Oil Context Weekly (W3)

Crude prices rise and fall on Iran risk amidst heavy speculative flows and options skew, while throttled activity at the CPC marine terminal is keeping Brent term structure bid

Happy Friday, Oil Watchers!

Every week, I summarize and analyze developments in flat crude prices, calendar spreads, high-frequency inventories, refined products, and positioning data, as well as a taste of the themes I’ve been thinking about or following closely.

🎙️ I had the pleasure of rejoining Erik Townsend on the MacroVoices Podcast to discuss why I firmly believe that President Trump’s policy agenda has, thus far, been a clear net bullish factor for crude, despite his obvious preference for ever lower pump prices.

If you’re already subscribed and/or appreciate the free chart and summary, hitting the LIKE button is one of the best ways to support my ongoing research.

Summary

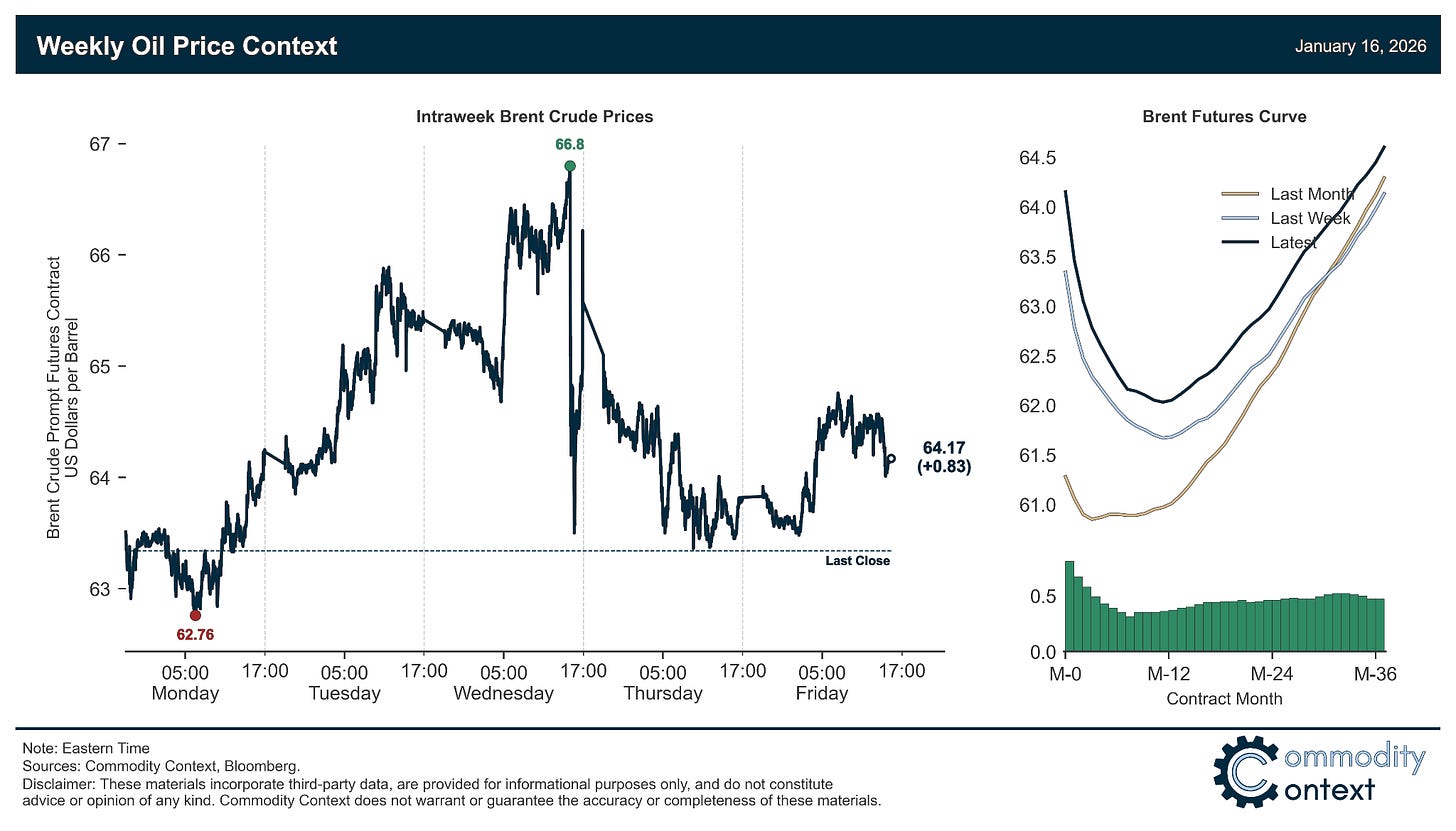

Flat Prices rose just less than $1/bbl as Brent ends above $64/bbl, well lower than the nearly $67/bbl crude reached on Wednesday amidst worry that Trump would militarily intervene in Iran; an abrupt about-face from the White House prompted a rapid unwind of that risk bid.

Timespreads were split between strengthening term structure in Brent and Dubai crudes, both of which benefitted from the ongoing CPC outage and precautionary Iran-related buying, and WTI, which felt the specific downward pressure of Trump forcing seized Venezuelan barrels into local markets.

Inventories data leaned bearish given large and counterseasonal builds for the US and ARA Europe, as well as still-high bunker fuels in Singapore; glutted NGL inventories are inflating US headline stocks to seasonal highs despite crude remaining not far off seasonal lows.

Refined Products were mixed between weaker gasoline crack spreads and a rally in diesel crack spreads that was supported by a recovery in prompt backwardation after ending December in rare contango.

Market Positioning data confirmed that speculators were substantial buyers of crude contracts over the past week through Tuesday (prices peaked on Wednesday), the heaviest weekly buying sprint since last October; speculative short positions remain high but spec length also reached its highest level since February 2025.

As Well As Venezuelan crude begins the process of reentering global markets, Venezuela announces piecemeal energy sector reforms, Kazakhstan production craters on CPC marine terminal disruptions, and Iran risk peaks on Wednesday before Trump walks back intervention threats.