Oil Context Weekly (W17)

Crude prices fell after an early-week rally was stamped out by a fresh bout of Kazakh-OPEC brouhaha, stymying an ongoing effort to rebalance still-deeply-oversold spec positioning in crude contracts.

Happy Friday, Oil Watchers!

Every week, I summarize and analyze developments in flat crude prices, calendar spreads, high-frequency inventories, refined products, and positioning data, as well as a taste of the themes I’ve been thinking about or following closely.

If you’re already subscribed and/or appreciate the free chart and summary, hitting the LIKE button is one of the best ways to support my ongoing research.

Summary

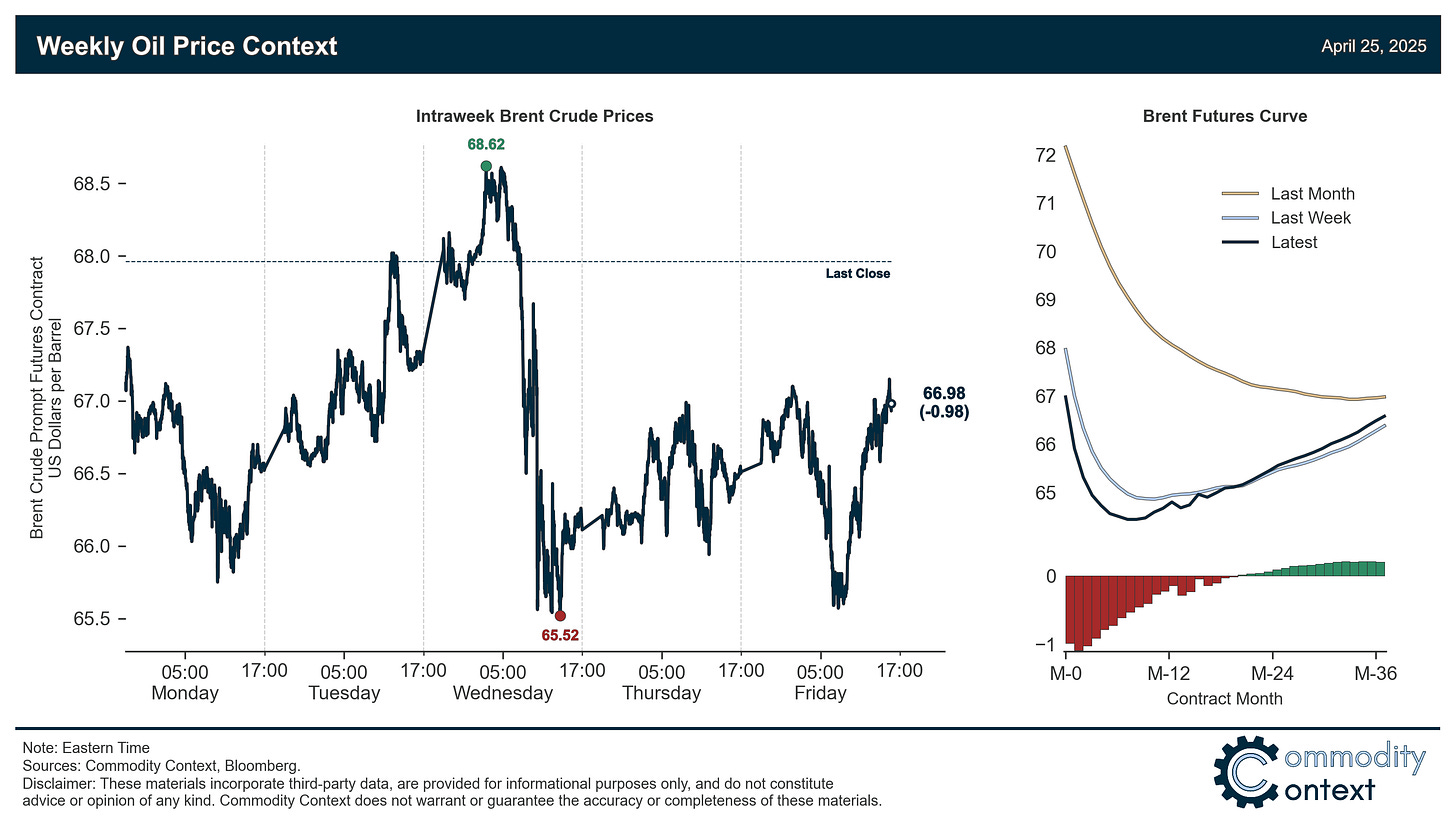

Flat Prices fell ~$1/bbl to end the week around $67/bbl (Brent) after OPEC members reportedly talked about another round of accelerated production hikes in June, derailing an early week rally and the ongoing attempt to rebalance still-deeply-oversold positioning.

Timespreads were split between strengthening Brent prompt futures spreads and a material pullback in both Brent DFLs and prompt Dubai spreads, with the latter—which shifted lower immediately following the OPEC drama on Wednesday—likely more indicative of the real physical market.

Inventories data was mixed across the major hubs: US stocks are drawing, counterseasonally, on the back of aggressive declines in road fuels while Singaporean bunker fuel inventories are surging.

Refined Products markets strengthened with gasoline and diesel crack spreads rising, supported by stronger than usual stock draws heading into the US driving season.

Market Positioning data confirmed that speculators were net buyers of crude contracts over the past week-through-Tuesday but their overall position remains deeply oversold—and is likely lower again since Tuesday’s high-water mark close; accordingly, positioning normalization remains a tailwind for the barrel and the fuel for sharp rallies is greater than that for further sudden declines.

As Well As Kazakh-OPEC drama and musings of further OPEC+ output hike accelerations in June spook market.