Oil Context Weekly (W45)

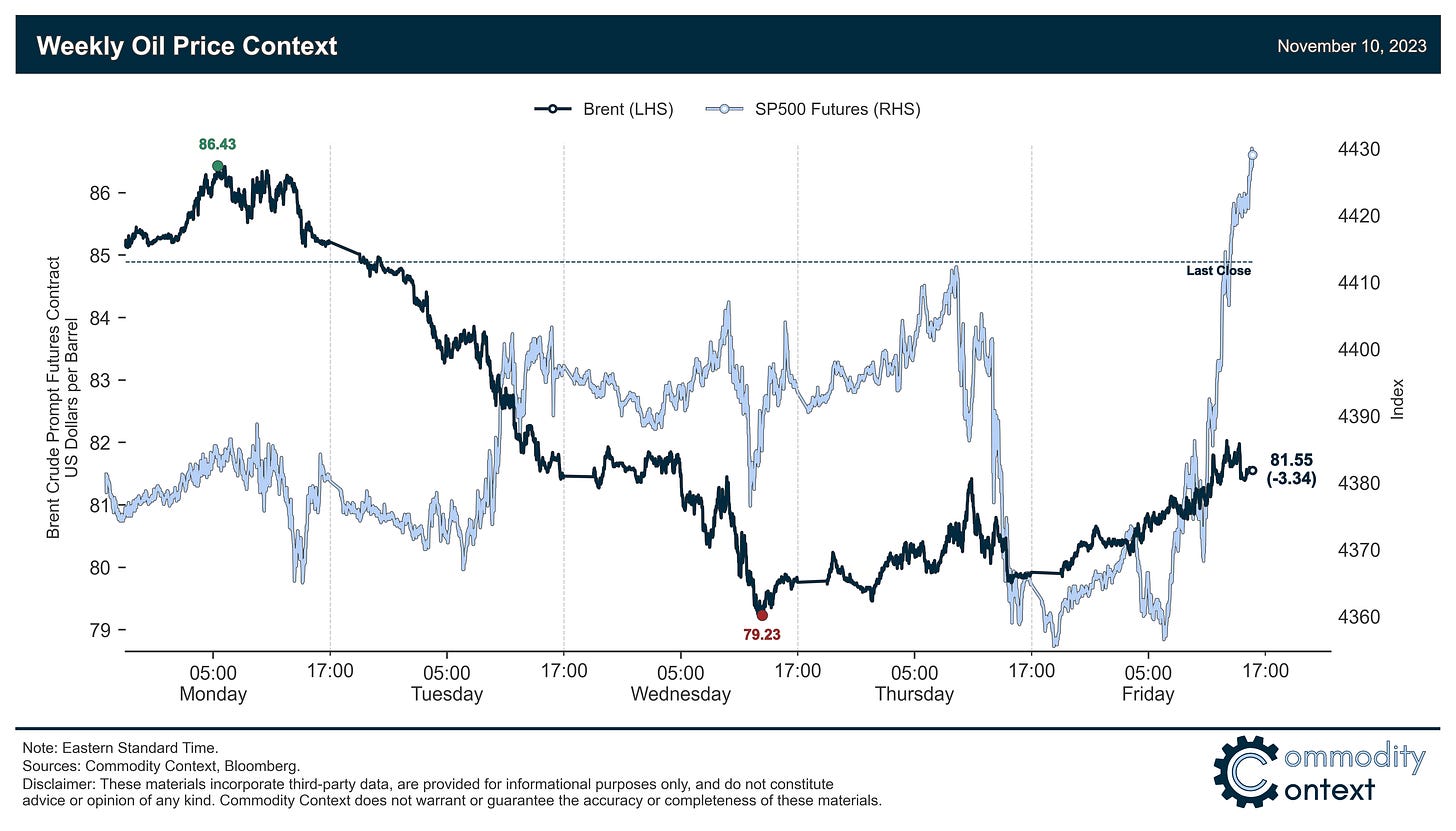

Oil prices continued their collapse for the third consecutive week, down $3/bbl driven by a suspected pullback of speculative capital amidst continued demand concerns and stronger-than-expected supply

Happy Friday!

Every week, I summarize developments in flat crude prices, calendar spreads, high-frequency inventories, refined products, and positioning data, as well as a taste of the themes I’ve been thinking about or following closely.

If you’re already subscribed and/or appreciate the free chart and summary, hitting the LIKE button is one of the best ways to support my ongoing research.

Summary

Flat Prices fell for the third consecutive week, shedding ~$3/bbl to head into the weekend at ~$82/bbl Brent, while WTI closed around $78/bbl (notably still below the SPR repurchase guidance).

Futures Curve weakened, with WTI flipping into prompt contango for the first time since July; however, the physical Brent market, which would normally be expected to track prompt spreads, has remained far firmer and lends credence to spec-driven selloff thesis.

Inventories data were bullish but incomplete given a lack of EIA weekly reporting (two weeks worth of data next Wednesday); the data we did have showed decent-sized draws across ARA Europe and Singapore, while the less accurate API data showed a very large crude build in the US that

Refined Products experienced a reversal of fortune, with gasoline crack spreads climbing back to their highest level since the end of September while diesel cracks continue to ease back and are near their lowest level since June.

Investor Positioning data indicated that speculators sold the most Brent contracts in a month last week-through-Tuesday, partially explaining the week’s price weakness; unfortunately, WTI data is

As Well As critical data delays amidst uncertainty, Saudi speculator blame game, OPEC export seasonality, and signs of a pullback in Chinese refining activity (albeit from exceptionally high levels)