Oil Context Weekly (W18)

Crude sank again this week on concerns of another accelerated OPEC+ output hike in June while collapsing term structure and creeping contango removed a key prior indicator of fundamental support.

Happy Friday, Oil Watchers!

Every week, I summarize and analyze developments in flat crude prices, calendar spreads, high-frequency inventories, refined products, and positioning data, as well as a taste of the themes I’ve been thinking about or following closely.

This edition of Oil Context Weekly is a bit longer than usual and includes my thoughts on the latest oil price rout and the chatter going into tomorrow’s OPEC+ meeting as well as my oil-relevant thoughts coming out of the Canadian federal election and my trip to Calgary and the oil sands immediately after.

If you’re already subscribed and/or appreciate the free chart and summary, hitting the LIKE button is one of the best ways to support my ongoing research.

Summary

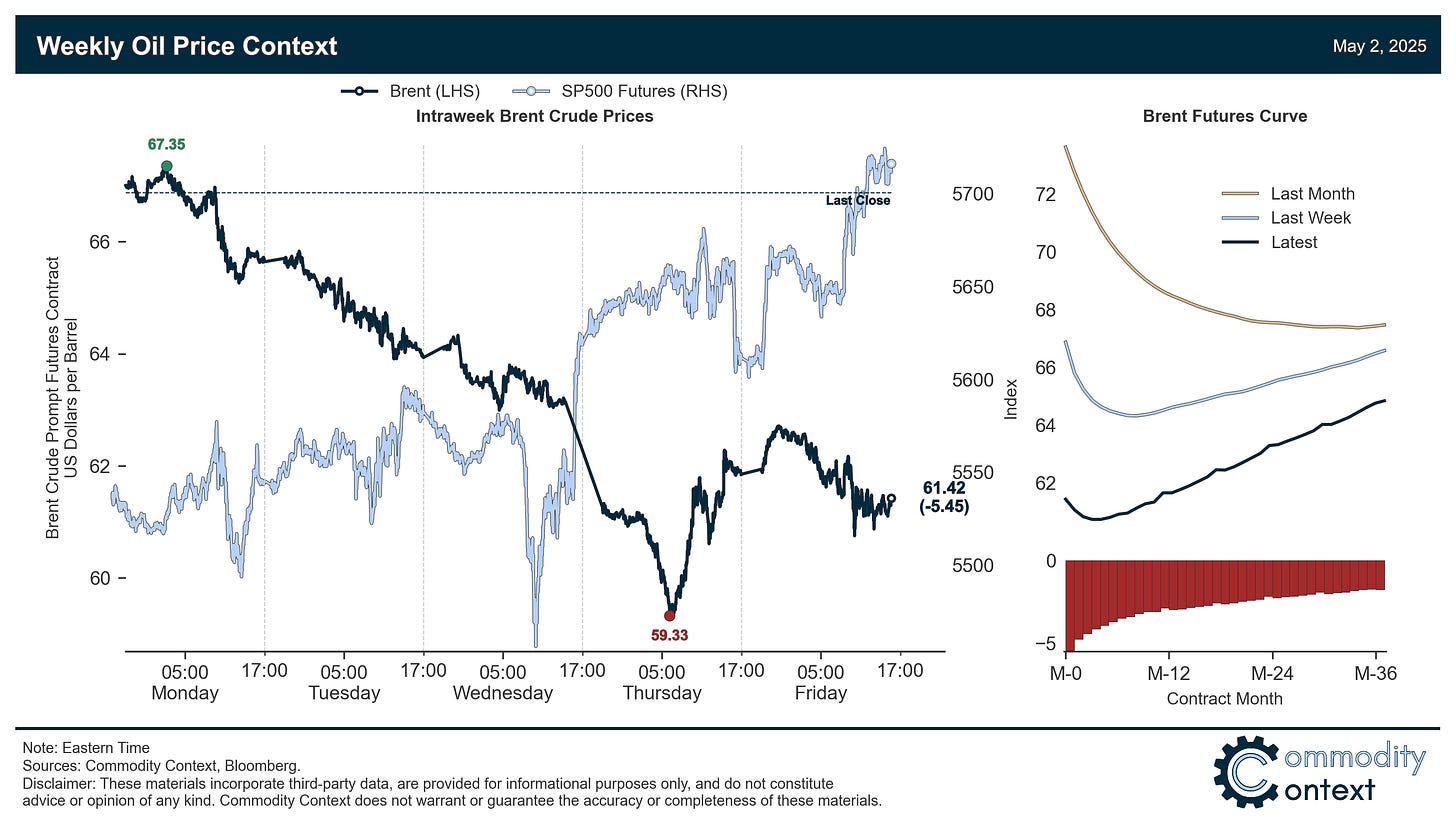

Flat Prices fell by roughly $5.50/bbl for Brent to finish the week in the low-$60s and briefly dipped into the $50s again on Thursday before Iran sanctions headlines supported the barrel higher again.

Timespreads weakened for a second consecutive week and all major benchmarks saw front-end backwardation erode further; futures curves have shifted from their previous “smile” (prompt backwardation with mid-curve contango) to, at best, a checkmark with still-weakening backwardation only present across the first few months juxtaposed with deepening contango across the rest of the curve.

Inventories data was mixed but leaned bullish between very large draws in Singapore and ARA Europe and a headline build in the US that masked more constructive key product-level developments.

Refined Products were subdued again compared to crude complex volatility, with both gasoline and diesel crack spreads continuing to track closely to trailing seasonal average levels; gasoline cracks rose ~$1.50/bbl while diesel pulled back by ~$3/bbl from last week’s rally.

Market Positioning data revealed that speculators returned to modest net selling of crude contracts over the past week-through-Tuesday,

As Well As:

Reuters report validates concerns about Saudi’s dovish shift heading into OPEC+ meeting moved up to Saturday.

Iranian oil sanctions risk flares up again as US-Iran talks hit a bump and the next planned meeting was postponed.

Mark Carney’s Liberal Party wins minority government in Canada and the oil industry now awaits Cabinet appointments and early tangible signs of political (and energy sector-specific) priorities.

Reflections on a post-election trip to Calgary and the oil sands and how industry participants were talking about the result.