Dr. Copper still studying in China

Booming Chinese imports saved copper in 2020 but favourable demand trends will likely ease over coming months

Copper prices are really high and they’re moving higher yet again but the foundation of the rally above $4 per pound was built on a Chinese copper import boom in 2020.

Those imports began as opportunistic bargain shopping for strategic inventories but became a mad dash for metal to satisfying ravenous demand for Chinese exports and physical goods more broadly benefiting from the pandemic-shuttered service industry.

Absent a stark change in Beijing’s policy priorities, many of the favourable demand trends that have benefitted copper prices look set to normalize and exert downside pressure on contracts over the coming months, though longer-term energy-transition investment demand expectations remain strong even if timing remains an open question.

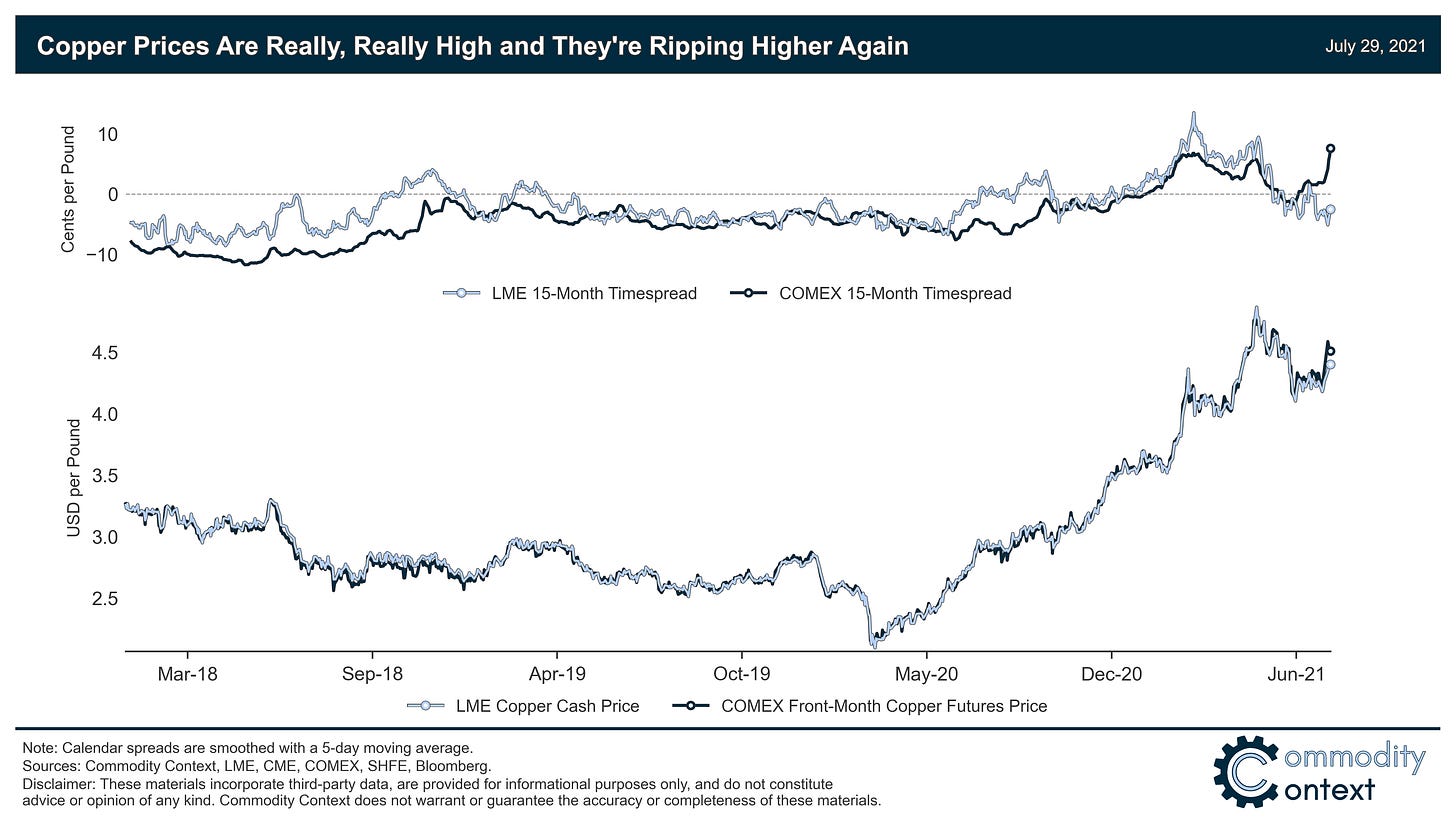

Copper prices are really, really high and US futures contracts are sitting around $4.50 per pound. For those less familiar with copper pricing: copper above $4 per pound is kinda like crude oil above $100 per barrel, except even rarer.

Copper futures reached an all-time-high of $4.77 this past May and had eased back over the months since. Then prices ripped higher again last week, a rally made all the more impressive when you consider that the red metal has made and held most of these latest gains amidst a broader macro selloff.

So, what’s got Dr. Copper all hot and bothered?

The most important thing to understand about copper’s currently lofty price is that 2020 ended up being a rip-roaring year for copper demand growth, driven almost entirely by robust Chinese metal imports. We’re still very much living in the shadow of that demand boom, with COVID-related mine disruptions and shipping bottlenecks only further tightening copper balances.

Much of the discussion around copper trends typically focuses on the metal’s medium-term future. The latest iteration of this forward obsession is the coming supercycle that would pass the mantle of copper demand growth from China’s capricious investment cycle to a wealthy country-driven push toward copper-intensive energy transition investments. But while copper’s future is certainly bright as the world transitions toward an electrified, net-zero economy, both its present condition and near-term outlook are still firmly anchored in China’s far less glitzy industrial gyrations.

