Oil Context Weekly (W9)

Tightening spot markets and wider backwardation press US crude prices to the highest level in nearly four months, though heavy speculative inflows provide reason for caution.

Happy Friday, Commodity Context Subscribers!

Every week, I summarize developments in flat crude prices, calendar spreads, high-frequency inventories, refined products, and positioning data, as well as a taste of the themes I’ve been thinking about or following closely.

If you’re already subscribed and/or appreciate the free chart and summary, hitting the LIKE button is one of the best ways to support my ongoing research.

Summary

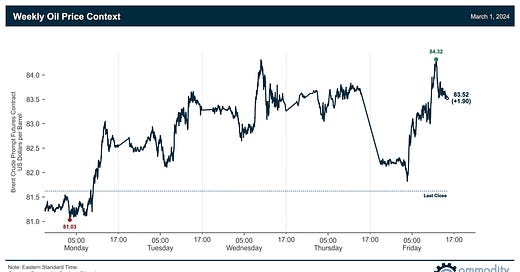

Flat Prices rallied ~$2/bbl to finish the week at $83.50/bbl Brent, at the upper end of its recent range, and just shy of $80/bbl for WTI, the US benchmark’s highest close in nearly four months.

Futures Curves strengthened considerably this week with prompt calendar spreads for both Brent and WTI doubling to around $1/bbl, the steepest backwardation since October.

Inventories data was mixed between a draw in the US and builds in ARA Europe and Singapore; abstracting away from the weekly chop, year-to-date US inventories have generally followed their typical seasonal path while stocks levels in ARA Europe and Singapore have rapidly recovered to seasonal normal levels after starting the year materially depleted.

Refined Products mostly traded sideways, with April gasoline gaining $2/bbl to finish at ~$26/bbl and diesel cracks ending the week flat at ~$30/bbl; with the expiry of the March contract, gasoline is entering its seasonally stronger half of the year and is already starting tighter vs diesel compared to this time last year.

Investor Positioning data revealed that speculators were net buyers of crude contracts last week and that their net position as a share of total open interest is at its highest since last September, shifting the balance of positioning-related risk unambiguously to the downside.

As Well As the latest OPEC+ production cut extension rumours, Russian oil policies—gasoline export ban, imposition of crude fiscal price floor—signaling hard times on the homefront, updates on the status of the ever-delayed Trans Mountain Expansion, and Guyanese complications for Chevron’s proposed acquisition of Hess.