Iran and Barrel Risk: Three Scenarios

Current oil market context, three scenarios for Israel-Iran oil risk, and why Israel—not Iran—will likely decide the next stage of conflict escalation.

Something a bit different for you this Friday morning.

Given the significant and ongoing developments in the Israel-Iran conflict, this topic would have constituted the bulk of my Oil Context Weekly (OCW) writeup this afternoon. Rather than cramming these important thoughts into that format, I’ve decided to release them as a standalone report for easier reference. As such, this isn’t an especially data-intensive write-up and instead provides some context around the key moving pieces I’m watching and my framework for assessing these oil market risks—up to and including what it would take to drive Tehran to throttle the Strait of Hormuz or strike other oil assets around the Gulf.

And fear not: you’ll still also be receiving an OCW report later today.

If you’re already subscribed and/or appreciate the free summary, hitting the LIKE button is one of the best ways to support my ongoing research.

Price response is currently entirely risk premium—reflecting rising odds of immense but still-low probability tail risks—with no tangible impacts to oil flows out of the region thus far.

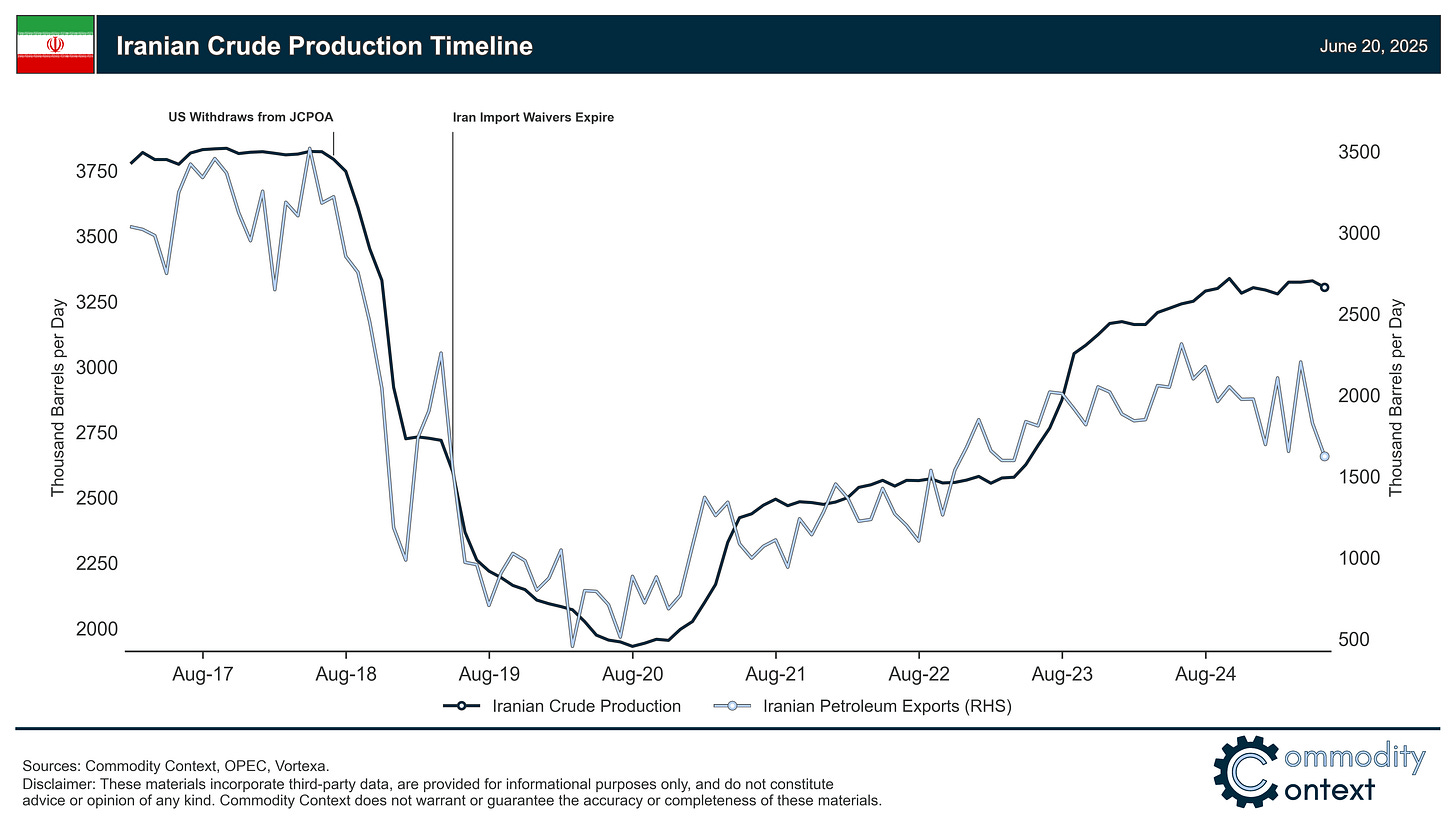

Israel is in control of the current escalatory ladder and the next oil market trigger isn’t whether Iran will lash out against regional oil assets but rather if Israel will expand attacks to hit Iranian oil export infrastructure.

Iran wants a deal to halt the attacks but can’t be seen as “surrendering” and needs to find a way to save face.

Three Scenarios:

Crisis fizzles on a deal being signed, oil market falls back to early June levels.

Israel expands attacks to include Iranian oil exports, oil market spikes.

Iran lashes out against regional oil assets, oil market erupts.

US considering its involvement, which would be immediately seen as price-positive but would likely reduce the risks of the conflict broadening to include oil (i.e., latter two scenarios above) given Trump’s pump price caution.

The oil market is experiencing what has, for decades, been considered one of if not the single greatest tail risk scenario: a full-blown war between Israel and Iran, with the US looking like it's on the verge of joining the fray. In terms of the market impact, we’re now well into a sea of “What if Iran closes the Strait of Hormuz?” headlines. And while there have as of yet not been any physical oil market impacts, we’re standing at the precipice of potentially catastrophic regional supply losses.

I’m fielding countless media calls and subscriber questions; so, I wanted to share my evolving thoughts on how to best weigh these risks with you. Specifically, what has and hasn’t materialized in this Israel-Iran conflict as well as three potential illustrative scenarios of where this conflict may head for the oil market.