Oil Context Weekly (W5)

Crude prices rocket to their highest level since last July on the combination of still-heightened Iran risk and the background energy of frothy commodity market sentiment and a plunging US dollar.

Happy Friday and the 365th day of January, oil watchers,

Every week, I summarize and analyze developments in flat crude prices, calendar spreads, high-frequency inventories, refined products, and positioning data, as well as a taste of the themes I’ve been thinking about or following closely.

🎙️ On the latest episode of the Oil Ground Up podcast, I was joined by Ronald P. Smith of the Russian Oil & Gas Monitor to talk about his comparatively positive outlook for Russian oil production. Anyone watching the crude market over the past few years has gotten a crash course in the Russian oil industry, and amidst a fog of sanctions and drone attacks most hold a roundly bearish outlook for Russian production—so I wanted to hear from Ronald about what consensus is missing.

If you’re already subscribed and/or appreciate the free chart and summary, hitting the LIKE button is one of the best ways to support my ongoing research.

Summary

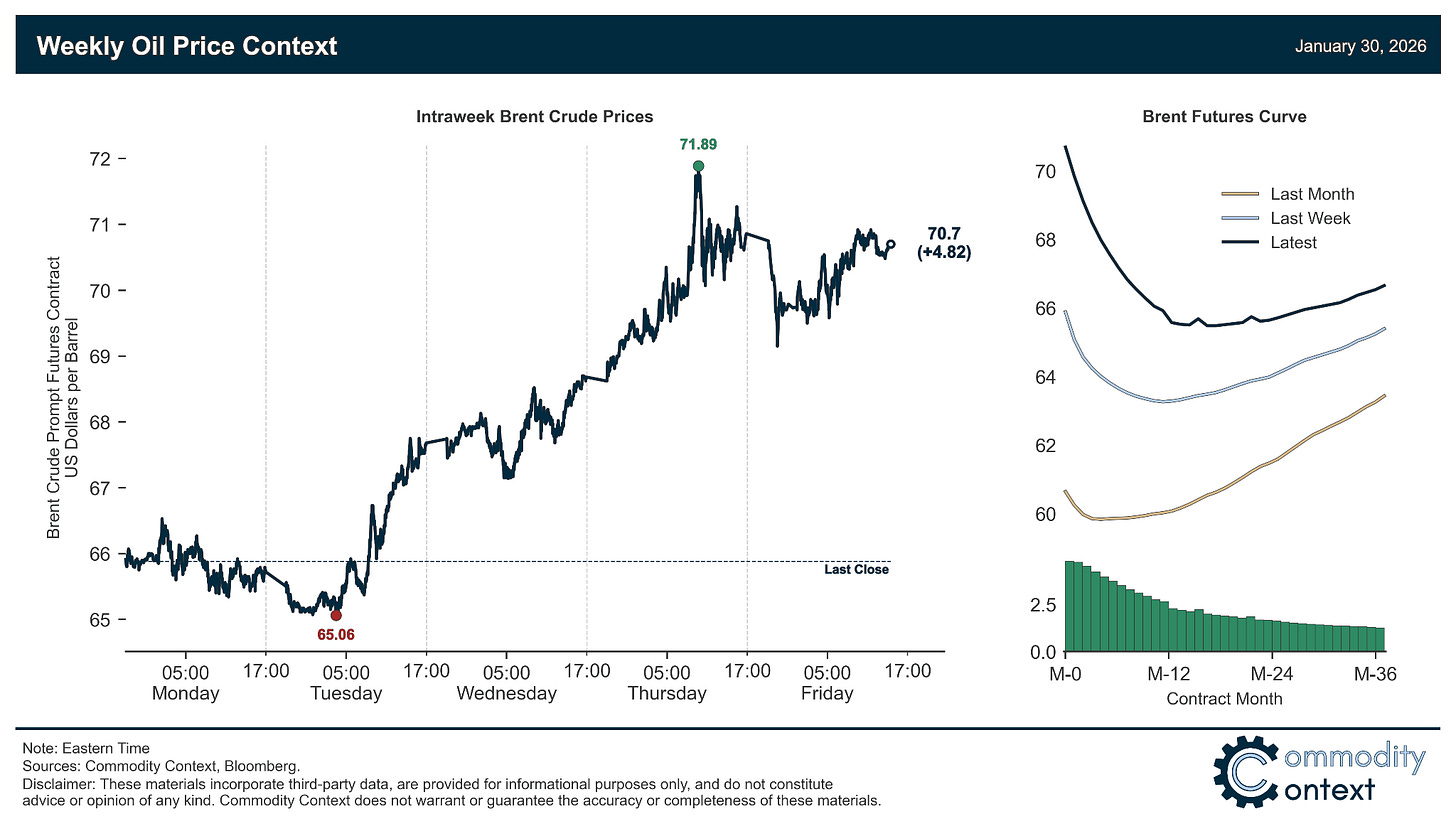

Flat Prices raced nearly $5/bbl higher for Brent to finish above $70/bbl, its highest level since last July; prices have been primarily supported by ongoing Iran tail risk hedging but are also now benefitting from cross-commodity complex speculative inflows and an ever-weaker US Dollar.

Timespreads strengthened but the steepest gains remain concentrated at the very front of the Brent curve; while the front of the curve is clearly more strongly backwardated on current Iran risk, our smiley-curve redux is a far cry from the full reversal into full backwardation experienced last June (the Israel-Iran war)—this gives a sense of immediate upside risk should the White House’s Iranian sabre rattling escalate further.

Inventories data leaned bullish given draws across all three tracked hubs; US headline stocks drew for the first time this year, while Singaporean bunker fuel stocks extended their decline to below seasonal from exceptionally overbuilt levels earlier this month.

Refined Products were dominated by middle distillates, the prices of which screamed higher, and US diesel crack spreads hit their highest seasonal level over the past half-decade—and that’s been an especially rich half-decade for diesel; demand remains boosted and supply hampered by exceptionally cold weather across North America.

Market Positioning data confirmed that speculators were again sizable buyers of crude contracts and, while still not especially long compared to the experience of the past few years, speculators are more bullish on crude today than they have been at any point since last July.

As Well As a flurry of developments across what are, these days, the usual suspects:

Iran: options tail risk wags the flat dog amidst renewed threats from Trump even as Iranian supply remains constrained.

Venezuela: US issues sanctions waiver, Caracas passes hydrocarbon law reform, Chevron shipping more (but not putting additional capital at risk), and more Venezuelan barrels hit the USGC refining market.

Kazakhstan: CPC back to full capacity (theoretically) and Restarting Tengiz.

Russia: stranded barrels getting so cheap they’re prompting renewed Chinese buying, and the EU considering a full services ban to replace price cap.