North American Oil Data Deck (March 2025)

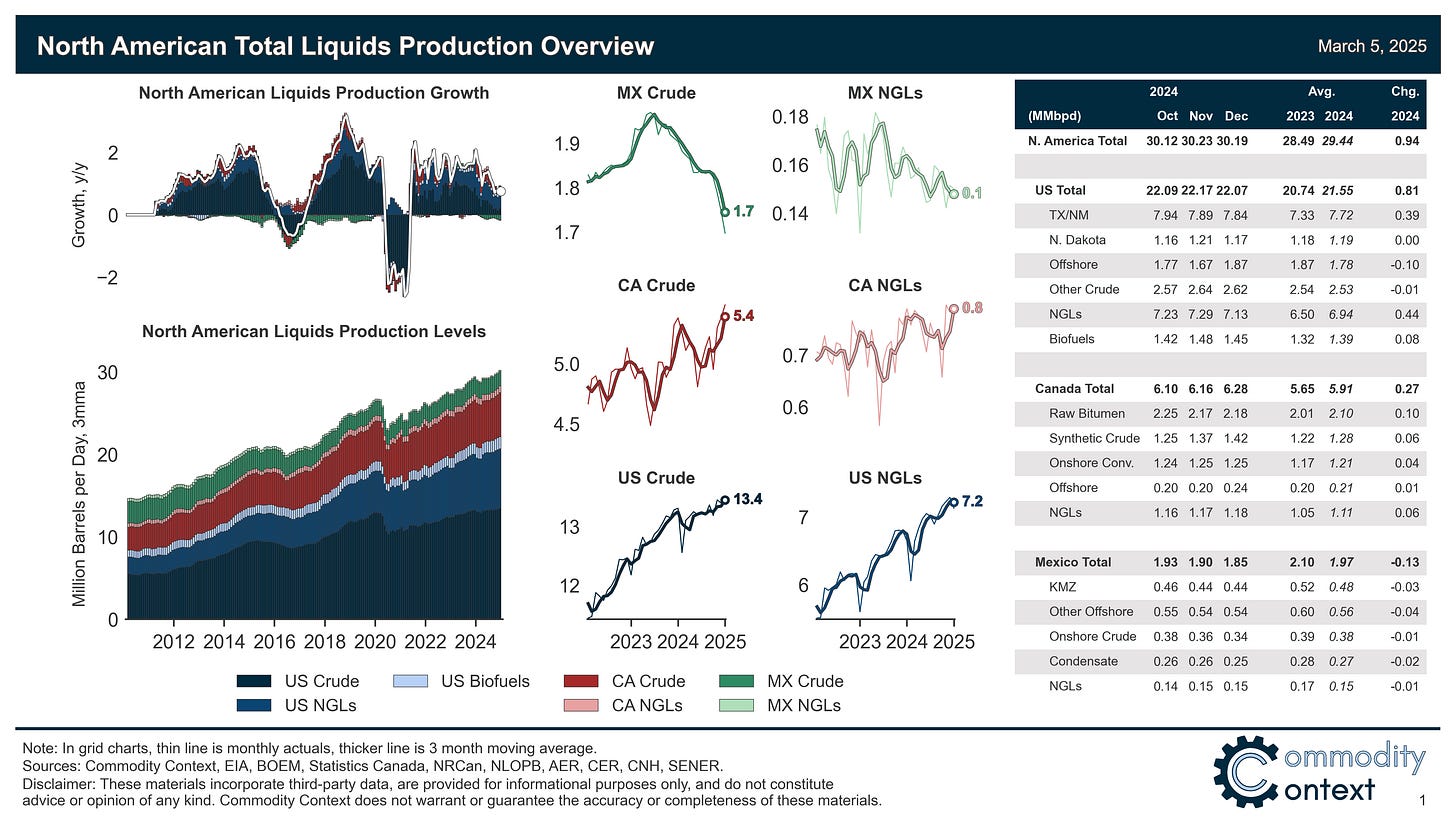

Fresh all-time high liquids production in the US and Canada helped offset accelerating contractions in Mexican output in 2024, while demand growth slowed across the continent.

This 36-page March 2025 edition of my monthly data-dense and visualization-heavy North American Oil Data Deck (attached PDF below paywall) is exclusive to paid Commodity Context subscribers. The deck contains detailed, decomposed accounting for US, Canadian, and Mexican upstream (i.e., production) and downstream (i.e., refining) oil activity as well as end-user demand.

If you’re already subscribed and/or appreciate the free chart and summary, hitting the LIKE button is one of the best ways to support my ongoing research.

North American total liquids production averaged 29.4 MMbpd in 2024, just shy of 1 MMbpd higher on the year. Specifically, fresh all-time high output of Canadian crude and US crude and NGLs offset accelerating across-the-board declines in Mexican.

North American petroleum product demand averaged 24.6 MMbpd in 2024, which is roughly flat on the year after substantial gains in 2023. Growth was concentrated in the consumption of natural gas liquids (used in the petrochemical industry) that offset outright declines in the demand for fuels—like gasoline and diesel—derived from crude oil.

US tariffs on Canada and Mexico were not once again delayed as many expected and entered force yesterday, but the situation remains in flux with the prospect of a partial rollback still being teased by the US Secretary of Commerce.

[Full PDF Deck and Country-Level Analysis Below Paywall]