Oil Context Weekly (W8)

Crude prices rallied on the mounting prospect of US military engagement with Iran, but the near-dated timespreads are showing weakness, likely as Iran paper risk overwhelms realized physical appetites

Happy Friday, Oil Watchers!

Every week, I summarize and analyze developments in flat crude prices, calendar spreads, high-frequency inventories, refined products, and positioning data, as well as a taste of the themes I’ve been thinking about or following closely.

If you’re already subscribed and/or appreciate the free chart and summary, hitting the LIKE button is one of the best ways to support my ongoing research.

Summary

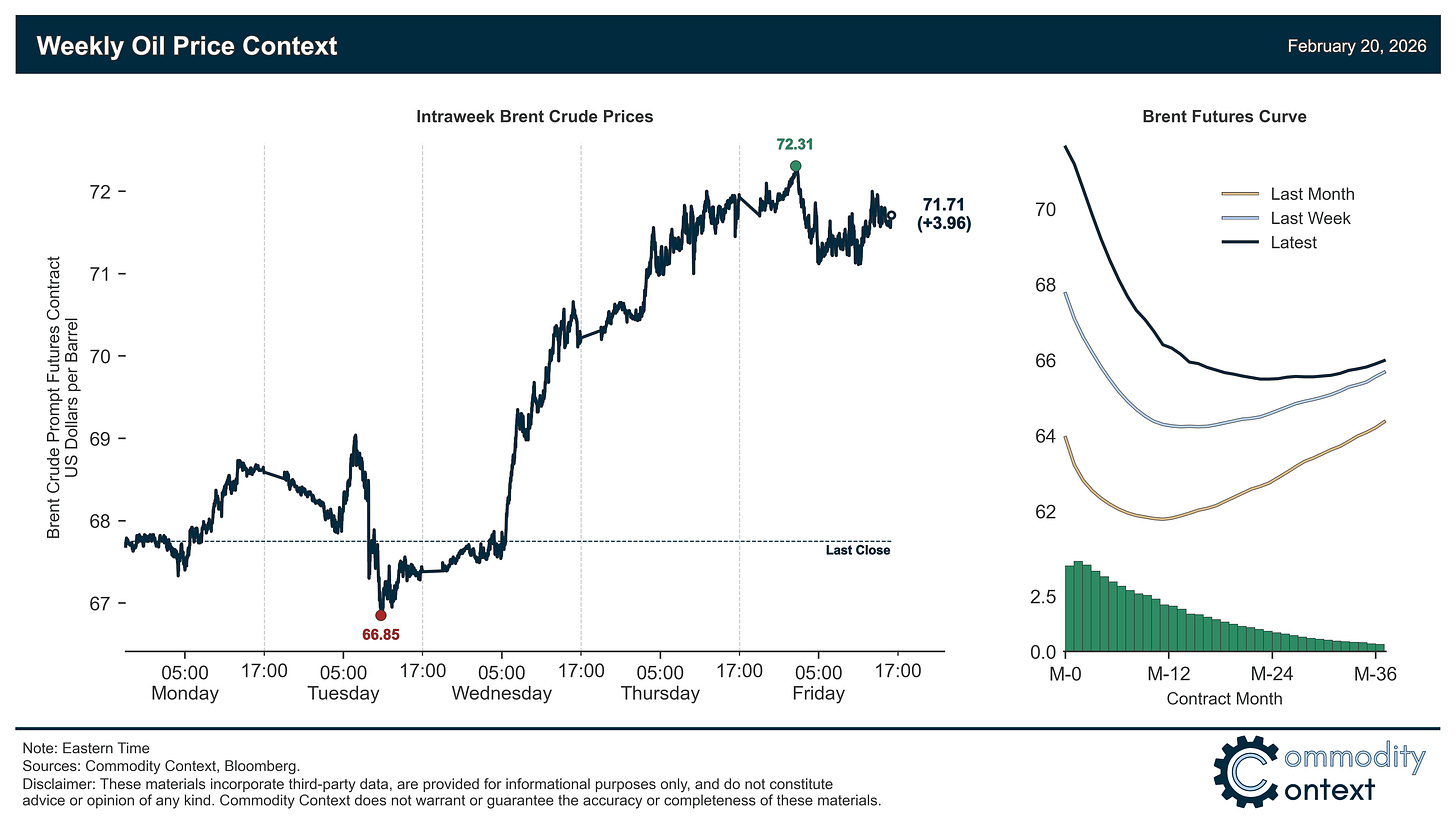

Flat prices raced ~$4/bbl higher for Brent crude to finish just below $72/bbl—the highest level since July 2025—on the back of mounting Iran risk as the Trump administration accumulates the largest US military buildup in the Middle East since the 2003 Iraq invasion.

Timespreads were more interesting than the rallying flat prices as prompt Brent futures spreads weakened against the expectation of rallying into steeper backwardation (i.e., given heightened Iran risk); while Brent term structure is broadly stronger (see further creeping backwardation and a less and less depressed belly w/w and m/m), the relative weakening of both prompt Brent timespread and Brent DFLs is a flashing warning sign that the Iran tightness reflected in paper markets is increasingly clashing with physical market appetites.

Inventories data was leaned heavily bullish given a shockingly large draw in the US, which brought the cumulative decline over the past four weeks to a staggering 52.9 MMbbl; far more modest builds were recorded in ARA Europe and Singapore, though Singaporean light distillate fuels have now built every week this year and sit at fresh all-time highs.

Refined Products markets were dominated by an aggressive bid for diesel, in an even more concentrated expression of the Iran risk, with the tight European middle distillates market especially sensitive to supply risks to the Middle Eastern supplies on which Europe now depends following bans on the import of Russian fuels.

Market Positioning data revealed that speculators were modest sellers of crude futures and options contracts over the past week through Tuesday, but with the big Iran rally only coming on Wednesday it’s highly likely that we’re back at the highest overall net long level since June 2025 if not January 2025, immediately prior to Trump reentering office. Prices continue to be supported by this ample speculative position, putting risks squarely to the downside when these positions ultimately pull back from currently elevated levels.

As Well As all eyes on Iran, US [again] threatens to leave the IEA, and Trump’s tariff temper tantrum.