Oil Context Weekly (W5)

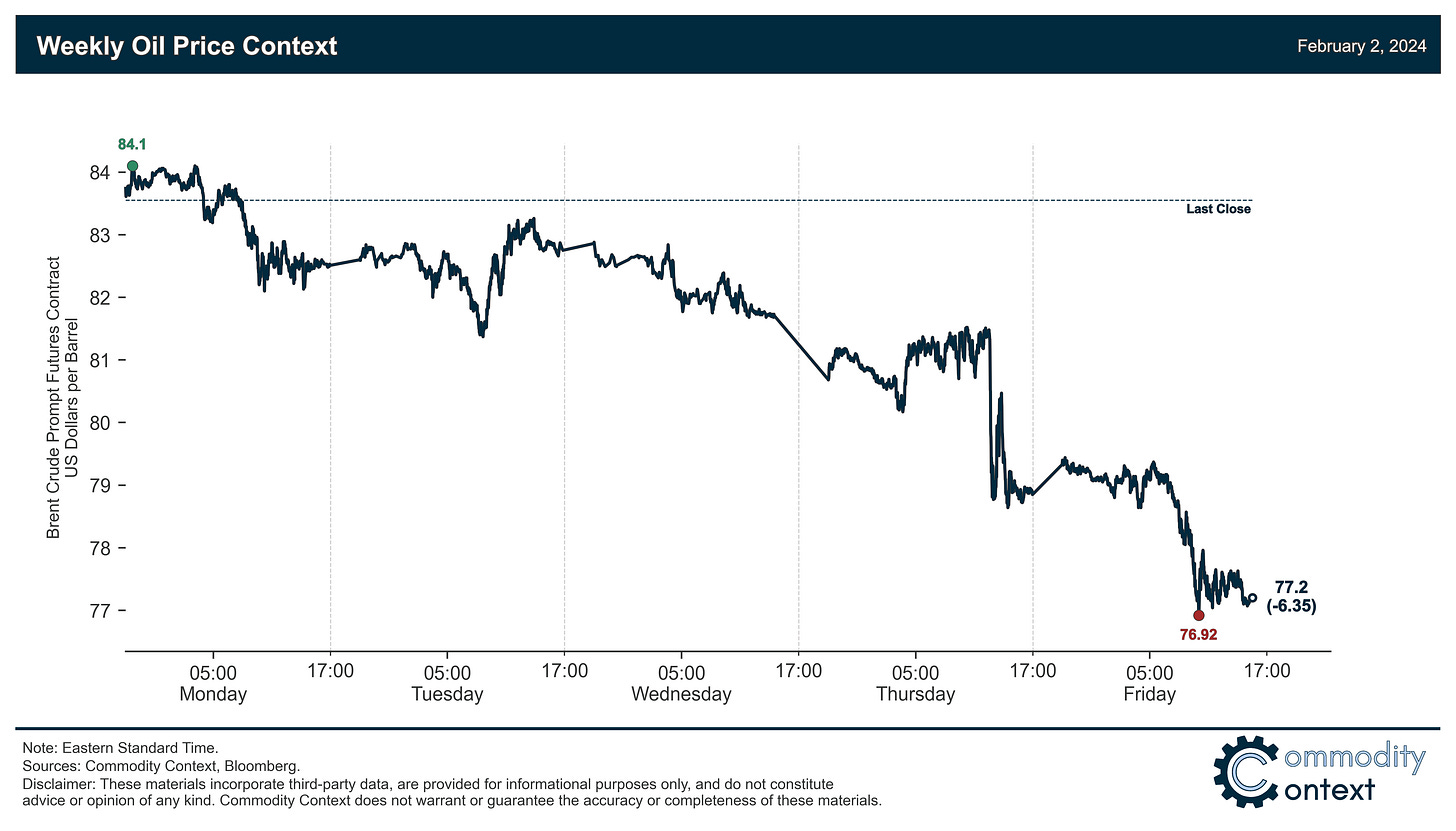

Crude prices fell more than $6/bbl for the worst weekly performance in four months, driven by a combination of legitimate spot market easing (Mon-Wed) and spec flow headline overreaction (Thu-Fri)

REMINDER: I’ll be in Calgary during the week of February 19th—I’d love to meet up with subscribers looking to discuss the latest oil market developments over drinks, so please let me know if you’re interested here (Google Form) so I can get a sense of numbers.

Happy Friday, Commodity Context Subscribers!

Every week, I summarize developments in flat crude prices, calendar spreads, high-frequency inventories, refined products, and positioning data, as well as a taste of the themes I’ve been thinking about or following closely.

This particular report ran a touch on the long side—a lot happened!—and clocked in at nearly 3,000 words.

If you’re already subscribed and/or appreciate the free chart and summary, hitting the LIKE button is one of the best ways to support my ongoing research.

Summary

Flat Prices collapsed more than $6/bbl to end the week at ~$77/bbl (Brent), marking the worst price performance since early October and undoing the entirety—and then some—of last week’s rally.

Futures Curves weakened, but at a pace that differentiates the week’s price declines with calendar spreads confirming the Mon-Wed declines alongside weaker spot market indicators and then trading sideways-to-up, counting the message sent by an accelerated flat price rout over Thursday and Friday.

Inventories data was mixed between a large but muddled US draw—big headline decline but driven by NGLs while core products were flat—and sizable builds in Singapore and ARA Europe.

Refined Products were reasonable staid compared to the tumult experienced by crude, with major US product crack spreads mostly trading sideways and the largest development being an unwinding of last week’s

Investor Positioning data confirmed that speculators were substantial buyers of crude contracts over the past week-through-Tuesday and brought the net spec position back to its highest level since mid-October, both helping explain last week’s rally and likely sowing the seeds of this week’s pullback as that capricious capital turned tail and bolted as momentum reversed.

As Well As Saudi Aramco’s surprise capacity expansion cancellation announcement (long comment on this one), the newly rising risk of a US-Venezuela sanctions snap-back, and yet more bad news for Western Canadian crude values following another TMX delay and a BP Whiting refinery outage.