Oil Context Weekly (W10)

Crude prices fell further on the back of OPEC+’s surprise decision to proceed with planned April production hikes and exceptionally volatile US trade policy, which prompted broad risk off sentiment

Happy Friday, Oil Watchers!

Every week, I summarize and analyze developments in flat crude prices, calendar spreads, high-frequency inventories, refined products, and positioning data, as well as a taste of the themes I’ve been thinking about or following closely.

If you’re already subscribed and/or appreciate the free chart and summary, hitting the LIKE button is one of the best ways to support my ongoing research.

Summary

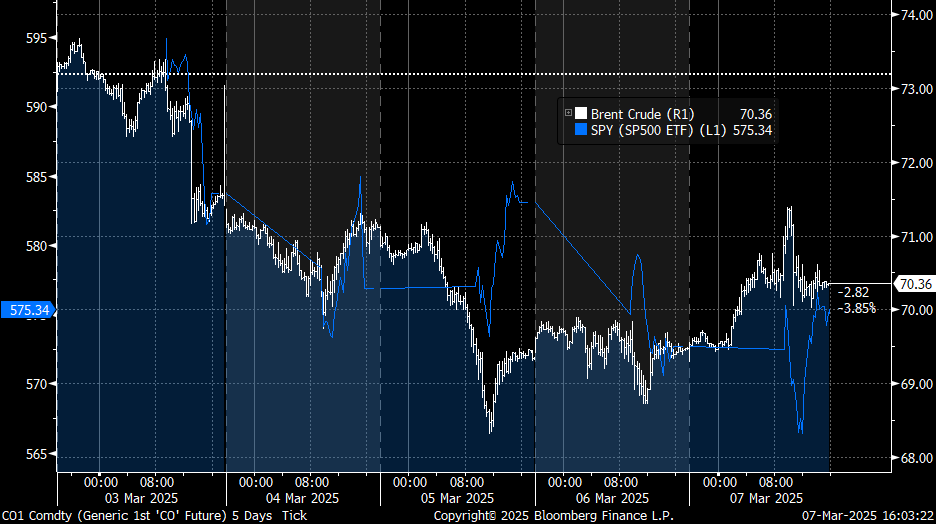

Flat Prices fell nearly $3/bbl for Brent crude to finish just north of $70/bbl after Monday’s surprise announcement from OPEC+ that the producer group would be going ahead with planned production increases in April as well as a ceaseless torrent of US trade policy uncertainty that thoroughly unnerved risk assets across the board.

Timespreads across the crude complex remained stable, with Brent and Dubai spreads flat-to-up while WTI spreads narrowed slightly; Dubai spreads were most volatile following the OPEC+ announcement, weakening rapidly before recovering to a net stronger level.

Inventories data was mixed but leaned bullish as draws across the US and Singapore were only somewhat balanced by builds in ARA Europe; US inventories resumed normal seasonal trends, Singaporean fuel oil stocks cratered to incredibly low levels for this time of year, and ARA European gasoline stocks jumped back to near-record levels.

Refined Products weakened with both US gasoline and diesel crack spreads shedding roughly $2/bbl.

Market Positioning data confirmed that speculators were net sellers of crude contracts for the sixth consecutive week, bringing the net speculative position to the lowest level since last November; once momentum peters out, hot money flows will return as a tailwind for the barrel after constituting crude’s strongest headwind over the past month and a half.

As Well As US delays—some?—Canadian tariffs and prompts further crude trade uncertainty, Trump admin seeking more Congressional funding for SPR refill plans, and Kazakh crude overproduction worsens but the government promises OPEC+ that they’ll make it up.