Oil Context Weekly (W24)

Crude prices recover to pre-OPEC+ meeting levels, term structure has seemingly turned the corner stronger, and diesel markets are showing signs of life for the first time in months.

Every week, I summarize and analyze developments in flat crude prices, calendar spreads, high-frequency inventories, refined products, and positioning data, as well as a taste of the themes I’ve been thinking about or following closely.

If you’re already subscribed and/or appreciate the free chart and summary, hitting the LIKE button is one of the best ways to support my ongoing research.

Summary

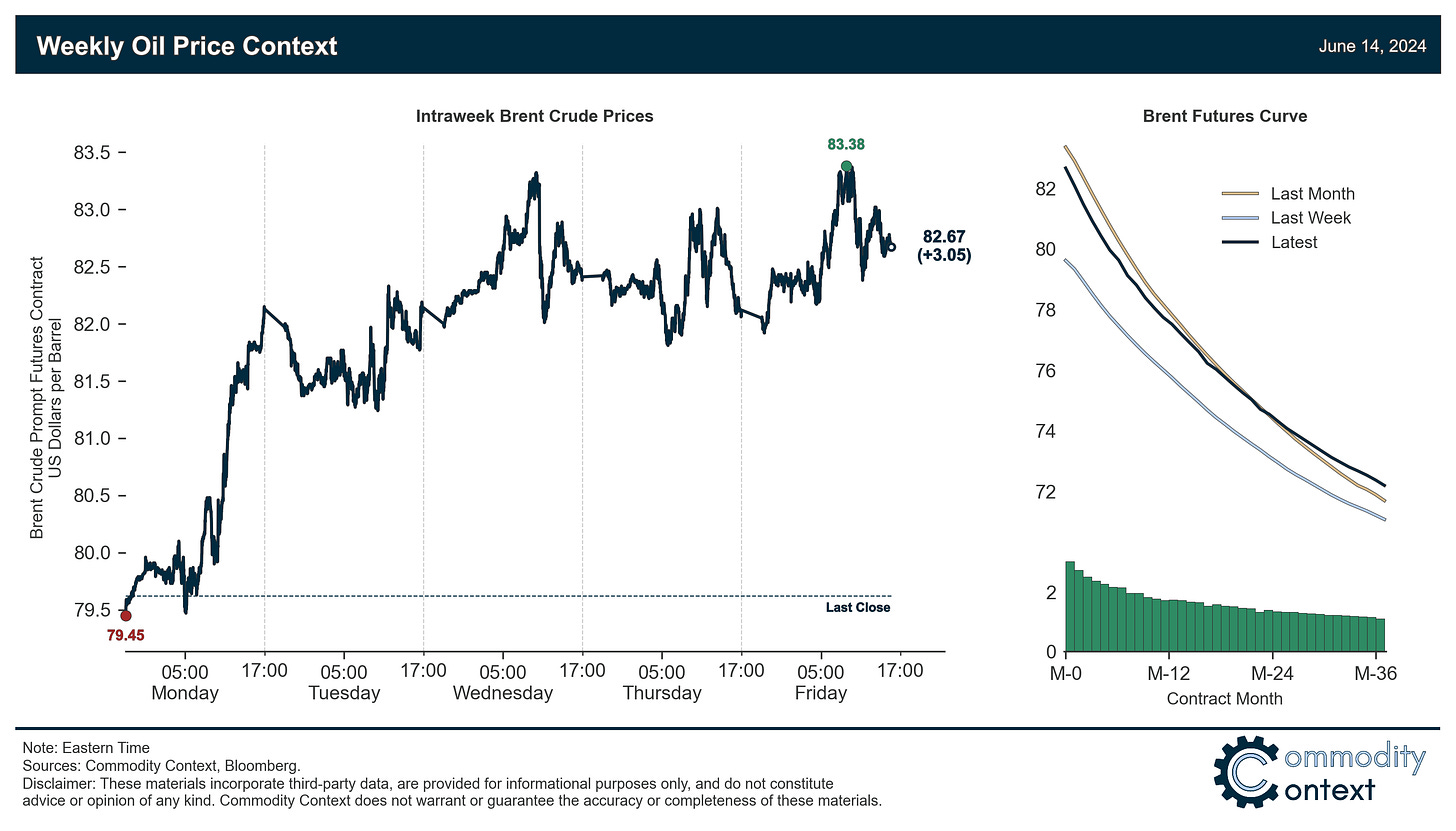

Flat Prices completed their recovery back above pre-OPEC+ meeting levels, climbing $3/bbl over the course of the week to just shy of $83/bbl Brent.

Futures Curves continued to strengthen into steeper backwardation, especially for Brent contracts that are now back at a notably prompt calendar spread premium to WTI; physical market spreads are also trending stronger.

Inventories data was mixed, caught between the third consecutive weekly build of more than 10 MMbbl in the US and a flip back to sizable stock draws across both Singapore and ARA Europe after a month of mounting inflows.

Refined Products market developments were dominated by the breakout strength of middle distillates, with European gasoil contracts aggressively flipping back into backwardation after two months of sustained contango and US diesel crack spreads rallying back to a premium vs. gasoline despite trading well into driving season at this point.

Investor Positioning data revealed that speculators were modestly strong net crude buyers over the past week-through-Tuesday, coming off the extremely low levels witnessed last week; however, net speculative positioning remains low, gross shorts remain high, and positioning normalization risk remains squarely tilted to the upside.

As Well As the IEA’s uber-bearish demand-peaky medium-term oil market outlook, the heated response to the IEA’s outlook from both OPEC and industry, concerns about the outlook for Chinese refining runs, underperformance of energy equities, and a renewed declining trend in US oil-directed rig counts.