Oil Context Weekly (W28)

Crude prices rose amidst renewed geopolitical tumult, now with a focus on potential Russian sanctions, and ever-stronger spot market pressures alongside seemingly ever-shorter diesel supplies.

Happy Friday, Oil Watchers!

Every week, I summarize and analyze developments in flat crude prices, calendar spreads, high-frequency inventories, refined products, and positioning data, as well as a taste of the themes I’ve been thinking about or following closely.

🎙️🎧 On the latest episode of the Oil Ground Up Podcast, I had the opportunity to speak with François Cazor, co-founder and Executive Chairman of Kpler. We spoke about Kpler’s inception, how independent alternative industry data sources have changed oil price formation and risk management, and the future of market intelligence data.

If you’re already subscribed and/or appreciate the free chart and summary, hitting the LIKE button is one of the best ways to support my ongoing research.

Summary

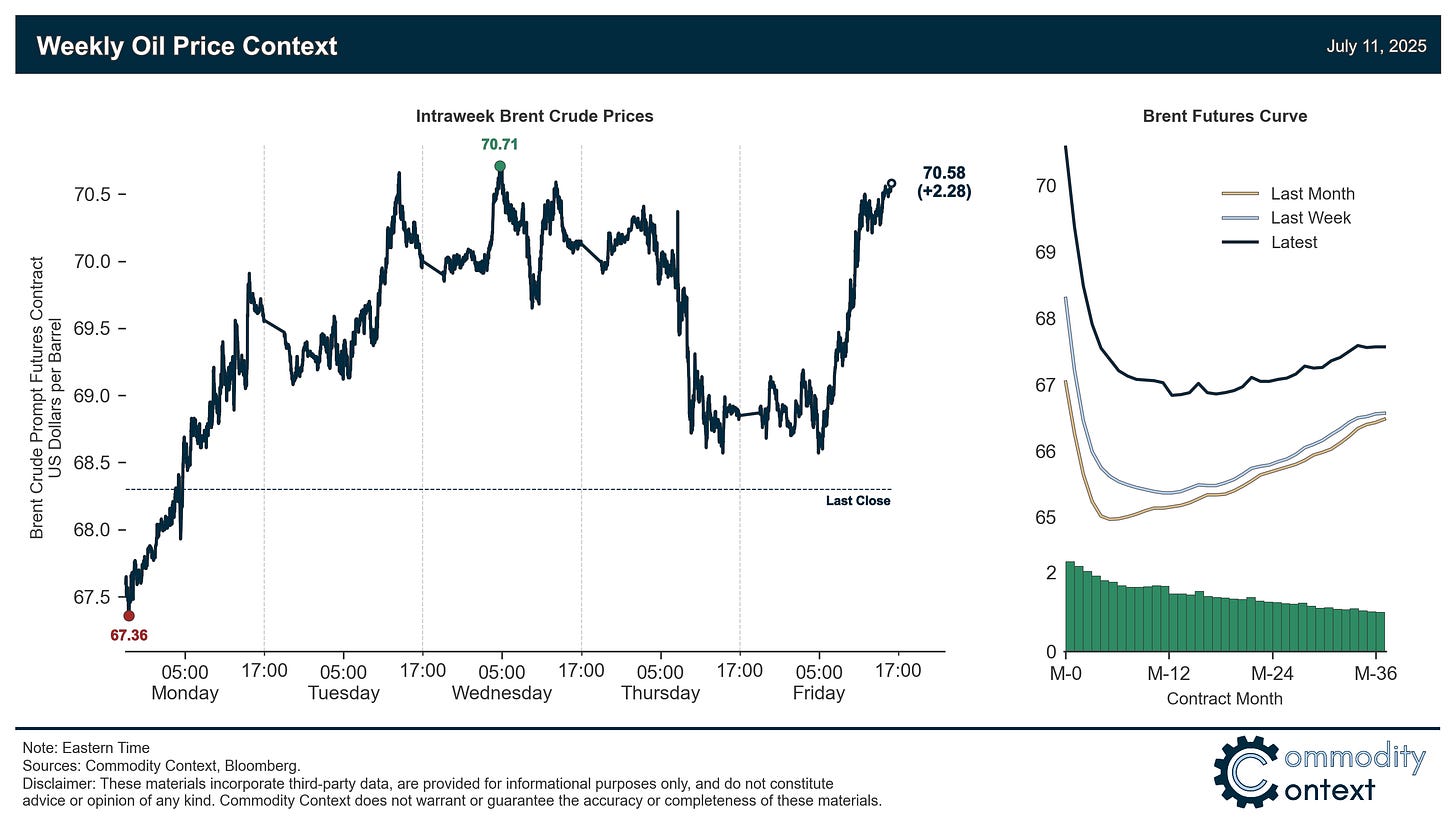

Flat Prices rallied amidst heightened geopolitical tensions related to renewed Houthi attacks on Red Sea shipping traffic, which resulted in the sinking of two ships, as well as the prospect of renewed and harsher US sanctions against Russia.

Timespreads were broadly stronger led by Brent Dated-to-Frontline (DFL) spreads, which rose another ~35c/bbl back to highs of near-$2/bbl—not seen since the peak of the Israel-Iran conflict in mid-June; prompt futures spreads were comparatively subdued but all remain steeply backwardated and rose on the week.

Inventories built across all major tracked hubs last week but the biggest jumps was seen in US crude, which rose steeply and counterseasonally (albeit from very low levels); also, global diesel stocks continue to fall.

Refined Products remain firmly diesel-driven, with the scarcity of middle distillates pushing up crack spreads and pressing ever-more marginal refineries into action, while US gasoline cracks have gradually recovered along a similar seasonal path as seen around this time last year.

Market Positioning data confirmed that speculators returned as net buyers of crude contracts for the first time in three weeks; speculative positioning remains relatively balanced, and doesn’t present any immediate directional risks to the barrel.

As Well As Saudi crude production in June skyrocketed according to the IEA, but the Saudi Ministry of Energy disagrees (kind of), Trump admin taps SPR, likely related to separately reported zinc contamination in Mars crude stream, and Nigeria is seeking a big upgrade to its OPEC production baseline in 2027 following output turnaround.