The Great [Oil] Fall of China

Beijing’s commitment to COVID-zero lockdowns has prompted the steepest oil demand retrenchment in a generation

If you’re already subscribed and/or appreciate the free headline chart and bullets, hitting the LIKE button is one of the best ways to support my ongoing research.

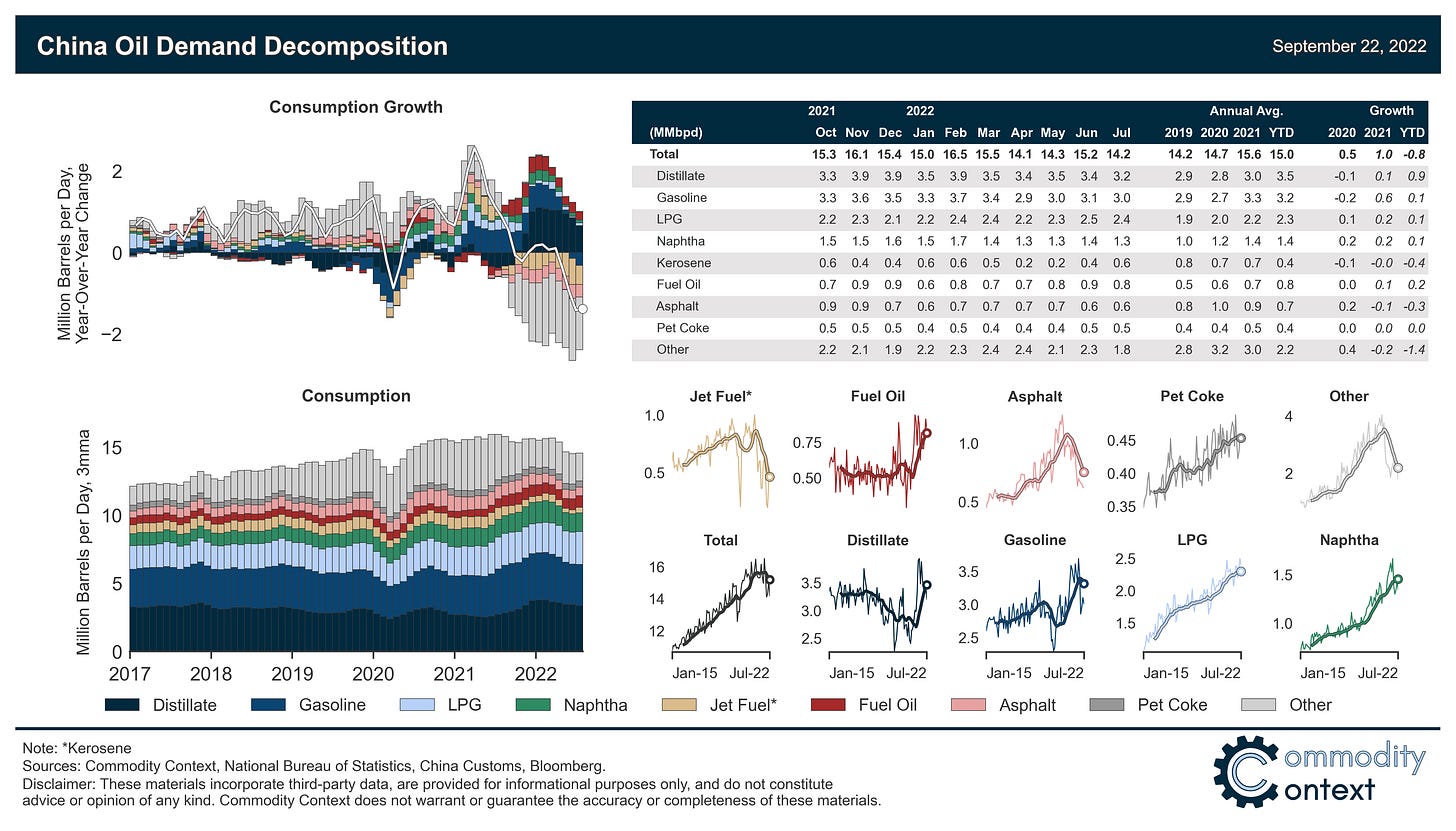

After reaching a fresh all-time high in February, Chinese petroleum demand cratered on the back of Beijing’s persistent, draconian COVID-zero lockdowns, which helped make July the most oversupplied month globally since the initial COVID response in early-2020.

Chinese oil demand is lower by roughly 750 kbpd year-to-date vs the same period last year, and the country now looks set to contract on an annual basis for the first time in modern history; July demand was down a staggering 2.3 MMbpd from February.

Crude oil imports also fell back in June and July by some 2 MMbpd vs earlier in the year, a higher confidence data point confirming the scale of downturn seen in apparent demand; Chinese importers continued to prioritize shipments from favoured partners through the downturn.

One possible near-term upside to China’s oil market slumber is the boosting of refined product export quotas, which had been held back over the past year, and, if normalized, would achieve the dual benefit of lifting crude feedstock demand and increasing effective refining capacity in a global market still tight on that front.

Unfortunately, it’s hard to envision an overnight about-face from Beijing given the connection forged between COVID-zero, the CCP, and Xi Jinping personally—but the good news for market watchers is that such a shift in messaging should be easy to spot when it does indeed occur, giving us an early warning to the torrent of pent-up crude rushing the market’s way.

It turns out that not even a war in Europe can unseat COVID as the driver of the global oil market. Anticipated Russian supply losses on the back of post-invasion sanctions have largely failed to materialize given the Kremlin’s successful rerouting of barrels to willing buyers in Asia. Meanwhile, China began a cascading—and still very much ongoing—series of increasingly draconian “COVID-zero” lockdowns earlier this year, and these lockdowns have crushed domestic mobility and reduced Chinese oil demand by millions of barrels per day.

It’s all but certain that 2022 will mark the worst annual demand growth in modern Chinese history. By my estimation, Chinese petroleum product demand is down, as of July, roughly 750 kbpd y/y on average year-to-date, a far fall from a fresh all-time high of 16.5 MMbpd this past February. No surprise, a demand collapse of this magnitude—from typically the largest single source of incremental demand in the world—has had an acute impact on global market balances. What was expected to be a year of persistent deficits yielded to a year defined by protracted supply surpluses. Indeed, July was the most oversupplied month since the initial COVID response in early-2020 (as outlined in my recently updated Global Oil Data Deck).