Decomposing Demand Deceleration

Digging deeper into the oft forgotten demand side of oil's ledger

I recently announced the formal launch of Commodity Context, a new kind of commodity market data and analysis service that delivers numbers, narrative, and nuance straight to your inbox. If you enjoy my research, please consider upgrading your subscription today.

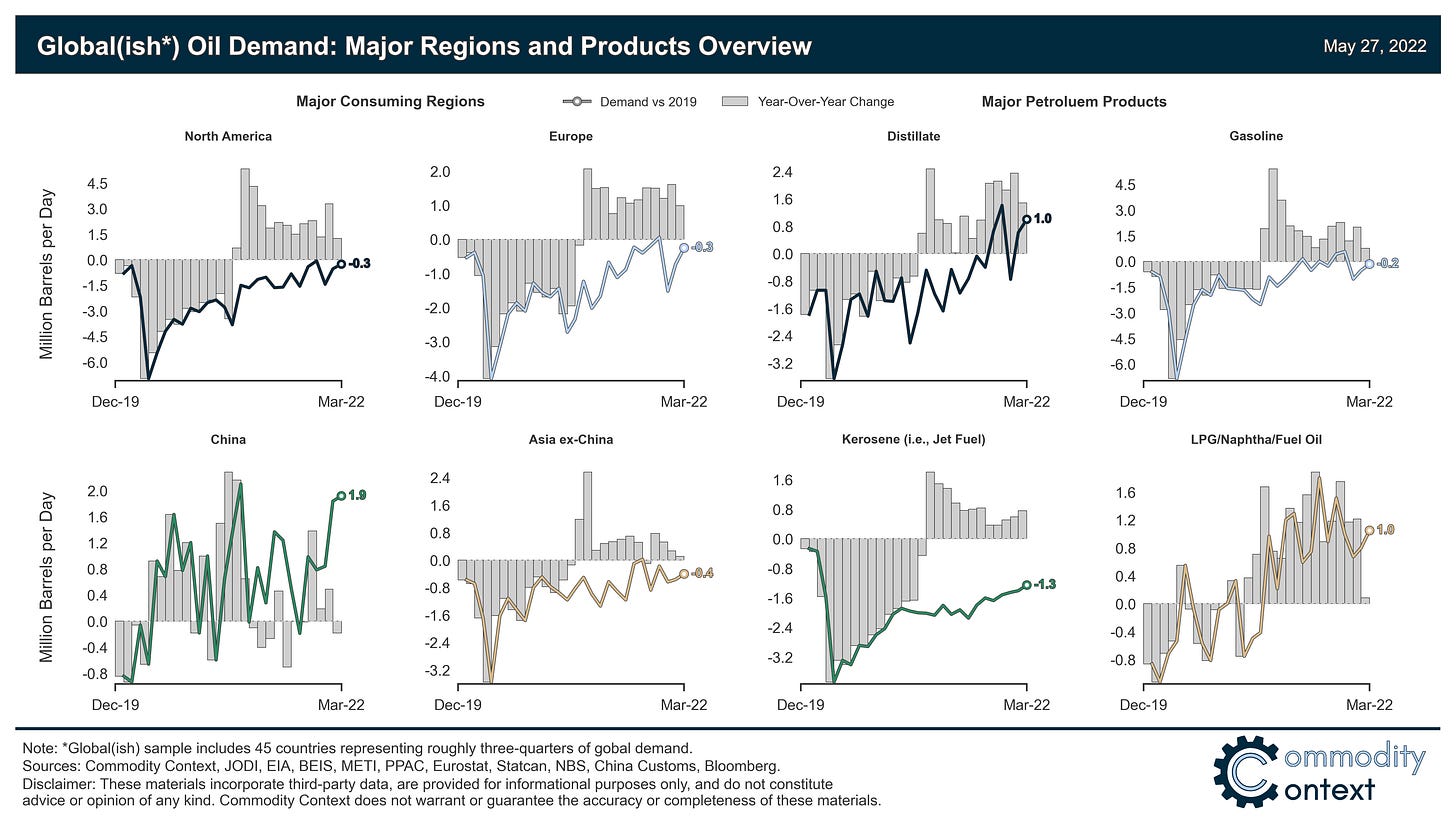

Overall global oil demand has rebounded to roughly pre-COVID levels and, despite a (hopefully) temporary slowing, looks set to begin durably exceeding the pre-pandemic norm later this year.

