Oil Context Weekly (W14)

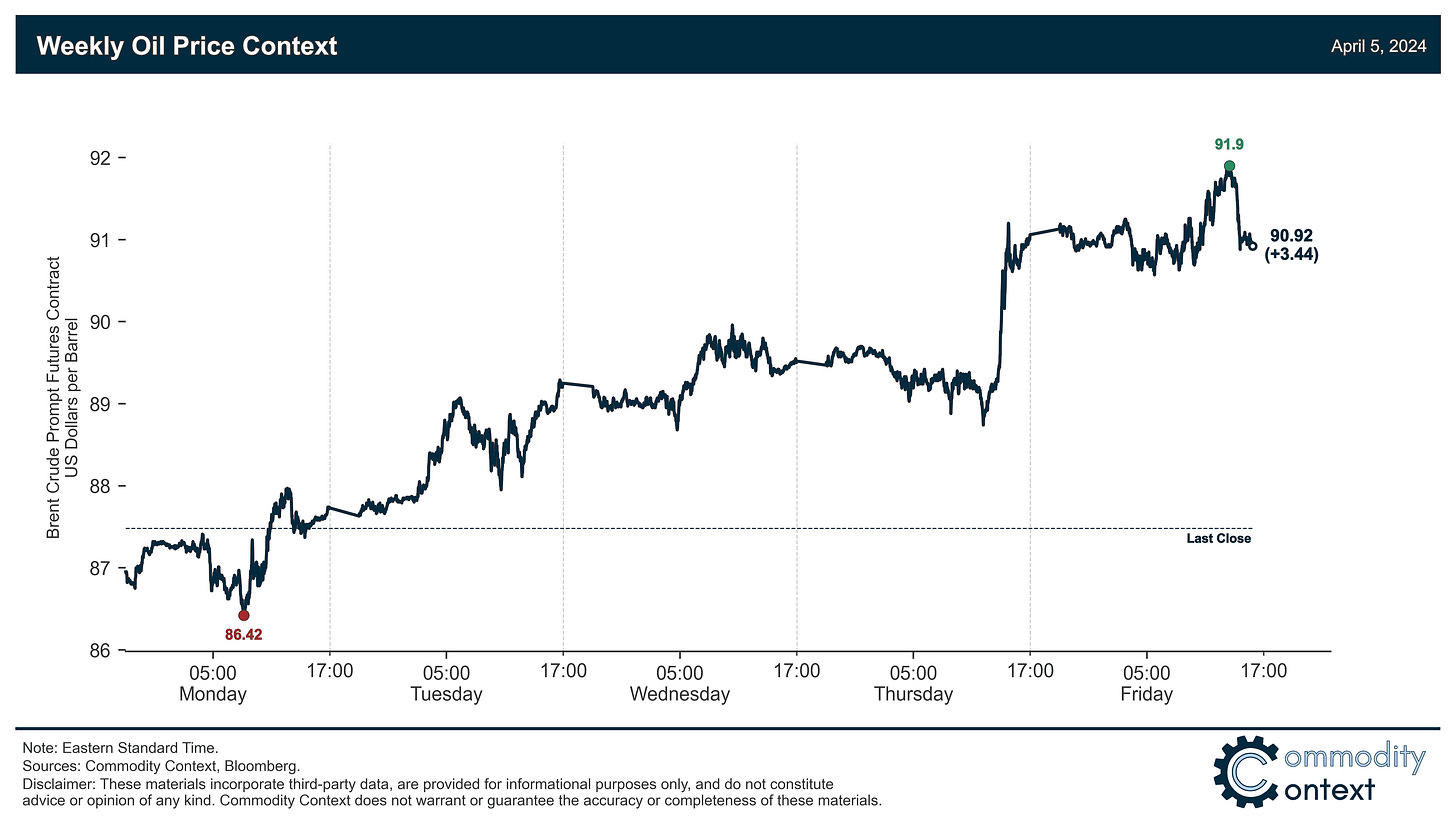

Fundamentally supported but speculatively driven rally pushes Brent crude prices into the $90s for the first time since last October on heightened geopolitical tensions between Israel and Iran.

Every week, I summarize developments in flat crude prices, calendar spreads, high-frequency inventories, refined products, and positioning data, as well as a taste of the themes I’ve been thinking about or following closely.

If you’re already subscribed and/or appreciate the free chart and summary, hitting the LIKE button is one of the best ways to support my ongoing research.

Summary

Flat Prices rallied hard to breach the $90/bbl (Brent) mark for the first time since last October; fundamentals provided broad support but, ultimately, momentum-related and geopolitically-driven speculative flows drove the barrel higher.

Futures Curves added considerable context and, specifically, put the focus of upside pressure firmly on Brent rather than WTI; prompt Brent spreads point to some fundamental support but, across the curve, steepener trades, more associated with hot money flows, appear to have been in the driver’s seat.

Inventories data was mixed between builds in ARA Europe and draws in both the US and Singapore; headline stocks across all major hubs are sitting around seasonally normal levels, with the US refined products continuing to represent the only real area of readily apparent tightness.

Refined Products played second fiddle to crude this week, though rallying diesel crack spreads did notably close the level gap after only recently experiencing their normal seasonal tradeoff; rallying diesel confirmed fundamental early-week support for crude but then rejected demand-side support for Thursday’s spike.

Positioning data revealed that speculative participants drove their net position in crude contracts over the past week-through-Tuesday to the highest level since last September’s rally and continued gains in the latter half of the week are all but certain; positioning remains the key near-term risk to oil prices, given that, should momentum shift, those positions are likely to bolt en masse as we last saw in early October.

As Well As an acute escalation in tensions between Israel and Iran, oil markets reassess geopoltical risk, and high prices prompt an SPR refill pause in the US.