Oil Context Weekly (W31)

Crude prices got walloped lower as further speculative liquidations and a macro-driven selloff hammered the final nails in the fourth consecutive week of declines.

Had the opportunity to rejoin Erik Townsend on the Macro Voices podcast to discuss discretionary risks to the oil market, ranging from President Trump’s claim that OPEC is working hard to get Kamala Harris elected to the ultimate growth limits of U.S. Shale—listen to the full episode for free here.

Every week, I summarize and analyze developments in flat crude prices, calendar spreads, high-frequency inventories, refined products, and positioning data, as well as a taste of the themes I’ve been thinking about or following closely.

If you’re already subscribed and/or appreciate the free chart and summary, hitting the LIKE button is one of the best ways to support my ongoing research.

Summary

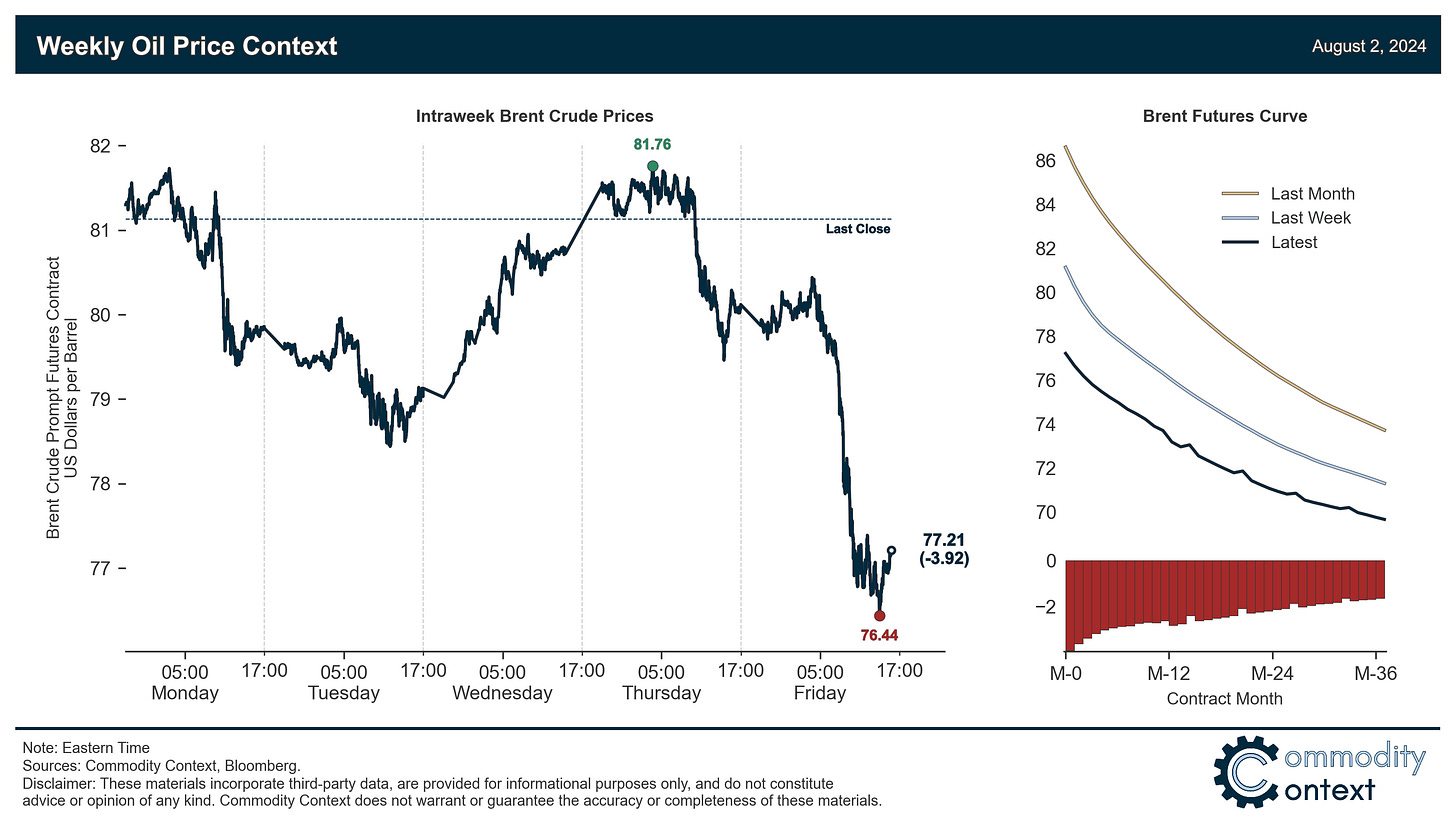

Flat Prices got hammered lower by an aggressive bout of speculative selling, capped off by a macro recessionary fear-driven rout on Friday, with Brent falling ~$4/bbl to close around $77/bbl and cap off the fourth consecutive week of crude price declines.

Futures Curves added fundamental flavor to the weakness in flat prices, trading lower on the week, and physical Brent timespreads provided an even more dour signal of current fading market strength; WTI spreads, meanwhile, are holding relatively firm.

Inventories data was modestly but nearly-unanimously bullish as the US and Singapore saw modest draws along seasonal paths while ARA European stocks rose marginally off the bottom of its seasonal range.

Refined Products traded largely sideways in contrast to the fireworks in crude and macro land.

Investor Positioning confirmed that speculators were massive sellers of crude over the past week-through-Tuesday, helping explain much of the weakness in flat prices; the net spec position is now at t’s lowest level since early June and tilts tactical, positioning related risk squarely to the upside—above and beyond any fundamental market pressures..

As Well As recession fears buffeted the barrel, Israeli strikes kill top Hezbollah and Hamas leadership in two separate hostile foreign capitals and push a dollop of risk premia back into crude prices, US crude growth takes a pause and stokes fresh peak shale claims, the US SPR buys more crude and is now almost out of cash (recapitalize the Petroleum Account!), Trump thinks OPEC is depressing prices to get Democrats elected (they are doing the opposite), and Venezuela’s election went the direction of maximum electoral fraud and repression, further diplomatically isolating the Maduro government.