Oil Context Weekly (W33)

Another Iran-risk hedging roller coaster cycle brought the barrel higher, then lower, as a looming and highly anticipated retaliatory strike against Israel was reportedly postponed.

Had the opportunity to rejoin Tracy Shuchart on the MicDropMarkets podcast for an oil market conversation together with Arjun Murti, which you can check out for free here.

Every week, I summarize and analyze developments in flat crude prices, calendar spreads, high-frequency inventories, refined products, and positioning data, as well as a taste of the themes I’ve been thinking about or following closely.

If you’re already subscribed and/or appreciate the free chart and summary, hitting the LIKE button is one of the best ways to support my ongoing research.

Summary

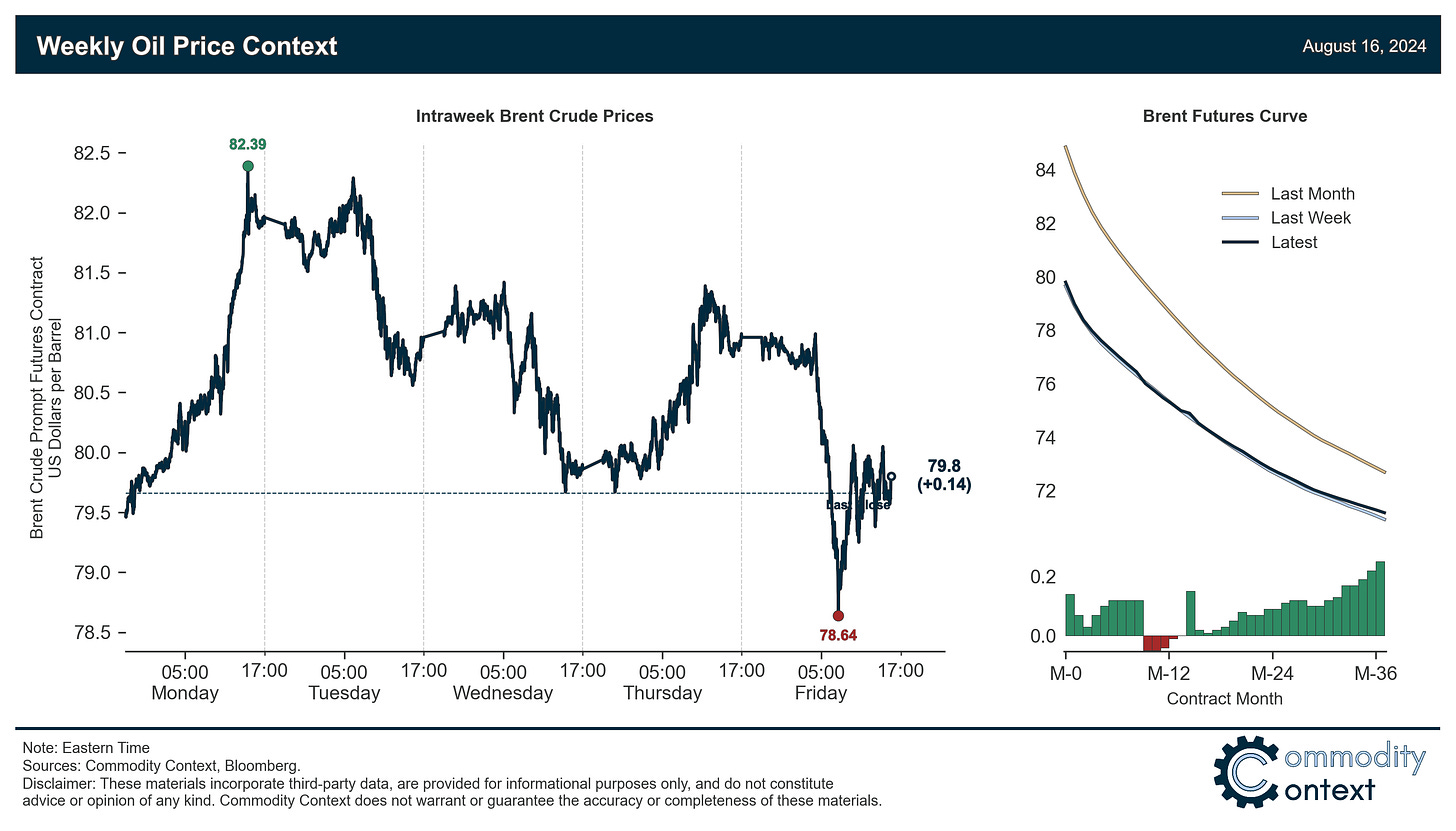

Flat Prices rose then fell on escalating then deflating fears of an Iranian strike against Israel, ending the week more or less flat despite considerable volatility and notable shifts in the crude options market.

Timespreads broadly strengthened, though physical-to-futures spreads rallied into steeper contango much more so than prompt futures spreads, which were a bit more muted and, in WTI’s case, actually narrowed on the week.

Inventories were mixed between a small draw in Singapore, an ongoing recovery in ARA European stocks, and a modest headline draw in the US that was marred by a counterseasonal build in crude stocks.

Refined Products were a source of outright weakness compared to crude, with diesel and especially gasoline crack spreads falling this week.

Investor Positioning data confirmed that speculators were net buyers of crude contracts through Tuesday, though overall speculative positioning remains low and a structural tailwind supporting near-term crude pricing.

As Well As hedging Iran fears in the options market, OPEC finally downgraded its ludicrously high demand forecasts for 2024/25, the widening split between the IEA and EIA on oil balances over the next 18 months, and rail strikes threaten Canadian oil-by-rail shipments.