Oil Context Weekly (W1)

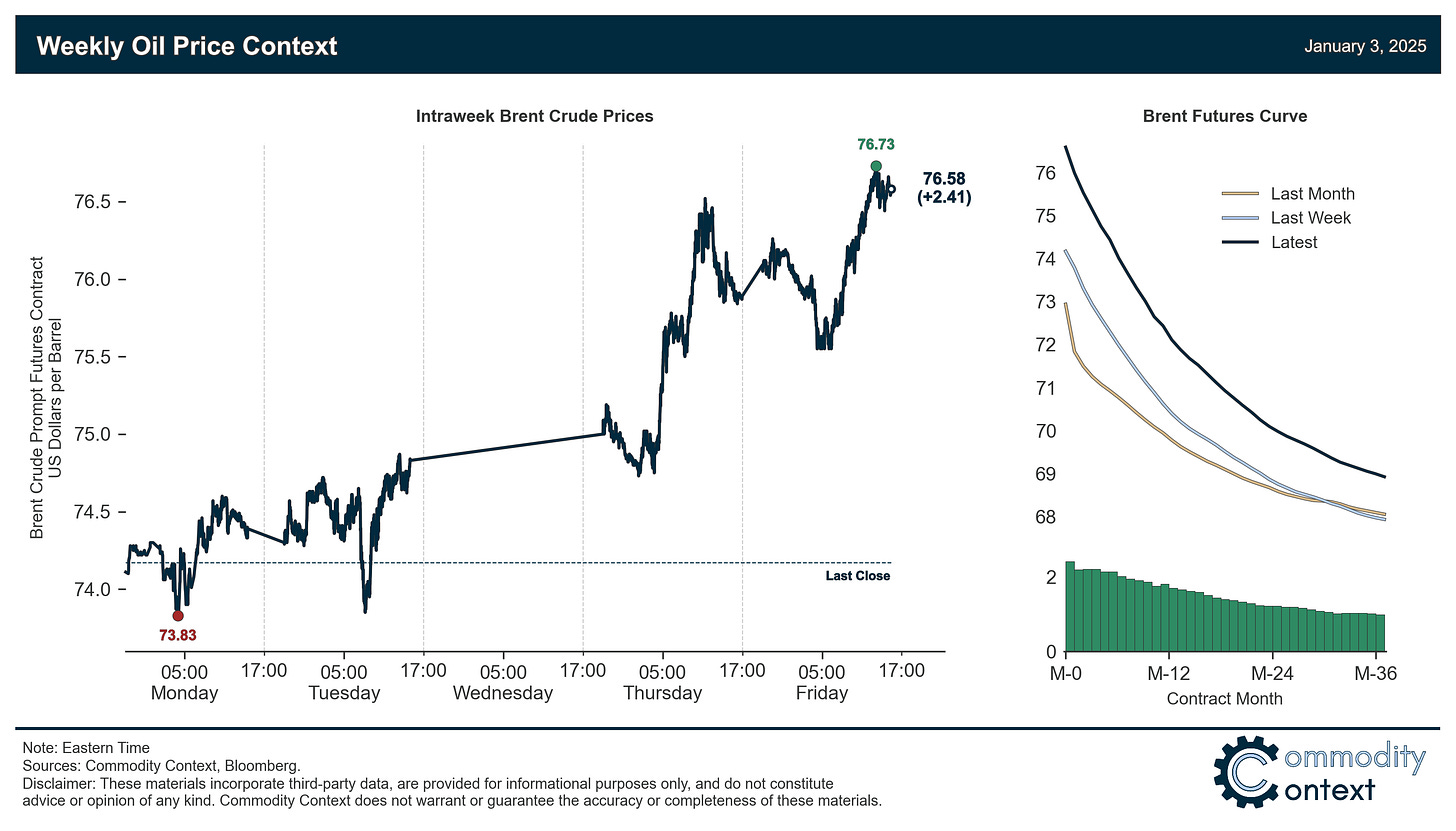

Crude prices rallied to their highest level since mid-October—threatening an upside breakout—bolstered by a rapid strengthening in crude futures term structure centered in North America.

Happy New Year and first Friday of 2025, Oil Watchers!

Every week, I summarize and analyze developments in flat crude prices, calendar spreads, high-frequency inventories, refined products, and positioning data, as well as a taste of the themes I’ve been thinking about or following closely.

I had the pleasure of joining BNN Bloomberg earlier this week to provide a rundown of my expectations for crude markets and prices in 2025—check out that full interview here.

If you’re already subscribed and/or appreciate the free chart and summary, hitting the LIKE button is one of the best ways to support my ongoing research.

Summary

Flat Prices rose ~$2.50/bbl for Brent to end above $76.50/bbl for the strongest close since mid-October, kicking off the New Year with a bang.

Timespreads strengthened even more notably than did flat prices, confirming a fundamental underlying driver of the rally beyond the more typical climb back up the hot money roller coaster.

Inventories data was mixed but leaned bearish thanks to a very large refined product build in the US and further inflows of road fuels into already well-stocked ARA European tanks.

Refined Products strengthened as both US diesel and gasoline margins gained $1–1.50/bbl, with middle distillates benefitting from a run-up in natural gas prices.

Positioning data was delayed again by the holiday schedule; the latest available release showed that net speculative positioning pulled back slightly through the week ending Christmas Eve but remained high compared to chronically depressed levels the past few months.

As Well As seasonally strong Canadian crude differentials in both Alberta and the US Gulf Coast, Dallas Fed Energy Survey anticipates Trump’s return and highlights plenty of optimism from smaller US oil firms, and Trump doubles down on centrality of tariffs to his economic vision.