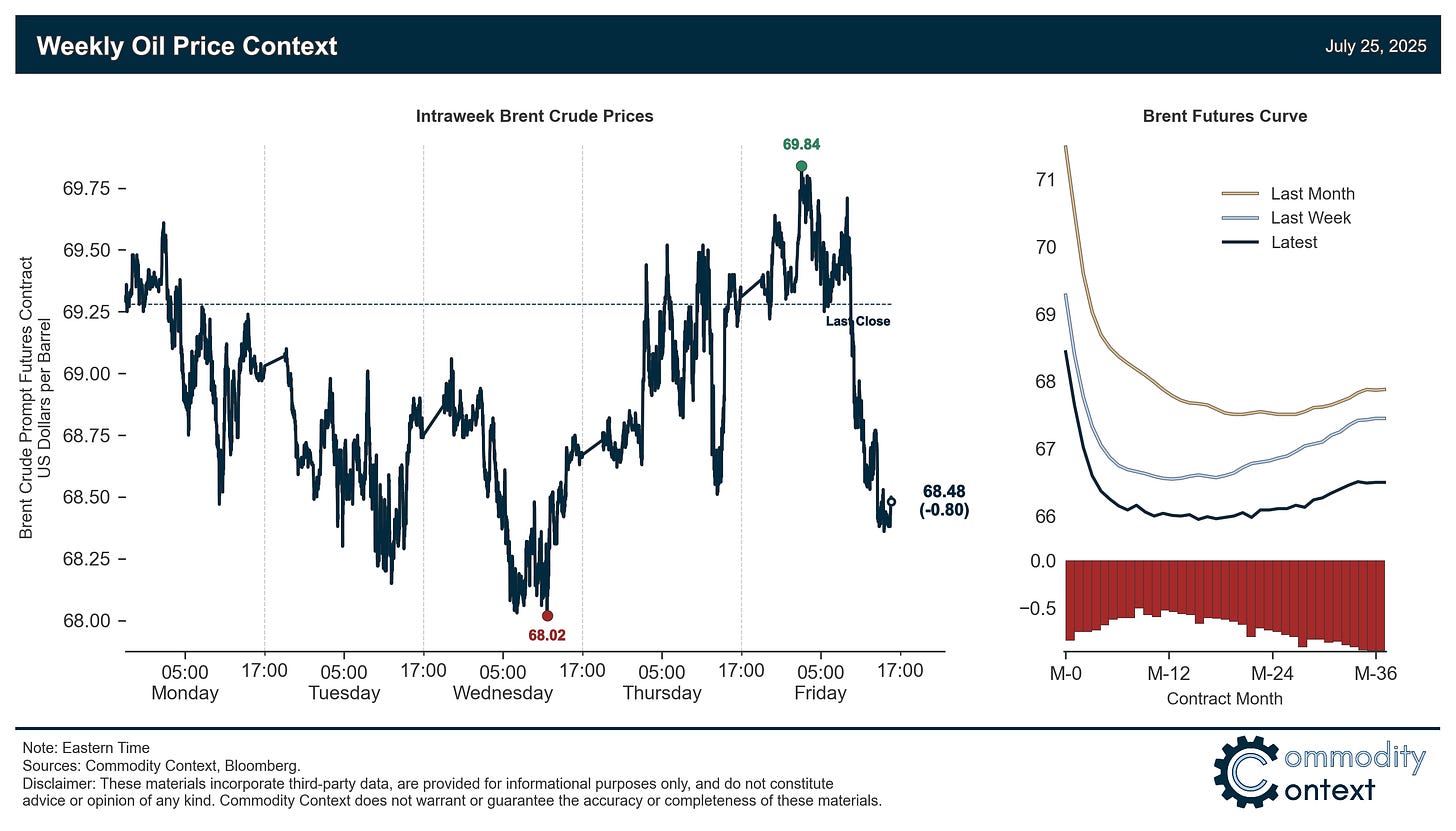

Flat Prices eased modestly, falling less than $1/bbl to around $68/bbl (Brent) through a relatively quiet week, with weaker term structure validating the prompt price softening.

Timespreads continued to weaken for Brent and WTI for the second week in a row, while Dubai bottomed on Tuesday and rallied; all major crude benchmarks remain modestly backwardated.

Inventories data confirmed headline draws across all major tracked hubs and the unifying theme remains plunging, and/or exceptionally low, stocks of middle distillate fuels like diesel.

Refined Products eased as crack spreads for both gasoline and diesel narrowed by $1-1.50/bbl; gasoline cracks remain around normal seasonal levels while diesel cracks are exceptionally strong (~$33/bbl) and earnings reports from major refiners noting investments to increase both diesel yield and fuel-switching optionality.

Market Positioning data confirmed that speculators were once again net sellers of crude futures and options contracts, with their net position continuing to slowly grind lower as expected; while the path of least resistance remains a continued grind lower, there remains more room for an upside spike—given a sufficiently punchy headline—than a commensurately sharp drawdown.

As Well As Trump Admin cracks door (back) open for Venezuelan oil exports, Syria back on the oil market and looking to sell first crude cargo since 2011, and Canadian crude price geographic differentials weaken amidst strong output.