Oil Context Weekly (W35)

Crude term structure remains firm despite flat price pullbacks, while OPEC+ signals continuing intention to ease production cuts given Libya’s outage and expected Iraqi compliance improvements

Happy Friday, Oil Watchers!

Every week, I summarize and analyze developments in flat crude prices, calendar spreads, high-frequency inventories, refined products, and positioning data, as well as a taste of the themes I’ve been thinking about or following closely.

If you’re already subscribed and/or appreciate the free chart and summary, hitting the LIKE button is one of the best ways to support my ongoing research.

Summary

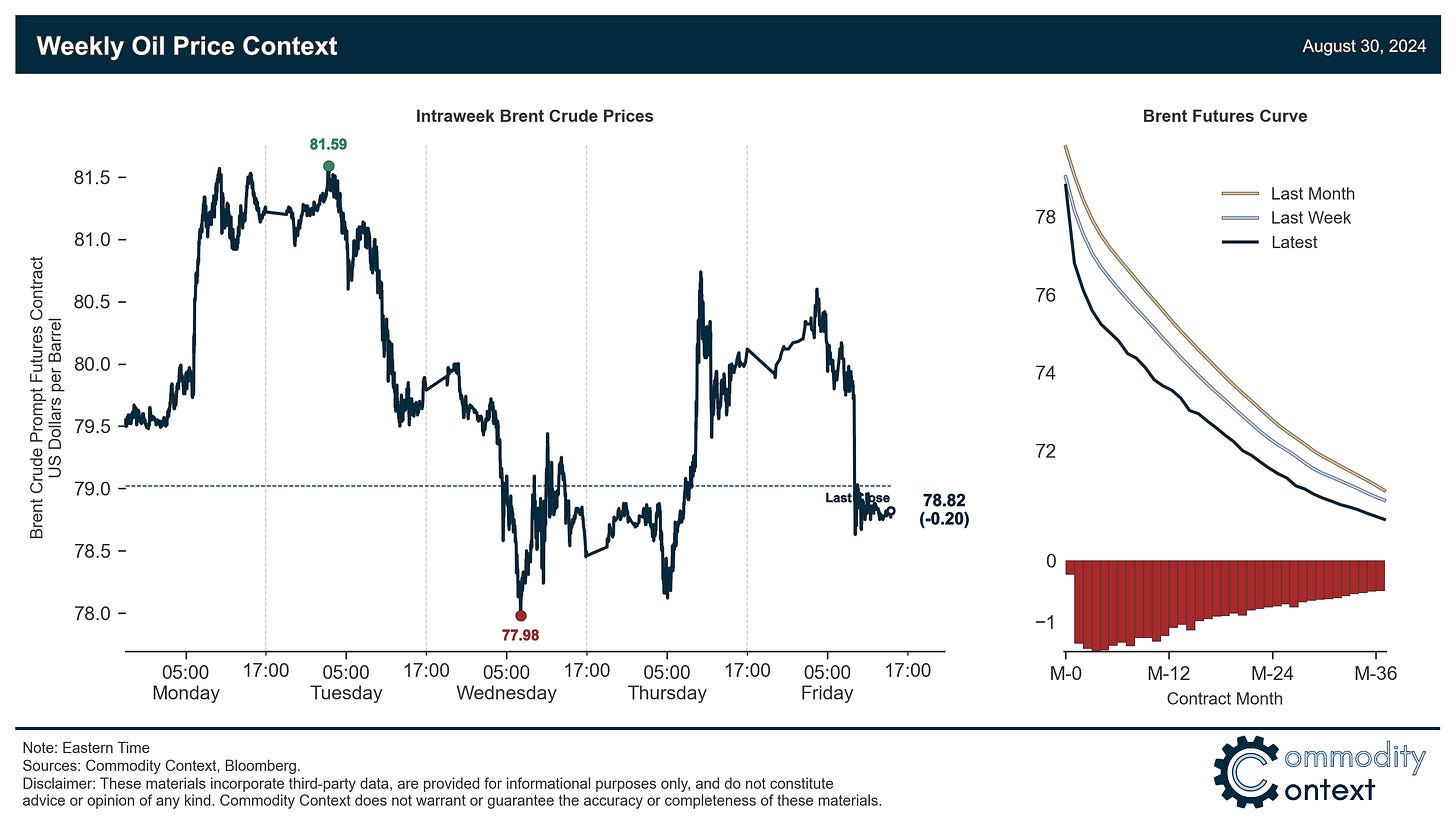

Flat Prices started strong (on Libya’s force majeure announcement), pulled back, climbed again, and finally were laid lower once again on Friday by a report indicating that OPEC+ is still planning to go ahead with scheduled cut easing despite recent price weakness.

Timespreads remained an area of relative strength compared to flat prices, especially in terms of the spread between physical spot markets and prompt futures contracts (i.e., DFLs); both flat prices and timespreads began recovering together on August 22nd, but flat prices—and, to a lesser extent, futures calendar spreads—have chopped back and forth while DFLs have risen steadily.

Inventories data was mixed but leaned bullish as headline commercial petroleum stocks across all major hubs stayed, more or less, at seasonal norms; gasoline stocks in the US are falling rapidly—an island of relative bullishness—while gasoline stocks in Singapore are headed the opposite direction, signaling weak Asia demand.

Refined Products weakened further, with both gasoline and diesel crack spreads giving back a $1-3/bbl; as far as signals go, crack spreads are feeling the weight of both weaker demand and stronger refined product supplies, making it difficult to clearly translate to a purely negative market signal.

Investor Positioning data confirmed that speculators were modest net buyers of crude contracts, though positioning remains exceptionally low and a tailwind for crude prices over the coming weeks; still-low speculative net length with Brent prices around $80/bbl likely indicates a positioning-neutral fair Brent value in the mid-$80s.

As Well As OPEC+ sources tell Reuters that the plan is still to begin easing production cuts in October, further production and now confirmed export losses in Libya, and now Iraq appears finally to get more serious about OPEC production quota compliance (we’ll see…)