Oil Context Weekly (W19)

Crude falls back into $50s coming out of OPEC’s weekend production increase before rallying to end week in the green on US trade policy optimism and an unwinding of overstretched bearish positioning.

Happy Friday, Oil Watchers!

Every week, I summarize and analyze developments in flat crude prices, calendar spreads, high-frequency inventories, refined products, and positioning data, as well as a taste of the themes I’ve been thinking about or following closely.

🎙️ Excited to announce that I'll be taking over as host of the Oil Ground Up Podcast. The same wonky, obsessive oil market analysis as always but, now, in conversational form.

And I was lucky enough to have Adi Imsirovic as our first guest. Adi is a former [head] physical crude trader and the author of many excellent books on the technical function of the oil market. Listen to the full episode, which immediately followed OPEC's big weekend, for free here.

I also spoke with both BNN Bloomberg and the Financial Post (video interviews) about the OPEC+ announcement last weekend, with my comments reflecting much of what subscribers read on Friday going into the meetings.

If you’re already subscribed and/or appreciate the free chart and summary, hitting the LIKE button is one of the best ways to support my ongoing research.

Summary

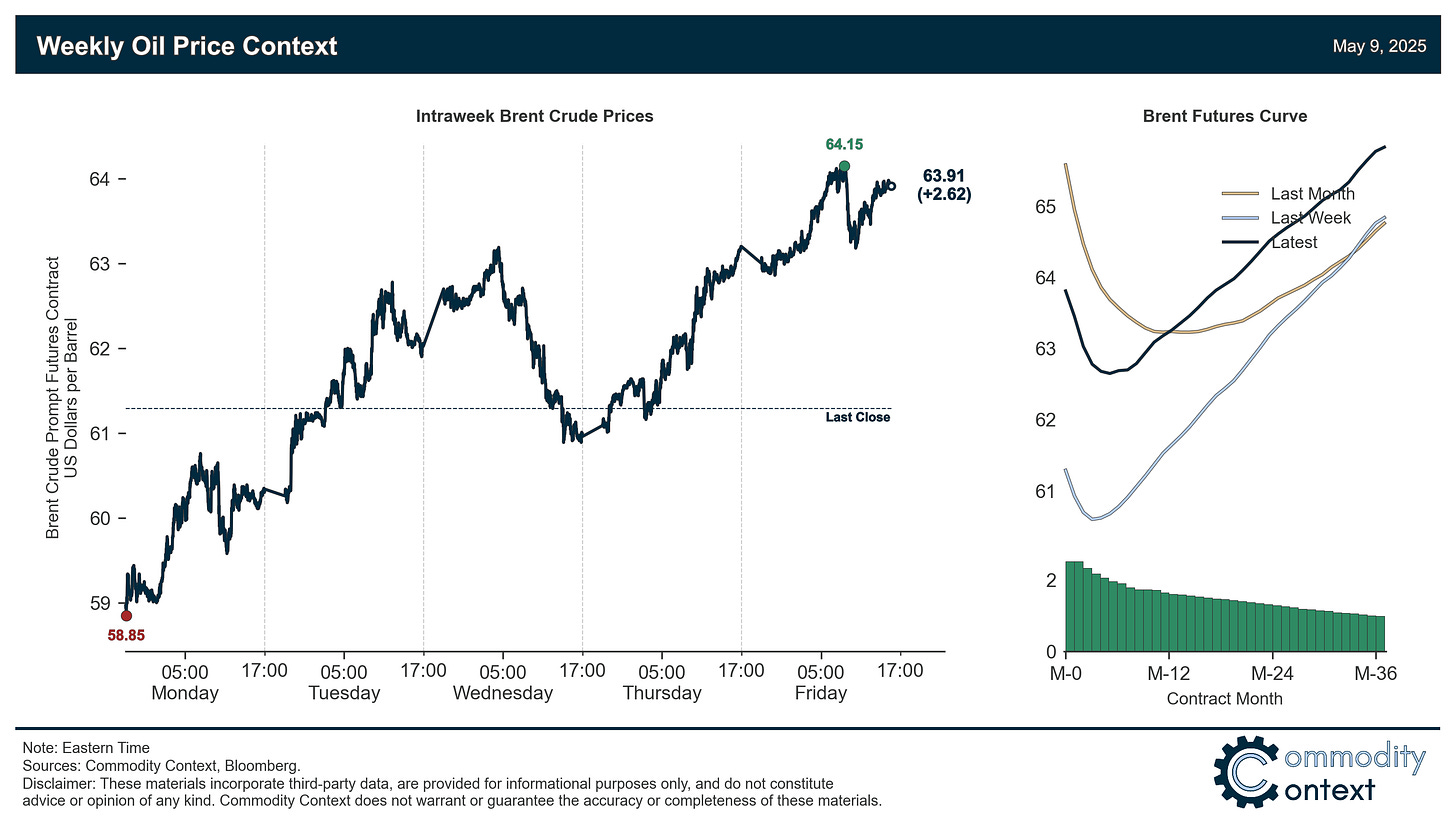

Flat Prices sank more than $2/bbl coming out of the OPEC meeting-filled weekend before staging a broad, week-long rally on trade policy optimism that ended with prices more than $2/bbl higher than where they ended last Friday.

Timespreads recovered after last week’s pullback, though overall crude term structure remains much weaker compared to the past few months; weaker prompt backwardation and broad contango through much of the rest of the curve, which went from entirely backwardated in early-April, to “smiling”, and then to a far more modest checkmark today.

Inventory data were mixed between further draws in Singapore, a small build off seasonal lows in ARA Europe, and a weaker-than-typical build in the US.

Refined Products markets were generally unfazed by OPEC’s weekend announcement and gasoline crack spreads in North America continued to climb along their normal seasonal trajectory heading into the summer driving season.

Market Positioning data confirmed that speculators were once again sellers of crude contracts and, as of Tuesday, remained notably oversold compared to more typical levels, and the normalization of this depressed positioning is expected to remain a broad tailwind for crude prices above and beyond any fundamental market pressures.

As Well As the market digests bearish-tilted OPEC weekend meeting and forward chatter, US E&Ps add to peak shale cry in quarterly comments, US E&Ps add to peak shale cry in quarterly comments, Houthi ceasefire a welcome sign but not expected to immediately ease shipping aversion, US-Iran talks set to resume despite another round of fresh sanctions, and China-US trade relations show first signs of thawing.