Oil Context Weekly (W43)

Crude prices rise and [likely] cap off the first monthly gain in October since April; diesel squeeze ahead of Monday’s contract expiry pushes backwardation in New York Harbor to eye-watering levels.

Welcome to Oil Context Weekly, my less formal wrap-up of the market analysis, news flow, and data releases that matter.

Every week, I summarize the developments in flat crude prices, calendar spreads, high-frequency inventories, refined products, and positioning data and then provide a taste of the themes I’m thinking about or following closely—highlights now included in the free summary.

If you’re already subscribed and/or appreciate the free chart and summary, hitting the LIKE button is one of the best ways to support my ongoing research.

Summary

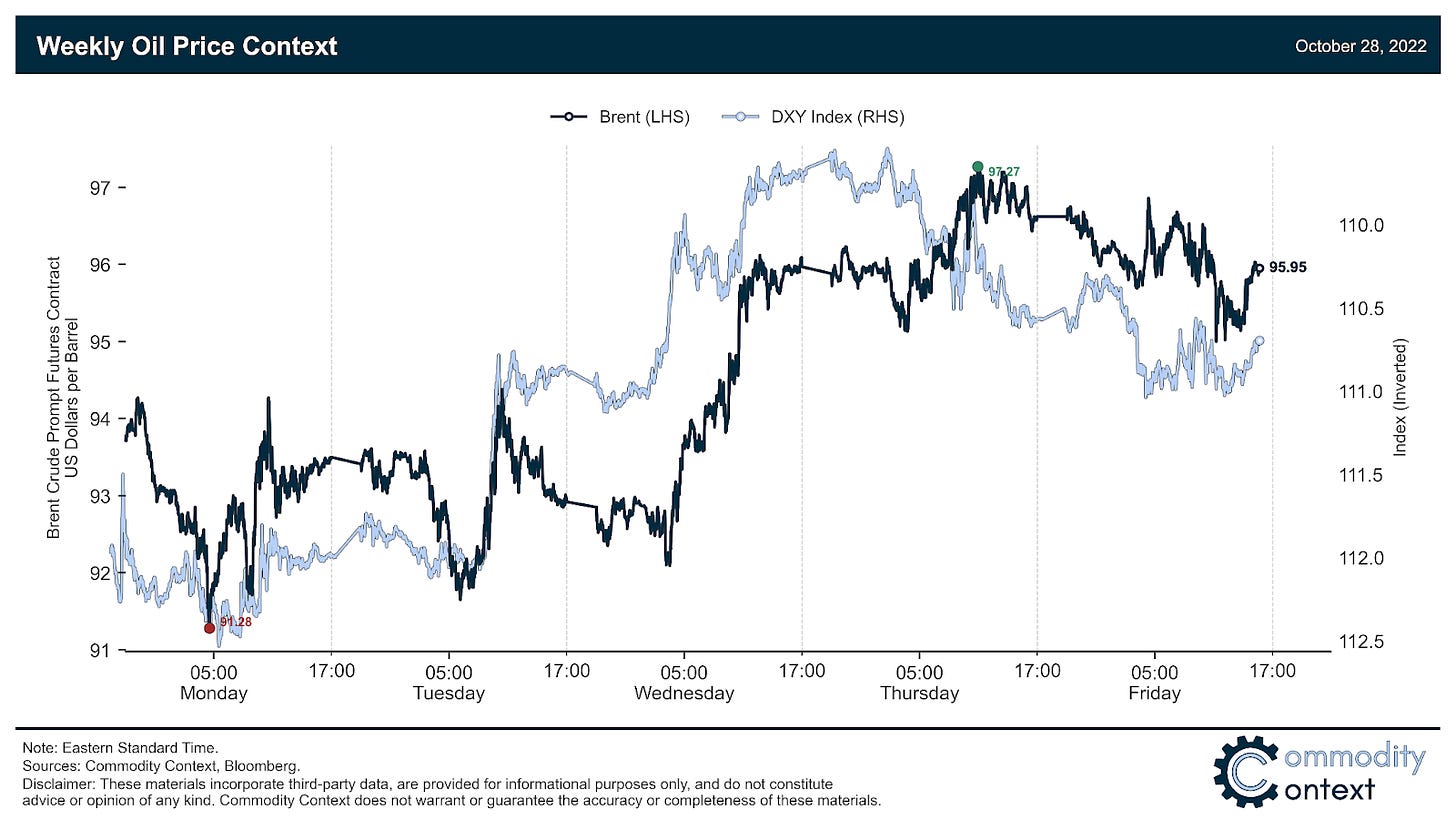

Flat Prices rose ~$2.50/bbl through the week to $96/bbl (Brent) at the time of publication; unless we get a truly spectacular selloff on Monday, it looks like October will represent the first monthly gain for crude prices since April.

Calendar Spreads were flat-to-down over the past week (prompt down, Dec/Dec flattish); both spreads eased together through the first half of the week before bouncing decisively on Wednesday morning.

Inventories data showed uniform draws across Singapore (-0.14 MMbbl w/w), Europe (-0.13), and the US (-1.7); global inventories remain low on an absolute basis and there is little sign of this downward trend abating, especially given the critically tight diesel market—as an example, American diesel inventories are still sitting at their lowest seasonal level as far as weekly data goes back (i.e., 1982).

Refined Products tightness remains squarely focused on those dwindling diesel inventories, which helped push New York Harbor contracts to nearly $200/bbl as of writing, a ~$37/bbl (23%) spread vs the next month—given that contract expires on Monday, it’s reasonable to ascribe much of this especially acute to pre-weekend short-covering.

Positioning data showed a bounce-back in speculative buying; net positions increased by 34.5 MMbbl this past week through Tuesday following the heaviest 5-day selling stretch since late-June in the week prior; the net managed money position as a share of overall open interest rose back to 8.3% from 7.5% last week but was still below the recent high of 8.8% two weeks ago.

Chinese Data: much-delayed Chinese data was released over the weekend showed domestic refinery runs rising ~1.2 MMbpd m/m to 13.9 MMbpd in September, their highest level since February—i.e., before the current form of mass COVID-zero lockdowns began.

Monster Earnings: oil companies releasing earnings reports are posting staggering earnings, with the two largest—ExxonMobil and Chevron—posting a combined $30.9bn profit for the past quarter, a fact that is surely to feature prominently in political lambasting ahead of the US midterms.