China’s Demand Boom Saved the 2020 Copper Market

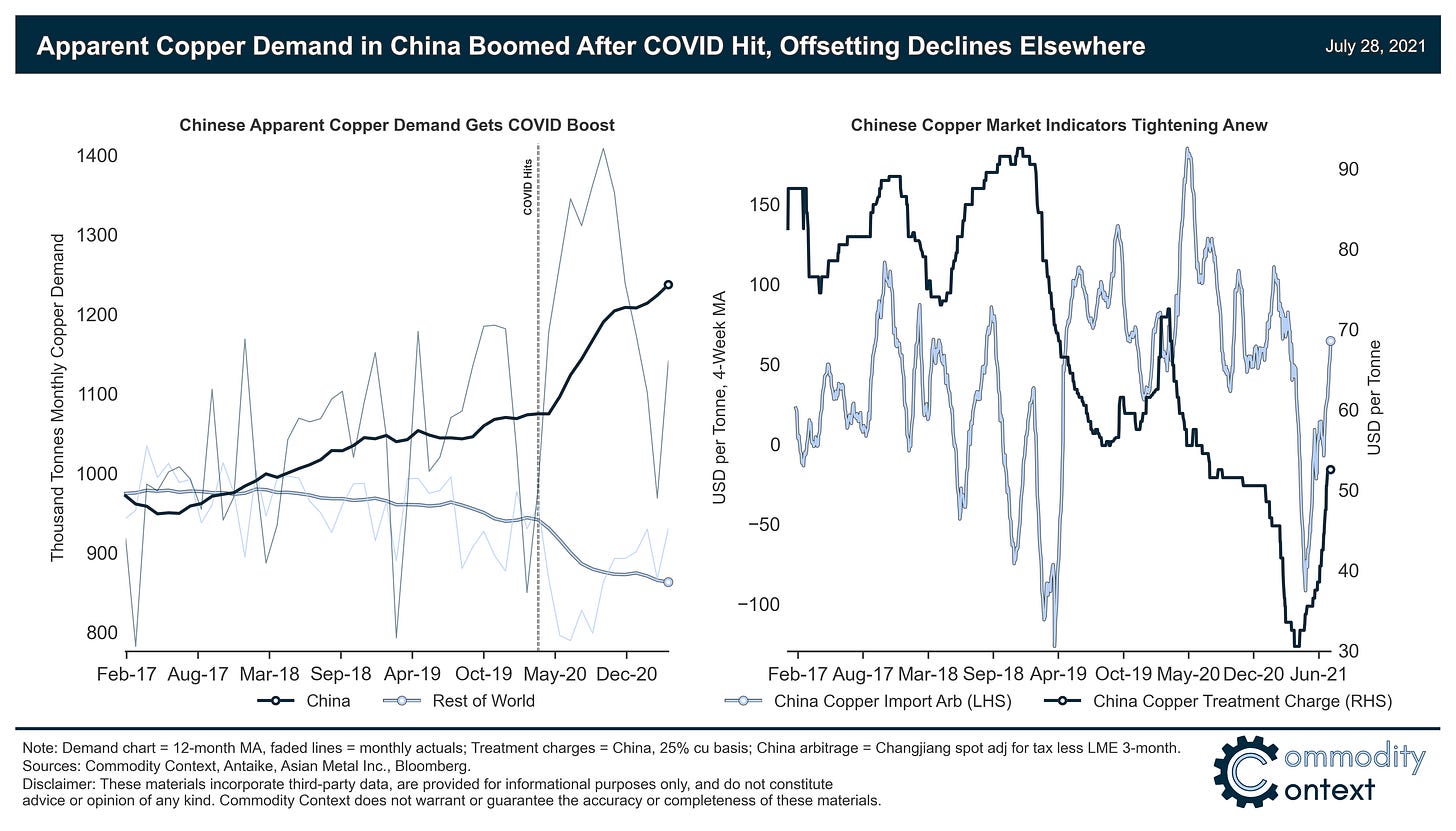

China’s influence over the copper market is difficult to overstate: its industries consume more than half of the world’s copper tonnage every year. And this influence has only grown more acute since the onset of the pandemic as China’s apparent demand ripped higher in stark contrast to waning consumption through the rest of the world.

In a global copper market of about 25 million tonnes annually, the International Copper Study Group (ICSG) estimates that 2020 saw a deficit of roughly 600 thousand tonnes (2.4%)—a very tight market, thanks entirely to a massive Chinese import boom. The ICSG now expects the copper market to record small surpluses in 2021-22, but forecasting is challenging in the best of times and mid-pandemic forecasts come with especially wide error bands. Last year’s China-driven deficit was hardly a foregone conclusion ahead of time.

Indicators of Chinese copper market tightness like local premia and refining margins were validating dour demand forecasts earlier this year. In April, the physical premium for Chinese copper cratered into negative territory for the first time since 2019 and refinery treatment charges for imported copper ore fell to their lowest level in more than a decade, a sign of relatively flush mined ore supplies. But both those indicators have begun to quickly rise again over the past couple months, signalling that China’s appetite for the red metal isn’t satiated quite yet.

Where does China’s copper demand go from here? It helps to better understand what drove the 2020 demand boom in the first place.

