Oil Context Weekly (W2)

Crude prices rally on Iranian protest tail risk amidst information blackout despite a flurry of headlines related to Trump’s plans for Venezuela.

Happy Friday, Oil Watchers!

Every week, I summarize and analyze developments in flat crude prices, calendar spreads, high-frequency inventories, refined products, and positioning data, as well as a taste of the themes I’ve been thinking about or following closely.

It’s been an immensely busy week and I’ve spoken to countless media about various implications of the very much still evolving situation in Venezuela, including Bloomberg, CBC News (Video), the New York Times, the Toronto Star, Barrons, the Globe & Mail, Reuters, the Canadian Press, Axios, the Free Press, the Financial Post, the Financial Post’s video team, Heatmap’s ShiftKey Podcast, the Rob Breakenridge Show, and the MBP Intelligence Briefing (Canadian industry/policy focus)

If you’re already subscribed and/or appreciate the free chart and summary, hitting the LIKE button is one of the best ways to support my ongoing research.

Summary

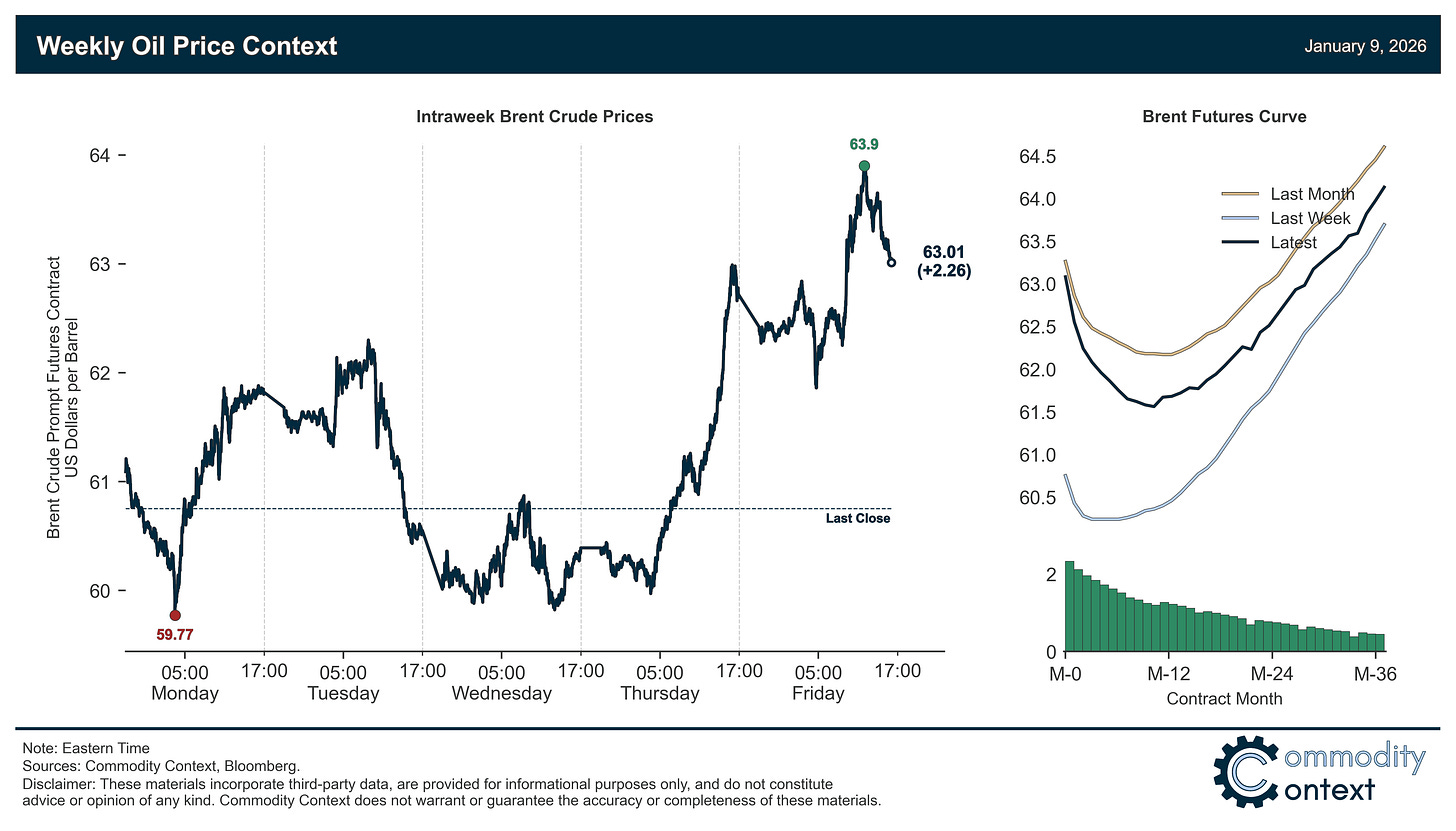

Flat Prices ended the week ~$2.50/bbl higher at just more than $63/bbl Brent, chopping sideways for the first half of the week, despite developments in Venezuela, and then rallying on Thursday and Friday, largely on concerns regarding rapidly escalating protests in Iran.

Timespreads strengthened for Brent crude, which returned to notably-stretched prompt backwardation, and Dubai, which rallied back into backwardation, on precautionary demand concerns with rising Iranian tail risks in the Gulf; WTI failed to benefit near as much and, specifically, was depressed by the prospect of additional Venezuelan barrels sloshing up on US shores.

Inventories data was mixed between more and sizable refined product-driven builds in the US juxtaposed with declines across both ARA Europe and Singapore; crude stocks remain tight while stocks of gasoline and diesel are in a far healthier position than a few months ago.

Refined Products are kicking off the New Year in line with seasonal levels, reflecting the normalization of stateside stocks and of previous refining capacity disruptions.

Market Positioning The net speculative position was roughly flat on the week across the six largest crude contracts and, while on the low-end of the longer-term range, now actually at the higher end of where we’re trended over the trailing quarter.

As Well As Trump’s 30–50 million barrel oil booty, the US isn’t a natural buyer for all of Venezuela’s crude exports, the great Venezuelan tanker chase continues, Trump pushes US oil companies to redevelop Venezuela’s oil industry, Iraq to nationalize Lukoil’s Iraqi oilfield stake, and Protests in Iran are steadily escalating.