Oil Context Weekly (W15)

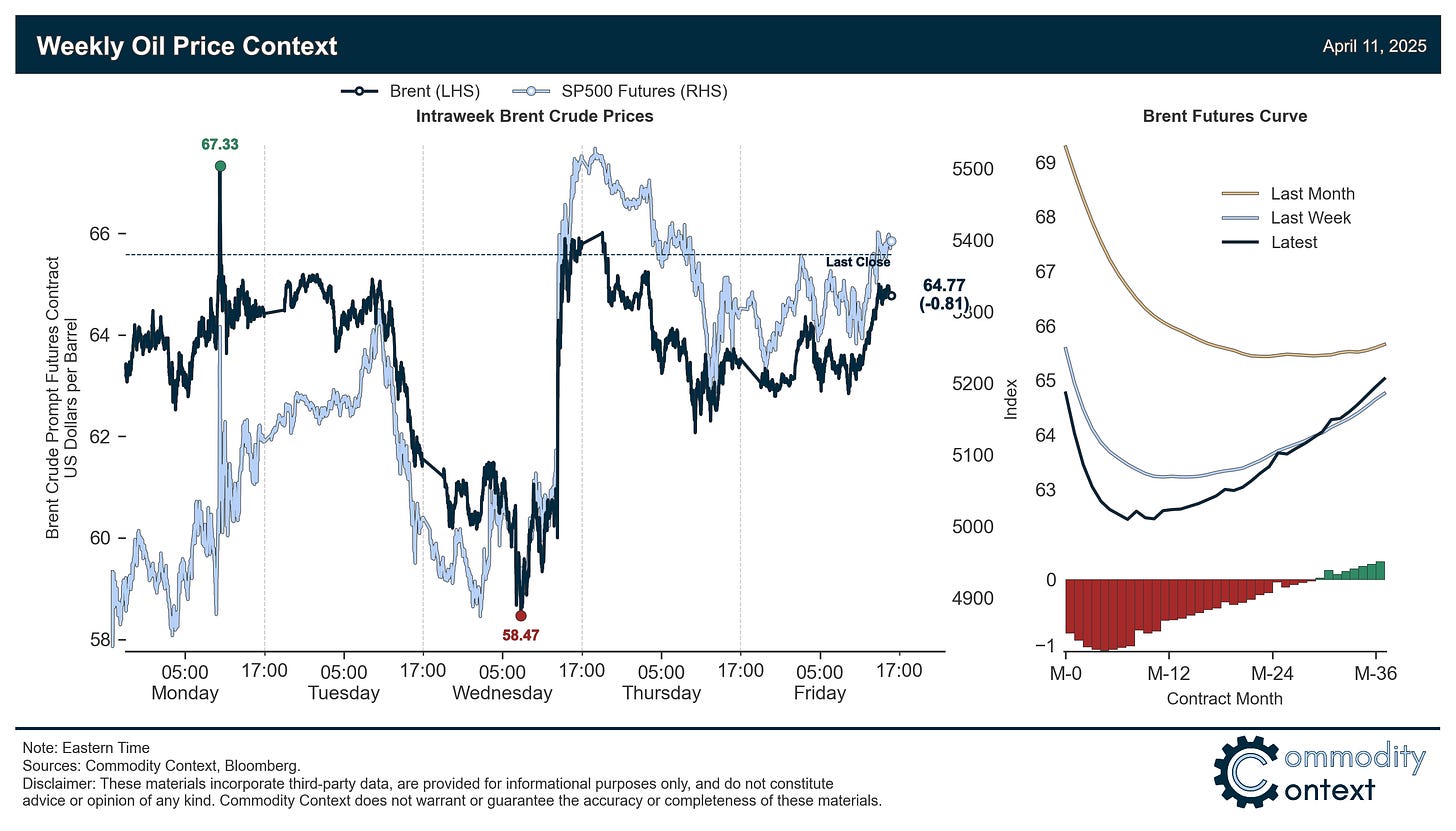

Crude continued to crater through mid-week before rebounding with other risk assets following Trump’s [partial] “tariff pause”; term structure strengthened while speculators sold record crude volumes.

Happy Friday, Oil Watchers!

Every week, I summarize and analyze developments in flat crude prices, calendar spreads, high-frequency inventories, refined products, and positioning data, as well as a taste of the themes I’ve been thinking about or following closely.

If you’re already subscribed and/or appreciate the free chart and summary, hitting the LIKE button is one of the best ways to support my ongoing research.

Summary

Flat Prices fell by just shy of a dollar on the week to end around $65/bbl Brent, though only following a sharp swing into the $50s for the first time since early-2021 before Trump “paused” steeper tariffs on countries other than China for 90 days, with positioning data confirming that a record liquidation of speculative positions drove the decline.

Timespreads significantly outperformed beleaguered flat prices as WTI prompt timespreads doubled and both Brent and Dubai timespreads rallied; while prompt spreads continue to signal tight spot markets, the bulk of the crude futures curve (from 2026 forward) is now in contango, which is a term structure typically associated with oversupply conditions.

Inventories data revealed a mixed picture given that builds in the US and Singapore were offset by draws in ARA Europe; overall crude stocks remain low while diesel stocks are falling fastest and gasoline remains comparatively well-stocked.

Refined Products markets saw weakness in core transportation fuels like gasoline and diesel while the relative value of high-sulphur fuel oil in Europe, largely used as shipping fuel, rose to an all-time high vs. crude.

Market Positioning data revealed that speculators sold crude contracts at record volumes last week, sinking prices despite still-healthy spot market conditions; the net spec position sunk from modestly overbought levels to deeply oversold ones, returning hot money flows to a crude tailwind through the coming weeks.

As Well As crude prices whip around on the tariff-induced risk asset rout and recovery, US oil-directed rig count saw the largest weekly decline in nearly two years, Keystone springs a(nother) leak, and US set to begin nuclear talks with Iran in Oman on Saturday.