Oil Context Weekly (W32)

Seventh week of crude gains joined by stronger prompt crack spreads and refining margins, demonstrating broader support for the barrel.

Happy Friday!

Every week, I summarize the developments in flat crude prices, calendar spreads, high-frequency inventories, refined products, and positioning data and then provide a taste of the themes I’m thinking about or following closely.

If you’re already subscribed and/or appreciate the free chart and summary, hitting the LIKE button is one of the best ways to support my ongoing research.

Summary

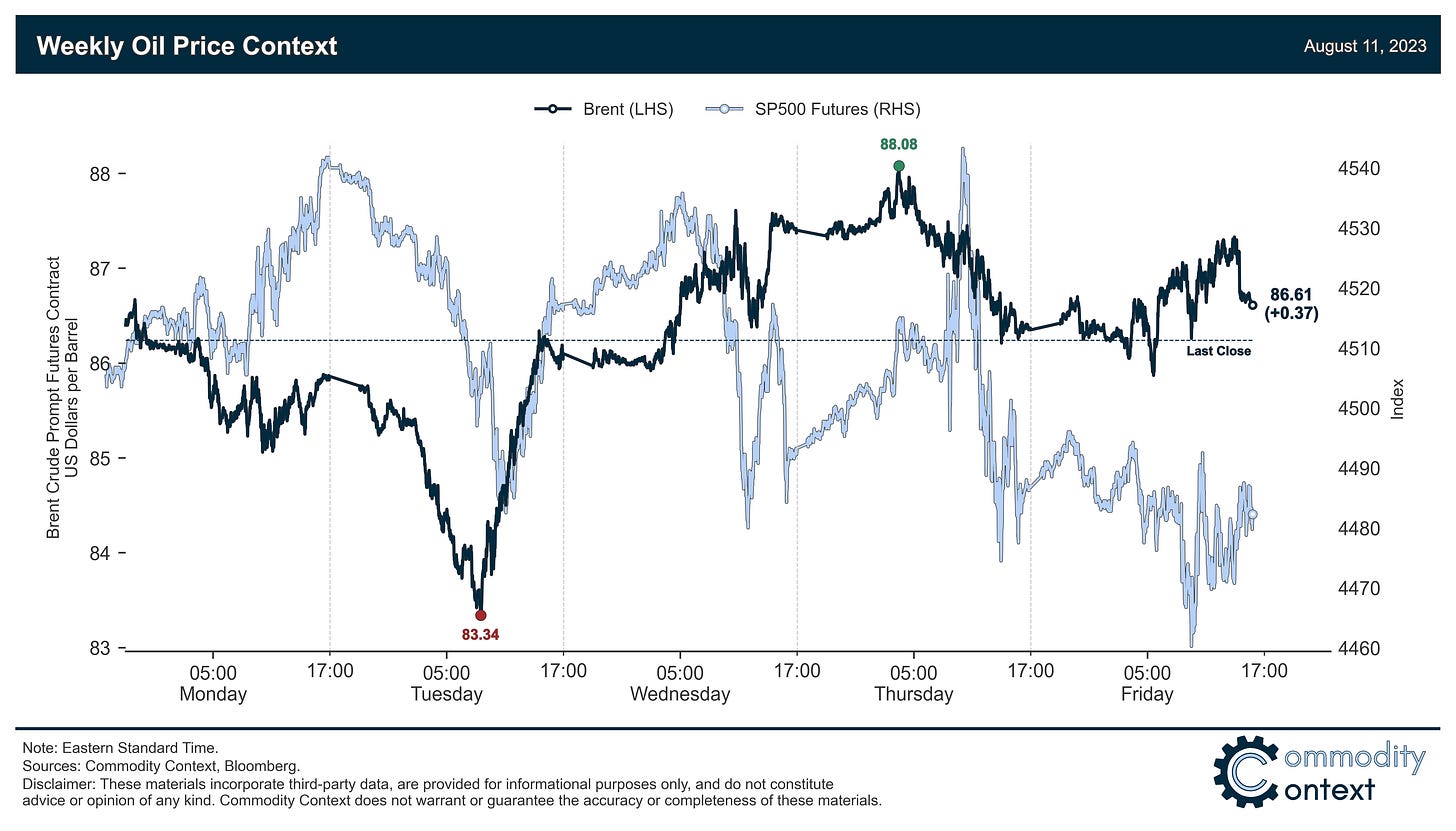

Flat Prices marked their seventh consecutive week of gains, the longest streak since early 2022; crude advanced another dollar per barrel to within spitting distance of a fresh year-to-date high and at the upper end of the stubborn range trade in which we’ve been trapped for most of the year.

Calendar Spreads were stronger on the week, with prompt spreads outperforming both Dec23/Dec24 spreads and flat prices to briefly tie for the widest level since November, which is the highest since, before that, June 2022 when Brent was fetching >$120/bbl.

Inventories data was mixed but leaned bearish on a large crude-driven US build that offset draws in Singapore and ARA Europe; however, refined product inventory declines continue to put upward pressure on crack spreads.

Refined Products continue to strengthen, with both gasoline and diesel crack spreads widening on the week; while still below last year’s crisis-level highs, current refining margins are sitting back above every other year prior.

Positioning data revealed that speculators were nearly net-neutral on the week (0.182 MMbbl of net sales); the net position as a share of total open interest remains relatively high, which maintains the balance of mean reversion risk on the downside.