Oil Context Weekly (W3)

Crude calendar spreads are strengthening notably, signaling tighter spot market conditions, despite flat prices remaining mired in their stubborn year-to-date range.

Happy Friday, Commodity Context Subscribers!

Every week, I summarize developments in flat crude prices, calendar spreads, high-frequency inventories, refined products, and positioning data, as well as a taste of the themes I’ve been thinking about or following closely.

If you’re already subscribed and/or appreciate the free chart and summary, hitting the LIKE button is one of the best ways to support my ongoing research.

Summary

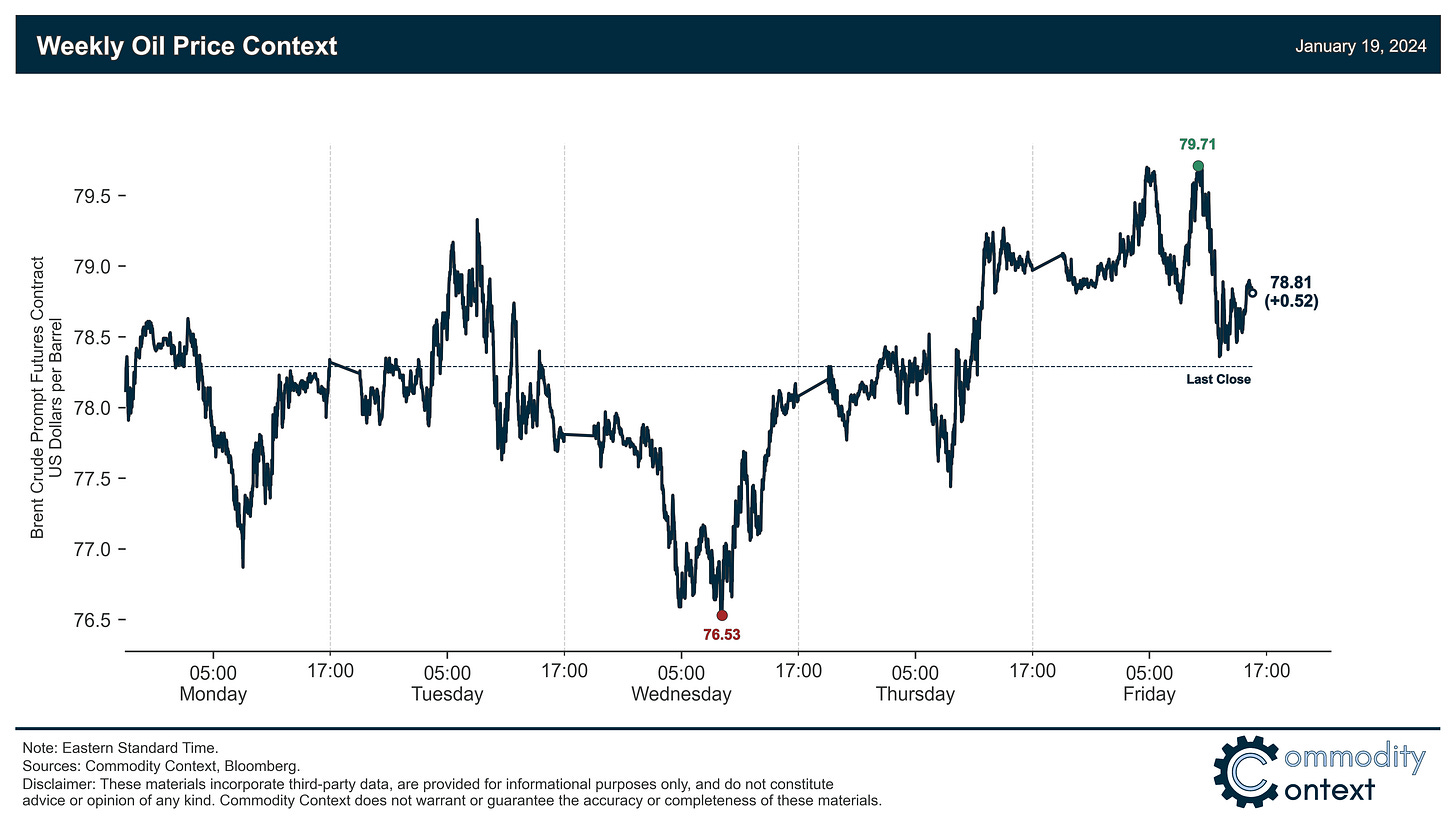

Flat Prices were just barely positive on the week (+0.50/bbl), bouncing between $76.50–79.50/bbl as the barrel remained trapped in its year-to-date range.

Futures Curves are indicating building strength despite range bound flat prices; Brent prompt spreads strengthened into steeper backwardation and WTI prompt spreads flipped from contango to backwardation for the first time since November, showing better momentum for the first time since last summer.

Inventories data revealed a continuation of the trend toward strong refined product builds in the US coupled with plunging refined product stocks in ARA Europe and Singapore; US stocks remain around seasonal norms for all major products, while both ARA European and Singaporean stocks are at or below the bottom of the seasonal ranges, driven by low gasoline and middle distillates.

Refined Products crack spreads traded sideways for gasoline and diesel, while high-sulphur fuel margins in the Gulf Coast fell back materially.

Investor Positioning data revealed the smallest weekly shift on a total crude basis since mid-September, but it was notable in the separate and nearly equal buying and selling pressure experienced by Brent (+18.1 MMbbl) and WTI (-21 MMbbl), respectively.

As Well As a pickup in Houthi shipping attacks and further US counterstrikes, mounting financial incentives for shipowners to divert away from the Red Sea route, North Dakotan production collapses as activity quite literally freezes, and a fallback in US Gulf Coast fuel oil markets will likely pull back on WCS’ recent pricing strength in the region.