Oil Context Weekly (W27)

Crude prices edged higher on firmer term structure and US trade deal optimism while middle distillates, like diesel, continue to be the epicenter of current market scarcity and concern.

Happy Friday, Oil Watchers, and Happy 4th of July to all of you American lovers of oil market context! Hope you have a great holiday weekend.

Every week, I summarize and analyze developments in flat crude prices, calendar spreads, high-frequency inventories, refined products, and positioning data, as well as a taste of the themes I’ve been thinking about or following closely.

In the latest episode of the Oil Ground Up Podcast, I spoke with Karim Fawaz, Director of Oil Markets and Refining at S&P Global Commodity Insights, about oil's evolving "risk premium" and why, after years of acute geopolitical tumult, political risk just isn't the oil price impulse it used to be.

If you’re already subscribed and/or appreciate the free chart and summary, hitting the LIKE button is one of the best ways to support my ongoing research.

Summary

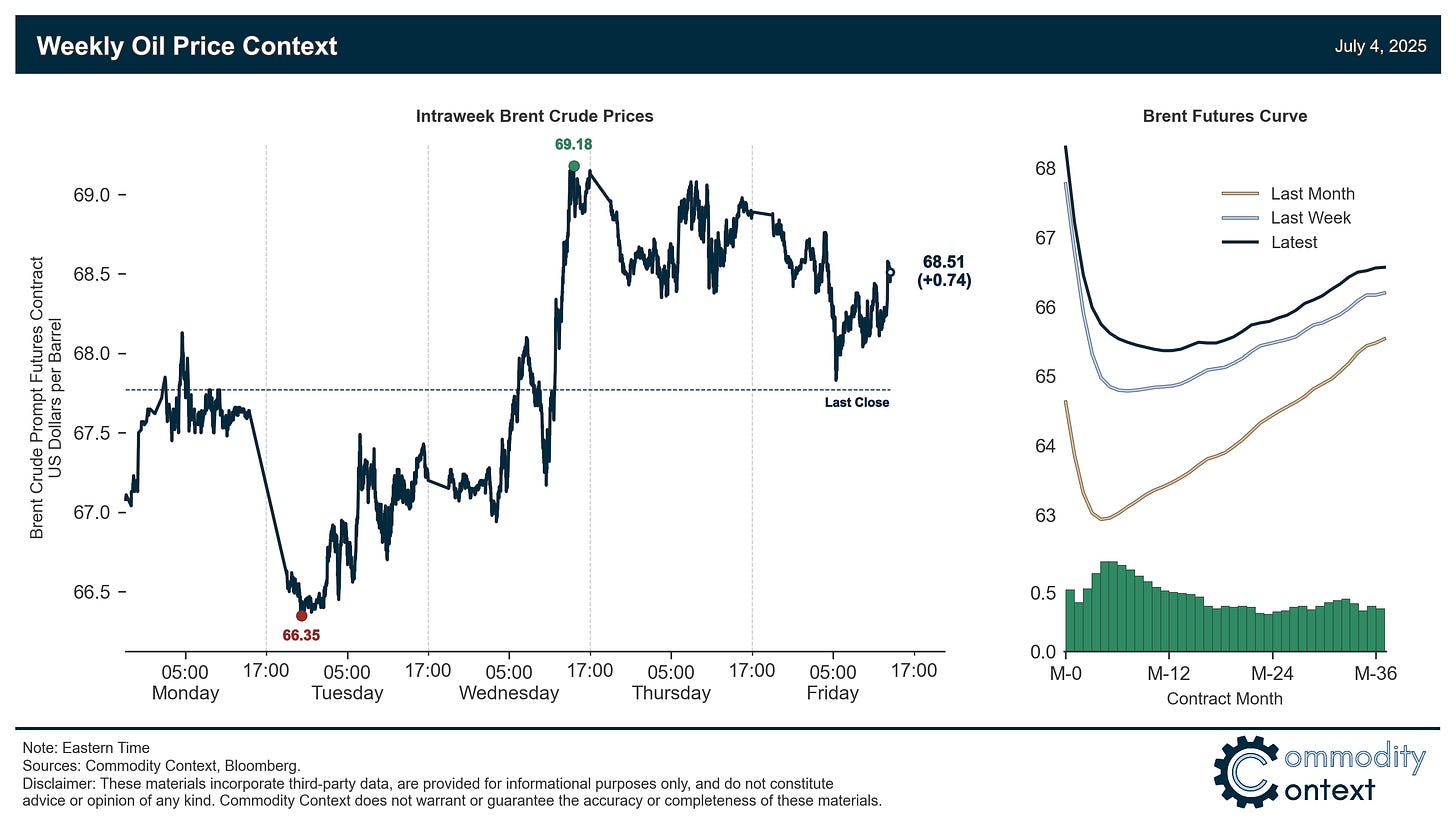

Flat Prices rose modestly through the week, benefiting from firming term structure, US trade deal optimism, and fresh sanctions on Iranian oil.

Timespreads continues to improve as Brent and Dubai prompt spreads strengthened and WTI’s traded flat—although WTI is still at the richest prompt futures spread among the big-3 benchmarks.

Inventories data were mixed but leaned bearish given a reversal of some of the US’ recently aggressive early season draws juxtaposed with small declines in stocks across Singapore and ARA Europe.

Refined Products market attention continues to be dominated by roaring middle distillates margins: the relative prices of diesel, gasoil, and jet fuel are holding near their Iran-crisis highs and notably outpacing gasoline in what should be the core passenger fuel’s strongest time of the year

Market Positioning data confirmed that, at least for Brent (WTI data delayed until Monday due to the holiday), speculators were net crude sellers again this week and had unwound virtually all of the net length that they had accumulated through the political risk spike that came on the back of the war between Israel and Iran.

As Well As OPEC+ expected to announce fourth “accelerated” production hike this weekend, while Saudi oil exports in June finally began to reflect some of these anticipated output increases; Dallas Fed Energy Survey confirms collapsing oil patch activity; Russian tankers are exploding, threatening Moscow’s oil trade and further complicating insurance coverage; and the IAEA has left Iran, further clouding Tehran’s nuclear programme.