Oil Context Weekly (W26)

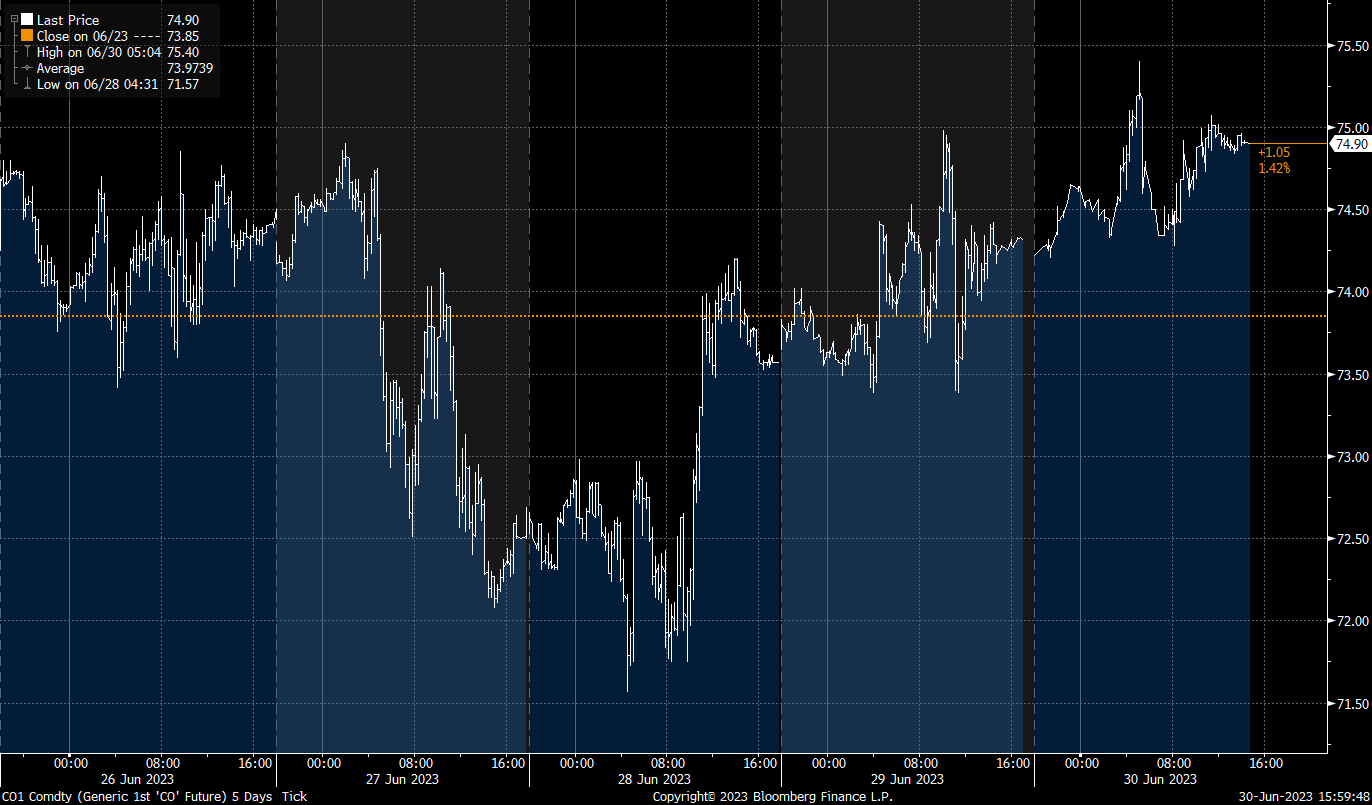

Crude prices rise modestly on the week but finish down for the fourth consecutive quarter.

Heads up that my thematic post this week, Royal Oil—a dive into Saudi oil production ahead of July’s unilateral production cuts—will be going out tomorrow morning instead of my normal mid-week release. It’s a fun one!

Every week, I summarize the developments in flat crude prices, calendar spreads, high-frequency inventories, refined products, and positioning data and then provide a taste of the themes I’m thinking about or following closely.

If you’re already subscribed and/or appreciate the free chart and summary, hitting the LIKE button is one of the best ways to support my ongoing research.

Summary

Flat Prices gained a buck and change over last week’s close; but, we’ve still managed to finish down for the fourth consecutive quarter as markets beg for concrete evidence of widely anticipated tightness meant to arrive in the latter half of the year. WTI closed above $70/bbl for the first time in more than a week.

Calendar Spreads re-strengthened into the end of the week after Brent 2nd-3rd month spreads fell into contango on Tuesday and Wednesday for the first time since last December; while slightly stronger over the past few days, the front of the crude curve remains near its weakest level since the end of 2020.

Inventories data was mixed but leaned bullish, with a large crude-driven draw in the US (-5.3 MMbbl) and a smaller draw in ARA Europe (-0.9 MMbbl); those were only modestly softened by a reasonably strong bounceback in Singaporean stocks (+2 MMbbl)

Refined Products were mixed with gasoline gaining and diesel falling back slightly; while crack spreads for both products are higher on the month, gasoline cracks remain near their month-to-date highs while diesel is near a two-week low.

Positioning data confirmed that speculators were net sellers of crude contracts to the tune of 65.8 MMbbl in the week-through-Tuesday, bringing the spec spec position as a share of total open interest to 4.5%, by far the lowest reading since the initial COVID collapse in early 2020; this remains a drag on current pricing by represents a substantial upside risk given that if prices start moving higher it’s likely that short-covering will materially accelerate any organic rally.