Oil Context Weekly (W23)

Market not buying what the Saudis say they aren’t selling as crude prices end the week lower than before the OPEC+ meetings even started.

Happy Friday,

I had the opportunity to rejoin BNN Bloomberg for a recap of the OPEC+ meetings over the weekend and to circle back on some of my comments on the same show the week before, heading into the meeting. I also joined the Financial Post for a longer segment going over both the OPEC+ meetings as well as what consumers can expect at the pump this summer.

Every week, I summarize the developments in flat crude prices, calendar spreads, high-frequency inventories, refined products, and positioning data and then provide a taste of the themes I’m thinking about or following closely.

If you’re already subscribed and/or appreciate the free chart and summary, hitting the LIKE button is one of the best ways to support my ongoing research.

Summary

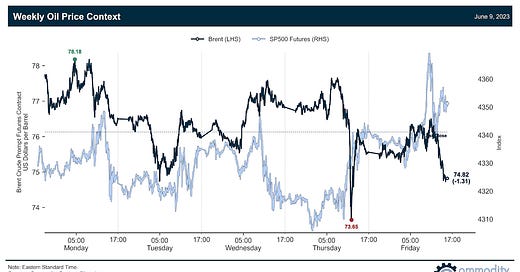

Flat Prices ended more than $1/bbl lower than last Friday despite Saudi Arabia’s weekend announcement about a large unilateral production cut—so far, the market just isn’t buying what the Saudis say they aren’t selling.

Calendar Spreads were mostly uneventful but we did see renewed pressure on Brent prompt spreads, which fell from $0.25/bbl to around $0.05/bbl and, ultimately, certainly doesn’t scream spot market strength at present.

Inventories were bearish across the board with builds in all major hubs; US stocks did see a mild crude draw but this was overwhelmed by sizable builds across products, including the first notable gasoline and diesel builds months (largest for gasoline since December, largest for diesel since February).

Refined Products experienced some upside pressure as gasoline cracks attempted to press back to May highs on the back of a refinery unit outage in New Jersey; while gasoline cracks are back in a leading position within the refined product complex, we’re still only seeing just more than half of the levels experienced this time last year.

Positioning data revealed that speculators were net buyers to the tune of 29.8 MMbbl in the week-through-Tuesday; as a proportion of total open interest, the net spec position, while still reasonably low, now stands at its highest level since mid-April.

SPR Refill announcement came just before publishing, confirming that contracts had been awarded for 3 MMbbl of crude to begin refilling the SPR as well as second follow-on solicitation for another 3 MMbbl (more on this below)