Oil Context Weekly (W7)

Crude prices rise on Hormuz advisory before falling back on the prospect of longer US-Iran talks, with headlines dotted with a flurry of US sanctions relief on Venezuela’s oil sector.

Happy Friday, Oil Watchers!

Every week, I summarize and analyze developments in flat crude prices, calendar spreads, high-frequency inventories, refined products, and positioning data, as well as a taste of the themes I’ve been thinking about or following closely.

If you’re already subscribed and/or appreciate the free chart and summary, hitting the LIKE button is one of the best ways to support my ongoing research.

Summary

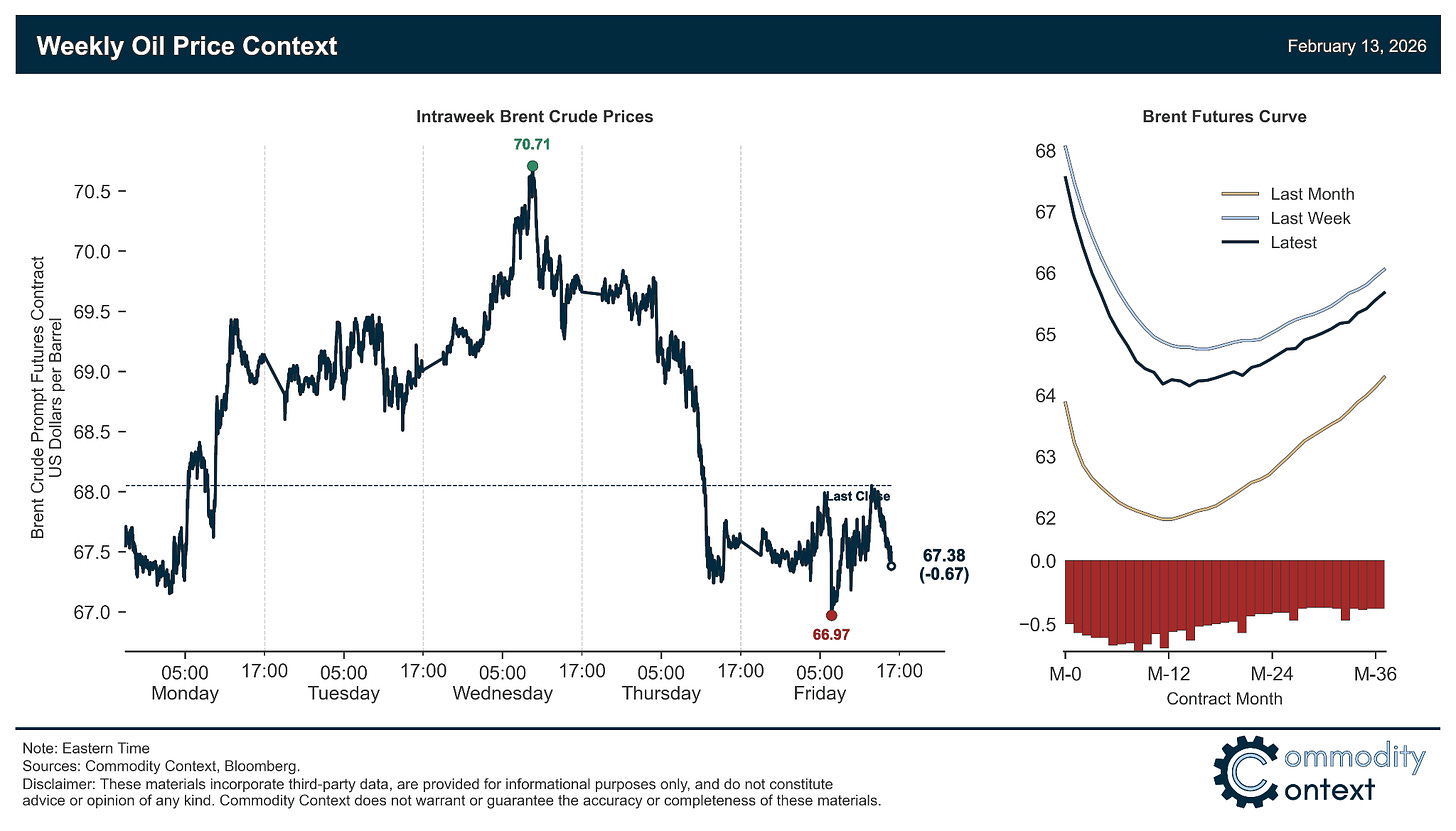

Flat Prices slipped ~70c for Brent to finish just above $67/bbl, benefitting early in the week from US Hormuz shipping advisory but ultimately slipping back as Iran concerns abated.

Timespreads were largely unchanged as the Brent futures curve experienced an almost perfectly parallel shift lower alongside the slip in flat pricing; the prompt timespreads remained modestly but steadily backwardated with Brent strongest, then Dubai, then finally WTI weakest.

Inventories data leaned bullish at the headline level, with draws across all major hubs, but was complicated by a large US crude build; ARA European crude stocks have gotten achingly low while Singaporean light distillate stocks are exceptionally high.

Refined Products were less eventful than Iran-torqued crude, with gasoline crack spreads slipping on high US and Singaporean stocks while both diesel balances and margins remain more supportive.

Market Positioning data revealed that speculative positioning was largely flat over the past week, with the two survey periods cutting off some of the recent highs and lows; overall, however, speculative positioning remains notably elevated relative to the experience of the past year, maintaining the positioning risk bias squarely to the downside.

As Well As Trump deflated immediate Iran risk when he said that talks could extend over the coming month; OPEC+ reportedly to resume its hiking cycle in April when group meets on March 1st; Trump administration’s rapid fire issuance of Venezuelan sanctions waivers opens door to upstream investment; Venezuelan exports continue to find new buyers but too slowly for USGC heavy oil market relief; and IEA demand downgrade pales in comparison to oil market’s supply-side indigestion.