Oil Context Weekly (W34)

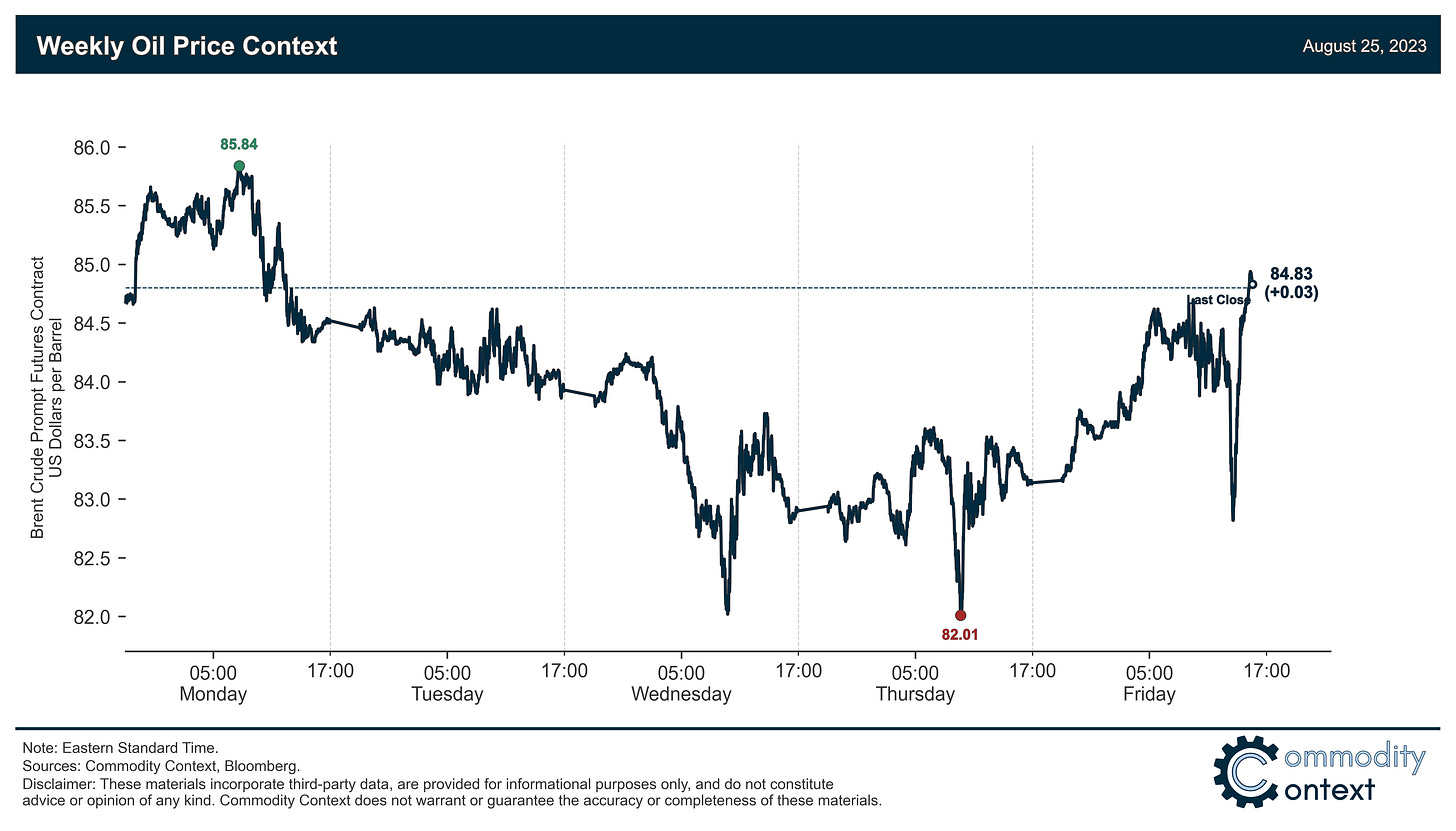

Crude prices ended the week effectively unchanged despite multiple attempted meltdowns, supported by rapidly mounting evidence of exceptionally large physical market deficits.

Happy Friday!

Every week, I summarize developments in flat crude prices, calendar spreads, high-frequency inventories, refined products, and positioning data as well as a taste of the themes I’ve been thinking about or following closely.

If you’re already subscribed and/or appreciate the free chart and summary, hitting the LIKE button is one of the best ways to support my ongoing research.

Summary

Flat Prices ended the week effectively unchanged vs. last Friday’s close despite multiple attempted meltdowns, supported by rapidly mounting high-frequency evidence of exceptionally large physical market deficits.

Calendar Spreads strengthened on the week despite the more-or-less unchanged prospects seen in flat prices, supporting claims of tighter spot market pressures

Inventories data was mixed but ever-so-slightly bullish overall, with a sizable build in Singapore (+3 MMbbl) and draws across ARA Europe (-2 MMbbl) and the US (-3 MMbbl).

Refined Products crack spreads rallied hard today and brought diesel margins higher by $7/bbl on the week to their highest level since mid-January; the relative fortunes of diesel and high-sulphur fuel oil provide interesting insight into the state of the global refining market amidst heavier-crude-tilted OPEC+ production cuts.

Positioning data confirmed that speculators were net sellers of crude futures and options contracts to the tune of 29.9 MMbbl over the past week-through-Tuesday; that this week’s downside crude pressure was confirmed to have been driven by speculative selling should come as good news to the bulls, especially given that we managed to end the week flat despite many, many clear attempts to bring the barrel lower.