Oil Context Weekly (W38)

Crude price gains ease on macro unease but the curve continues to steepen; Russia threatens to further upend the refined products market with a ban on diesel and gasoline exports.

In case you missed it, I had the pleasure of participating in the International Energy Forum’s (IEF) inaugural Oil Market Analysis Webinar, a new series diving into major differences and changes in the official outlooks published by the IEA, OPEC, and EIA. You can watch a free recording here.

Happy Friday!

Every week, I summarize developments in flat crude prices, calendar spreads, high-frequency inventories, refined products, and positioning data as well as a taste of the themes I’ve been thinking about or following closely.

If you’re already subscribed and/or appreciate the free chart and summary, hitting the LIKE button is one of the best ways to support my ongoing research.

Summary

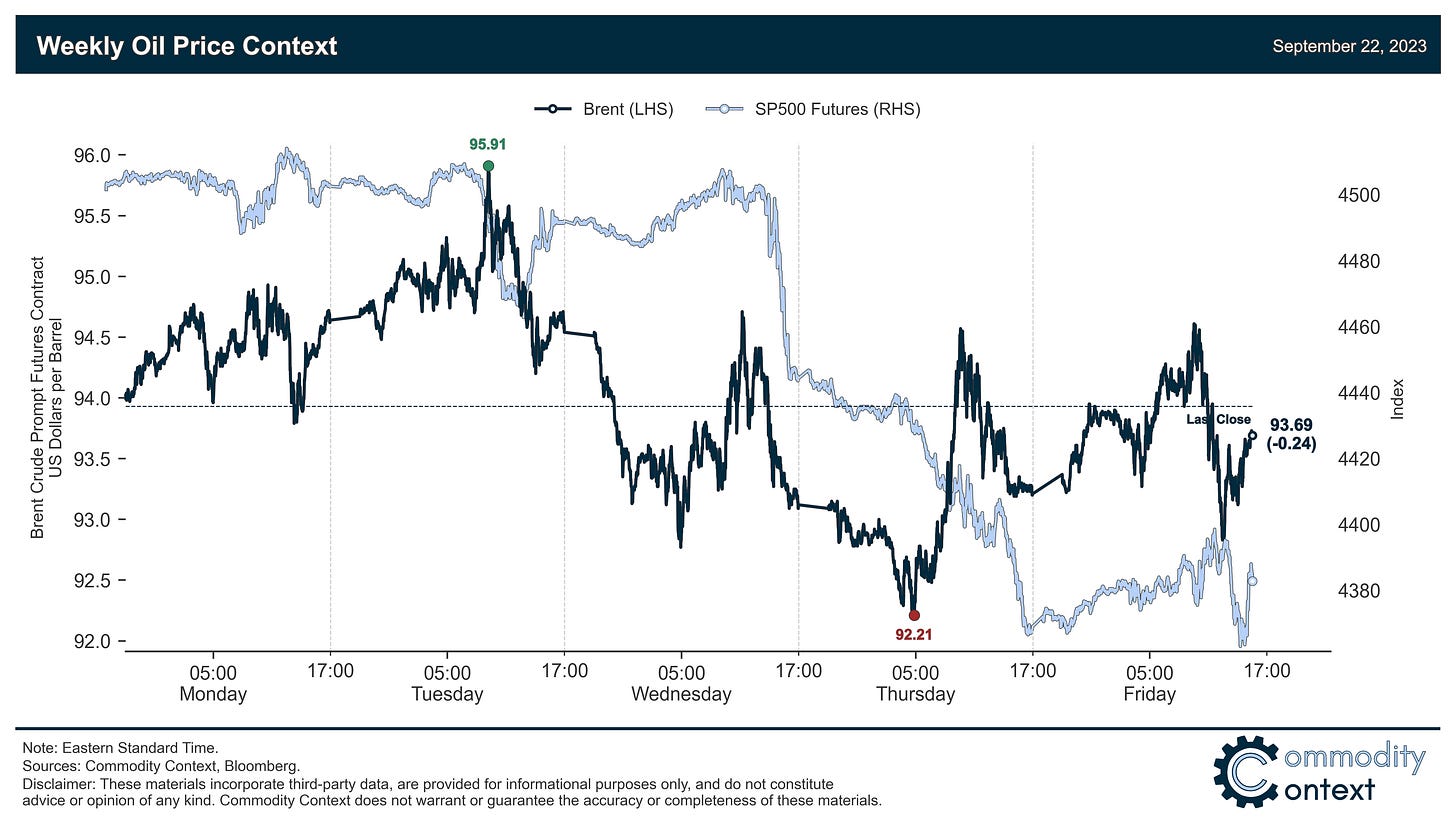

Flat Prices traded sideways to down as crude continues its efforts to consolidate above $90/bbl amidst bearish macro sentiment; both Brent and WTI eased by ~$0.25/bbl on the week, although WTI managed to close ever-so-slightly above $90/bbl.

Calendar Spreads widened into steeper backwardation, signaling strong spot and near-term fundamentals in the face of that selloff in flat prices.

Inventories data was caught between draws in ARA Europe and builds across Singapore and the US—even in the US, this headline build was driven by less valuable “other oils” vs. a return to draws across core liquids (i.e., crude, gasoline, diesel).

Refined Products eased back vs. crude, with crack spreads narrowing slightly across the board despite the news of Russia’s export ban; the rollover in fuel oil cracks points to a shift from crude quality concerns toward seasonal maintenance-related constraints.

Positioning data revealed that speculators were net crude buyers this past week-through-Tuesday, pushing the spec position as a share of total open interest back up to its highest level since the summer of 2021; these frothy sentiment keeps near-term positioning risk to the downside, and likely explains some of the barrels struggles over the past few days.

As Well As the bearish optimism of the Fed, Russia’s ban on the export of gasoline and diesel, a fake SPR headline gone viral, and the vibe of the World Petroleum Congress.