Oil Context Weekly (W36)

Brent crude prices breach $90/bbl for the first time this year on Saudi/Russian cut extension, end the week $2/bbl higher

Happy Friday!

Every week, I summarize developments in flat crude prices, calendar spreads, high-frequency inventories, refined products, and positioning data as well as a taste of the themes I’ve been thinking about or following closely.

If you’re already subscribed and/or appreciate the free chart and summary, hitting the LIKE button is one of the best ways to support my ongoing research.

Summary

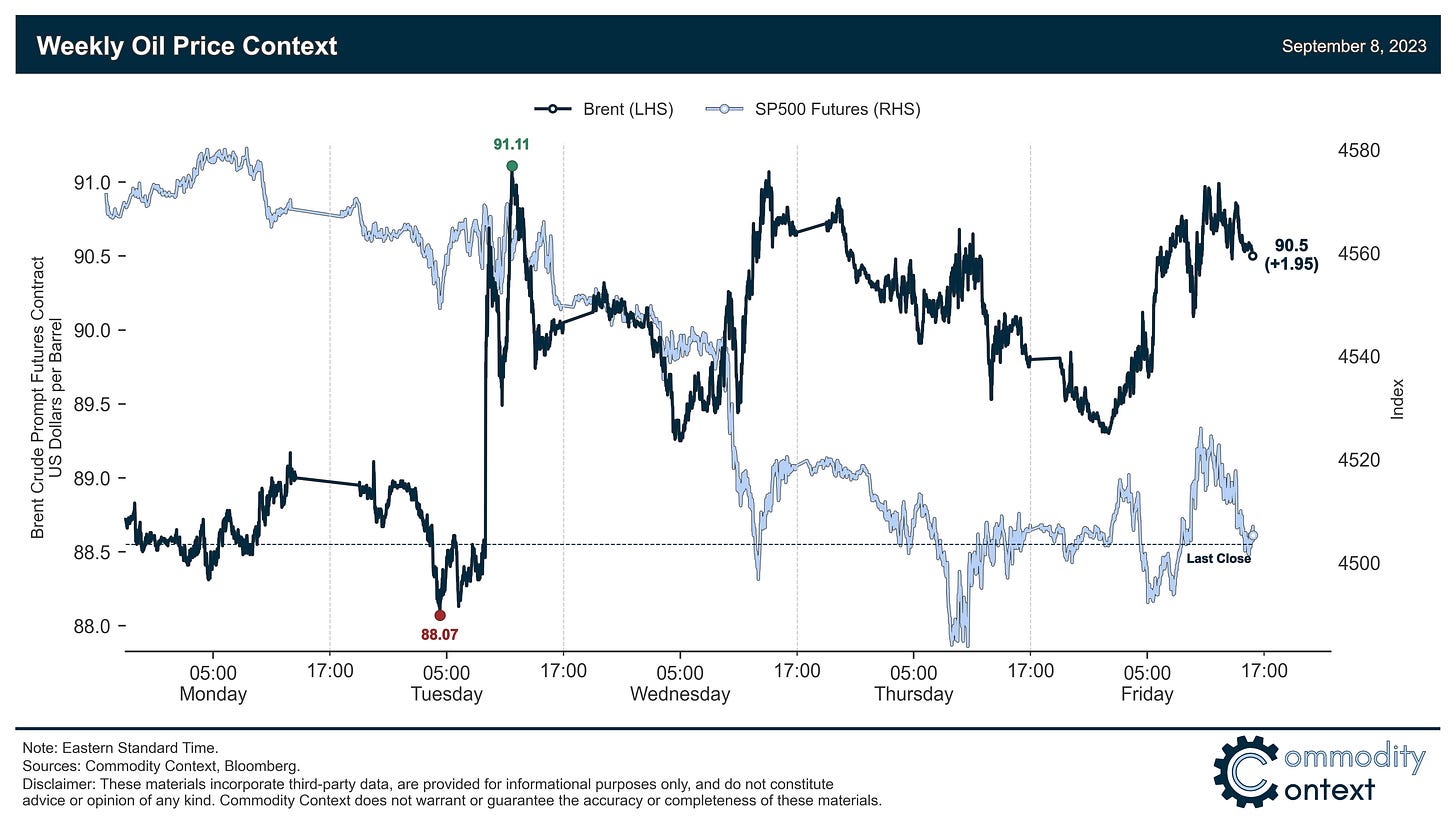

Flat Prices rallied to a fresh year-to-date high of $91/bbl on Tuesday following news that Saudi Arabia and Russia would extend their cuts until the end of the year; this is the first time Brent contracts have breached $90/bbl since last November, and contracts spent the balance of the week consolidating around this level, finishing Friday roughly $2/bbl higher on the week.

Calendar Spreads added considerable texture to moves in flat prices this week: bellwether Dec/Dec spreads trading in lockstep with prompt prices, while prompt calendar spreads actually ended the week lower, signaling that the rally may have modestly run ahead of current fundamentals.

Inventories data leaned mildly bearish, although modest commercial builds are coming off acutely depressed base levels across ARA Europe and Singapore and the large draws of non-core products obscured large crude and gasoline draws in the US.

Refined Products remain tight with crack spreads for diesel and gasoline rising again this week; diesel once again flirted with the $50/bbl level and gasoline floated back above $20/bbl, driven, in the short-term, by risks to Northeast supplies caused by Hurricane Lee and, more structurally, continued difficulties rebalancing ahead of hopeful Chinese refined product export relief over the coming month.

Positioning data revealed that speculators increased their net position in crude contracts at the fastest pace since the climb out of the mid-March mini banking crisis and the net spec position as a share of total open interest is, at 9.3%, definitively frothy—positioning risk is now squarely to the downside given the relatively limited dry spec powder and the elevated likelihood of profit-taking.