Oil Context Weekly (W1)

Crude ended the week roughly flat despite reports of material supply losses across Venezuela and Kazakhstan as the Dubai crude benchmark slips into prompt contango amidst supply surge.

Happy New Year, Oil Watchers!

Every week, I summarize and analyze developments in flat crude prices, calendar spreads, high-frequency inventories, refined products, and positioning data, as well as a taste of the themes I’ve been thinking about or following closely.

If you’re already subscribed and/or appreciate the free chart and summary, hitting the LIKE button is one of the best ways to support my ongoing research.

Summary

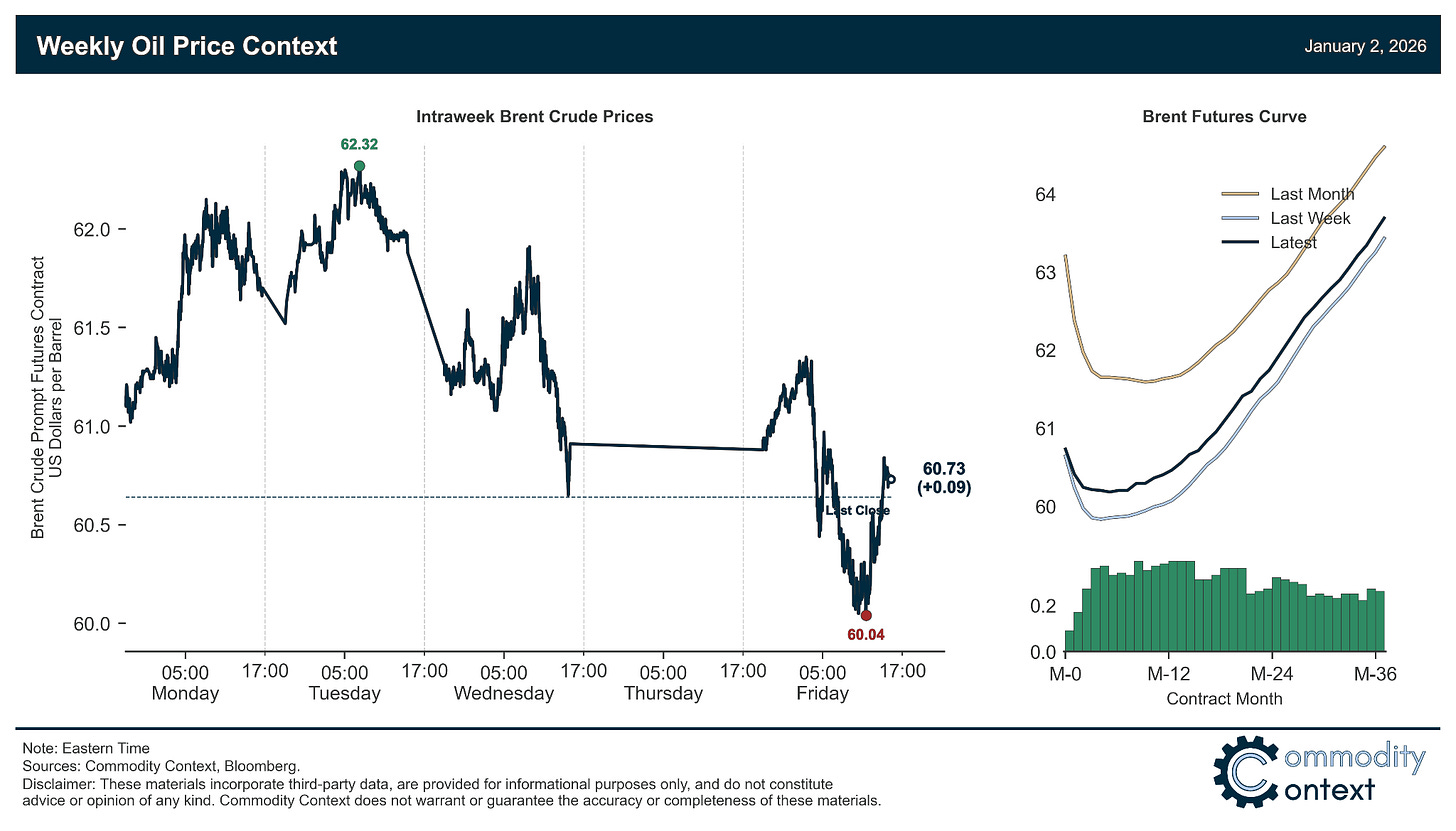

Flat Prices ended 2025 down roughly $15/bbl but ended the week very modestly positive, up a mere 10c for Brent to end just shy of $61/bbl; the barrel rose through Tuesday but grinded lower through the latter half of the week, managing to bounce back from a threatened dive below $60/bbl.

Timespreads were split between Brent and WTI, for whom prompt spreads ended the week flat, and Dubai, which slipped back into prompt contango; Dubai is clearly the contract currently experiencing the greatest downward pressure from the mounting supply surplus, but it also briefly flirted with prompt contango before rallying back to rejoin the stubbornly backwardated Western benchmarks.

Inventories data was leaned bearish thanks to a massive stateside commercial inflow, which swelled refined products, and NGLs even, as crude stocks ended the year at the bottom of their seasonal range; Singaporean stocks of both very light and very heavy products ended the year oversupplied while a ARA European headline draw was driven by a large decline in crude stocks.

Refined Products margins continued to fall through year-end and kicked off 2026, more or less, in line with seasonal norms, with headlines shifting away from refining sensitive themes toward more crude-sensitive ones.

Market Positioning data revealed that speculators were sizable buyers of crude contracts heading into Christmas (data delayed by holidays, should be caught up by next week), which corresponds with rising prices at that time; two-thirds of the weekly net gain was caused by a rationalization of what had been all-time high speculative short interest in crude contracts.

As Well As Venezuelan exports collapse amidst US blockade and pressure upstream production lower, Caspian Pipeline Consortium (CPC) terminal exports fall to 8-year low in December, and OPEC+ ministers expected to maintain flat production guidance through Q1.