Pandemic Bargain Hunting Turned Mad Dash for Metal

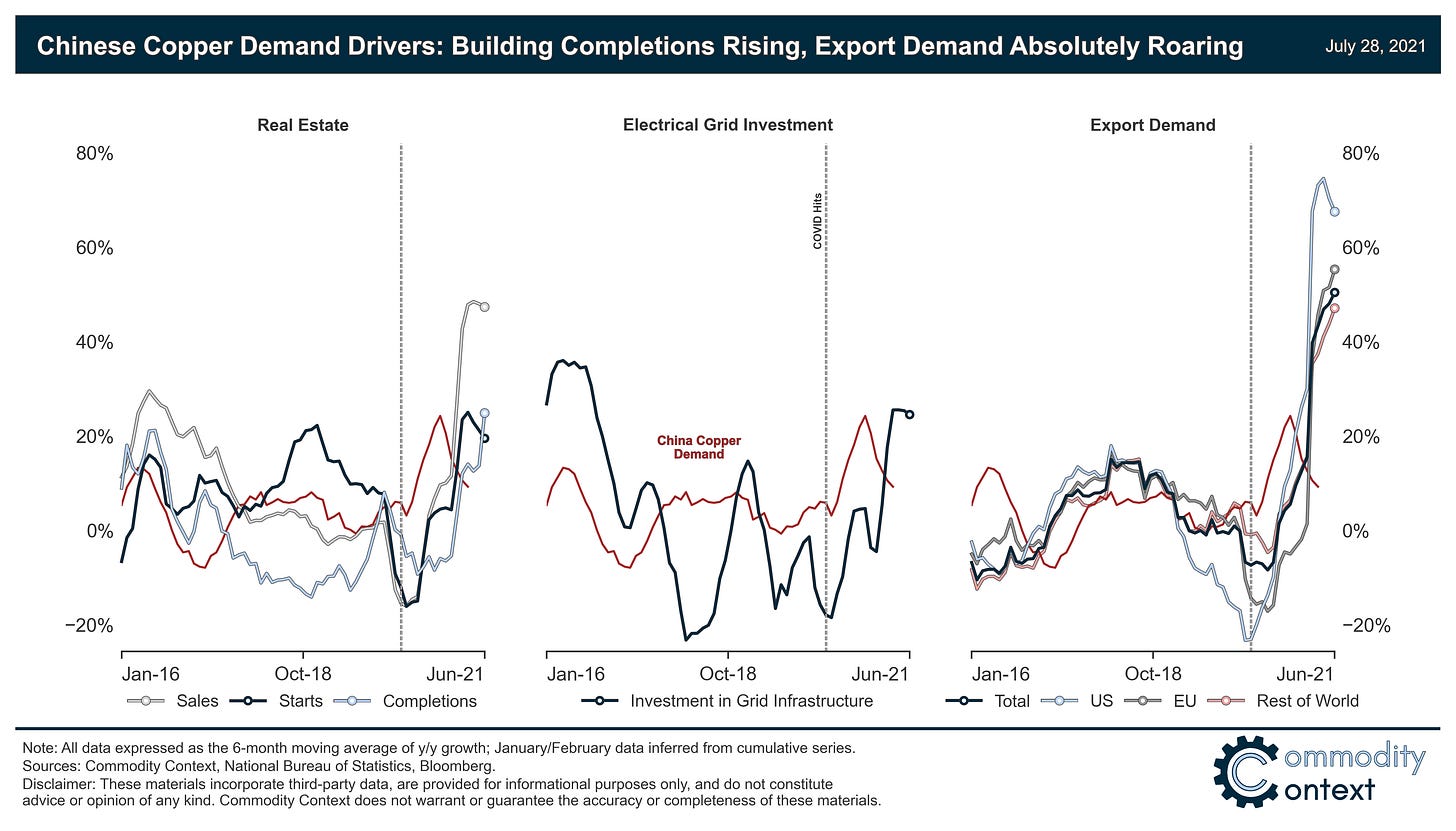

Chinese copper demand can be broadly broken down into four broad buckets: real estate construction, electrical grid investment, export demand, and strategic inventories. As can be seen in the chart above, China’s apparent demand for copper boomed before its three more-visible copper-intensive industries even got off the starting line, meaning the consumption jolt likely began as an opportunistic accumulation of strategic stockpiles at a time of pandemic-depressed pricing.

Then something funny happened. Government stimulus floated household purchasing power around the world and pent-up spending that would have gone to movie theatres, hair salons, bars, and vacations all got plowed into home renovations and physical consumer goods. Suddenly, the world really needed Chinese goods exports—and lots of them, which means plenty of new copper demand. China’s real estate market has begun adding further demand pressure on the back of rising sales and copper-intensive completions, which typically spur more copper intensive appliance purchases.

Demand was running so hot and prices rising so quickly that Beijing shifted its attention to what it increasingly saw as destabilizing commodity inflation. The Chinese government clamped down on financial speculation and Beijing’s strategic inventory managers came full circle by returning some of the accumulated stocks back to the market to cool prices.

Going forward, most of the trends that have supported copper’s wild rally look unsustainable. Strategic inventories are already being unwound. Chinese export demand will likely suffer as consumers shift back to spending on services in a reopening economy at the expense of copper-intensive goods. (i.e., People are going to go on vacation instead of upgrading a major home appliance.) And the last thing Beijing wants is another housing cycle.

Copper prices will likely face continued downside pressure as favourable demand conditions normalize over the coming months, though logistical bottlenecks and ongoing supply-side risks could add sporadic support. Longer-term energy transition demand expectations are strong but the timing of any material handoff from Chinese industry to broader global net-zero investments remains an unanswered question.