Oil Context Weekly (W7)

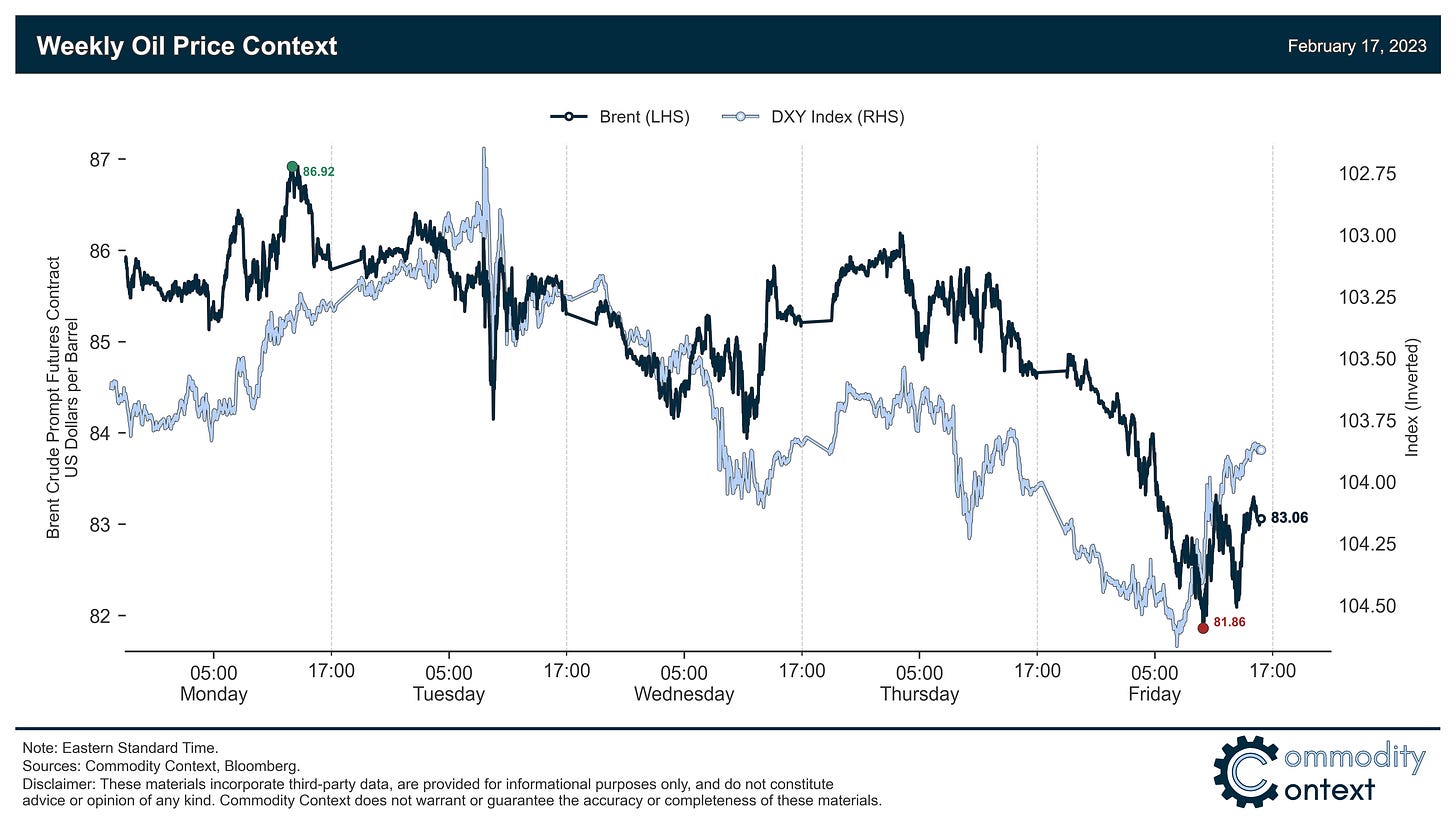

Crude prices fell steeply in yet another Friday selloff, dragged lower on a surging dollar boosted by renewed rate hike concerns; oil-specific news flow also leaned bearish but wasn't driving prices

Happy Friday, all! I had the opportunity to share some thoughts on, among other oil things, the recovery in air traffic and lagging jet fuel demand with BNN Bloomberg as I initially explored in Regaining Altitude—check out the full interview here.

Every week, I summarize the developments in flat crude prices, calendar spreads, high-frequency inventories, refined products, and positioning data and then provide a taste of the themes I’m thinking about or following closely.

If you’re already subscribed and/or appreciate the free chart and summary, hitting the LIKE button is one of the best ways to support my ongoing research.

Summary

Flat Prices were sleepy and uneventful for most of the past week despite a slew of relatively negative oil-related news flow; then, prices bombed lower on Friday, ultimately ending the week at ~$83/bbl, $3.50/bbl lower than last Friday’s close. Even so, it doesn’t entirely appear that crude spent the week trading on its own merits, rather getting tugged around by the almighty US dollar, which rose to a six-week high today.

Calendar Spreads weakened slightly this week but the pace was far gentler compared to what we saw in flat prices on Friday; both the prompt and bellwether Jun/Dec calendar spreads narrowed modestly.

Inventories data was unquestionably bearish this week as a monstrous 19.2 MMbbl total commercial petroleum build in the US utterly dwarfed the modest, nearly neutralizing moves in Singapore (+0.38 MMbbl) and ARA Europe (-0.44 MMbbl).

Refined Products resumed their pullback with both diesel and gasoline crack spreads in New York Harbor falling through the latter half of this week; diesel cracks reached their lowest level since mid-March 2022 on the combination of easing post-sanctions Russian export concerns and, most likely, some softening in demand.

Positioning data was once again not published this week by either the CFTC or ICE as fallout from the ransomware attack against ION Markets persists; it’s been three weeks since we last received a Commitments of Traders positioning update.

SPR was once again in the news following an announcement that DOE will be looking to sell 26 million barrels; however, it’s important to differentiate these congressionally mandated sales from the emergency releases that we saw last year—these were already baked in.