Oil Context Weekly (W16)

Crude prices eased sharply on deflated geopolitical concerns as Israel and Iran exchanged anxiety-inducing direct but ultimately low-damage strikes.

I rejoined Erik Townsend on the MacroVoices podcast to discuss oil market fundamentals, ongoing geopolitical risks, and the case for geopolitical optimism.

Also spoke with CBC about how the Canadian government isn’t going to get a price anywhere near high enough to cover the exorbitant costs of constructing the Trans Mountain pipeline when Ottawa tries to sell the project as intended.

Finally, spoke with Reuters about the disconnect between air travel activity re-reaching pre-COVID seasonal norms and jet fuel demand that still materially lags 2019 levels, updating some thoughts initially discussed in Regaining Altitude.

Every week, I summarize developments in flat crude prices, calendar spreads, high-frequency inventories, refined products, and positioning data, as well as a taste of the themes I’ve been thinking about or following closely.

If you’re already subscribed and/or appreciate the free chart and summary, hitting the LIKE button is one of the best ways to support my ongoing research.

Summary

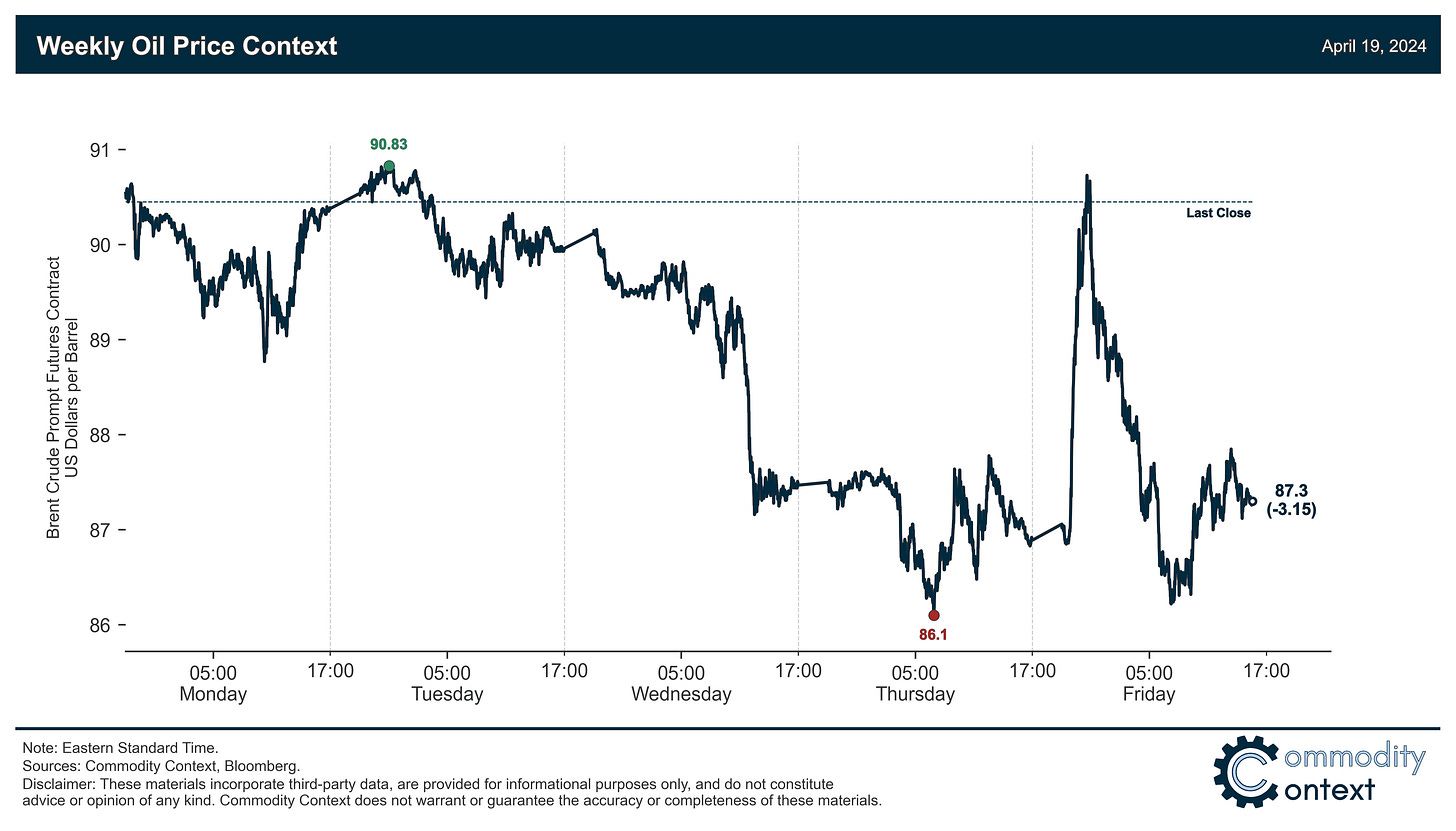

Flat Prices fell $3/bbl to around $87.30/bbl Brent as speculative geopolitically-driven sentiment—that had been prompting up contracts—deflated as tensions in the Middle East at least appeared to ease (despite all the unprecedented striking) over the course of the week.

Futures Curve signals were notably less negative when compared to flat price declines, with Brent prompt calendar spreads easing only slightly and WTI spreads actually gaining on the week (compared to plummeting flat prices); it’s suggesting a strong role of liquidated speculative positions after their establishment helped drive the market higher in early April.

Inventories data leaned bearish on large builds in the US and Europe that successfully overwhelmed a draw in Singapore; however, beneath the surface, US natural gas liquids drove those gains while crude builds slowed and key refined products resumed drawing.

Refined Products developments were dominated by continued weakness in diesel, which saw not only crack spreads fall another $3/bbl to below $20/bbl in NYH vs. Brent but also diesel prompt calendar spreads fall into their deepest contango since the end of 2020—a flashing red warning sign about demand for the industrial workhorse fuel.

Investor Positioning data revealed that speculators were small net sellers over the past week through Tuesday and, while that figure has surely fallen further given Wednesday’s price rout, positioning risks remain tilted to the downside with plenty more liquidation potential to go.

As Well As some general thoughts on the role of “political risk premia” in crude price formation, Israel and Iran exchanging direct attacks, an attempted tightening of US sanctions against Iran, and a reapplication of sanctions on Venezuela’s oil industry.