Oil Context Weekly (W13)

Crude prices rise despite broader pullback in risk assets as hot money moves back into oil contracts and Brent term structure points to tighter physical market.

Spoke with Reuters about the recent exceptionally strong Western Canadian Select crude pricing we’ve seen in Alberta—check out that full write-up here.

Happy Friday, Oil Watchers!

Every week, I summarize and analyze developments in flat crude prices, calendar spreads, high-frequency inventories, refined products, and positioning data, as well as a taste of the themes I’ve been thinking about or following closely.

If you’re already subscribed and/or appreciate the free chart and summary, hitting the LIKE button is one of the best ways to support my ongoing research.

Summary

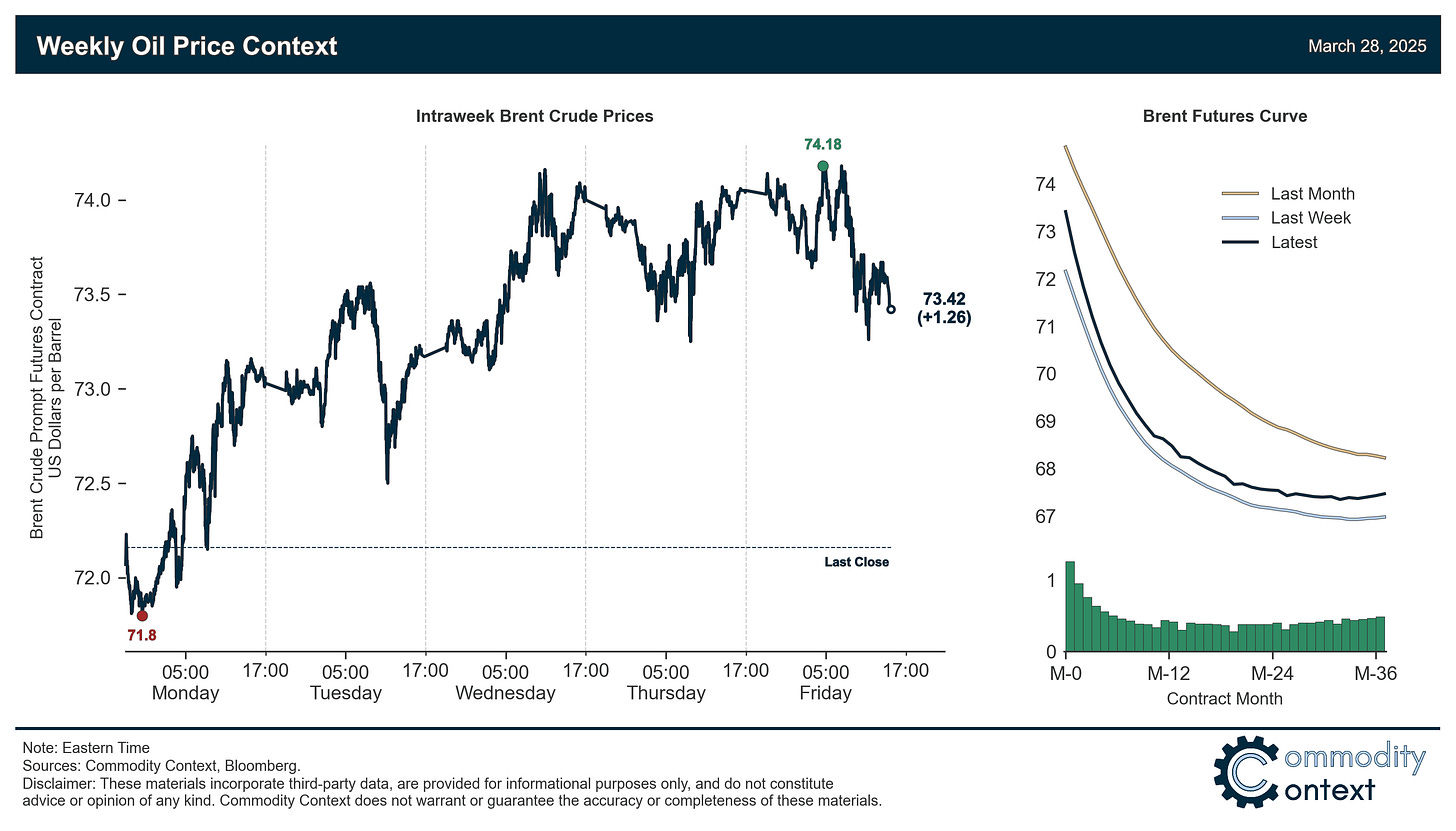

Flat Prices rose ~$1.25/bbl; Brent crude is hovering just above $73/bbl, up nearly $5/bbl from the early-March lows, and the barrel’s resilience is especially impressive in the face of a rout in broader equity markets as previously depressed speculative interest returns to the barrel.

Timespreads were flat to higher with notable performance divergences between the major global benchmarks. Brent term structure rallied more aggressively than expected given flat price performance to reach nearly as high a prompt spread as sported by Dubai barrels, which remain the more backwardated with flat performance on the week. WTI contracts are, meanwhile, least backwardated, though modest gains better dovetailed with flat price performance in both magnitude and timing.

Inventories built across all major tracked hubs but really on the back of US “other oils”—that actually masked a seasonally atypical draw—as well as a recovery in bunkering fuels in Singapore; stocks of ARA European transportation fuels, like gasoline and diesel, continued to decline from previously acutely elevated levels.

Refined Products markets were comparatively quiet, with inventories tracking back to normal seasonal patterns and lacking the same macro-level and positioning winds affecting crude.

Market Positioning data confirmed that speculators were sizable buyers of crude futures and options contracts over the past week-through-Tuesday, definitively off the oversold levels of two weeks ago and back into the lower end of what I’d consider balanced positioning; while it remains likely that as the buying cycle repeats that we overrun those balanced levels back into overbought territory, but positioning has shifted from a singularly bullish tailwind to a more balanced factor in near-term pricing pressures.

As Well As Dallas Fed Energy Survey reveals extent of US oil industry’s [anonymous] displeasure with Trump admin, US moves to impose tariff-laden secondary sanctions on countries who buy Venezuelan oil, report from St. John’s on Canadian offshore, and Trump and Carney have their first call.