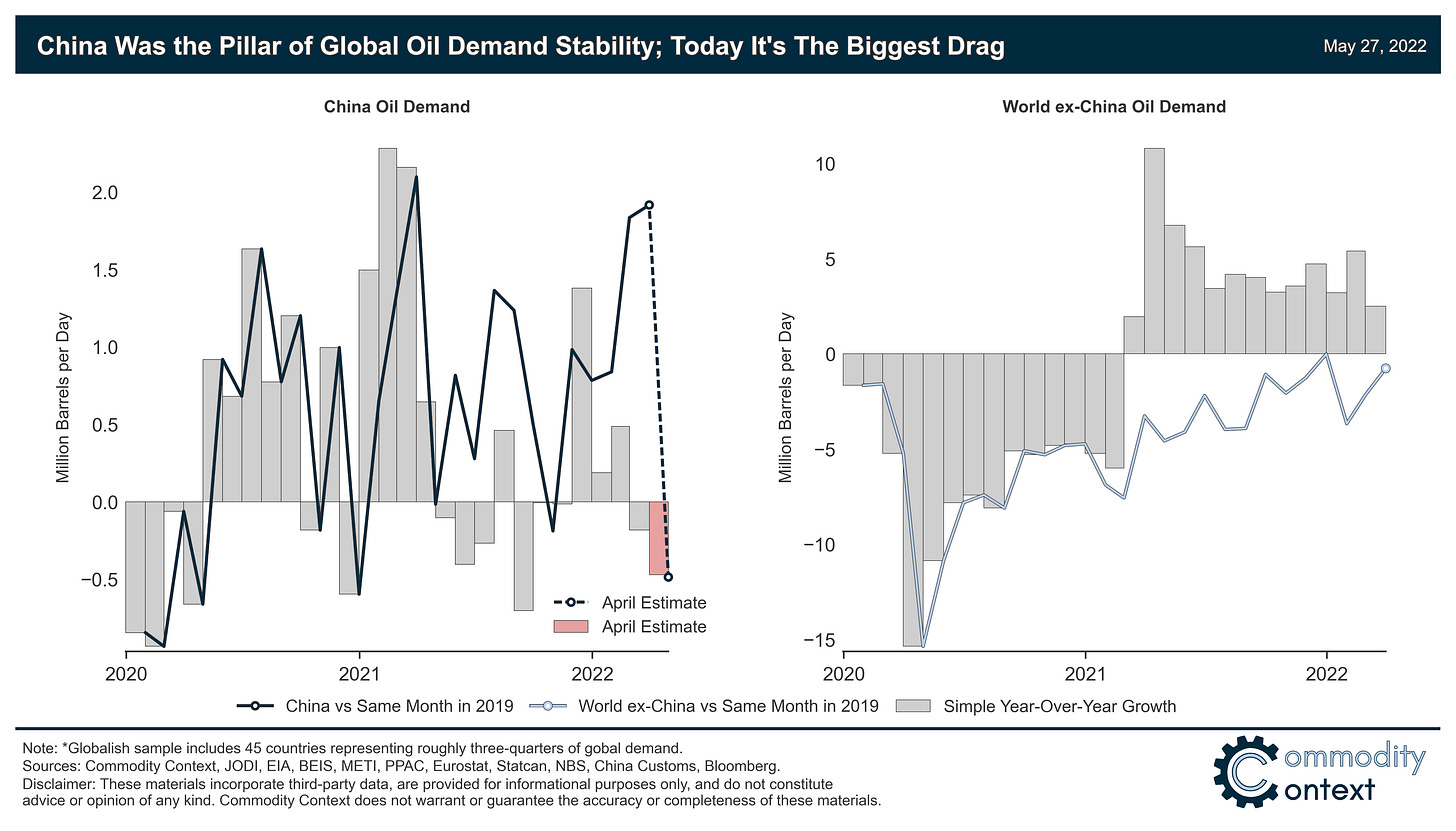

COVID-zero lockdowns in China are the single-largest drag on current global demand trends, though China’s positive contribution to global demand growth had already begun to wane part-way through last year.

Outside of China, the rest of the world has broadly followed the same script of rapid recovery but from much more depressed levels; however, continued price gains threaten to weigh further on consumption.

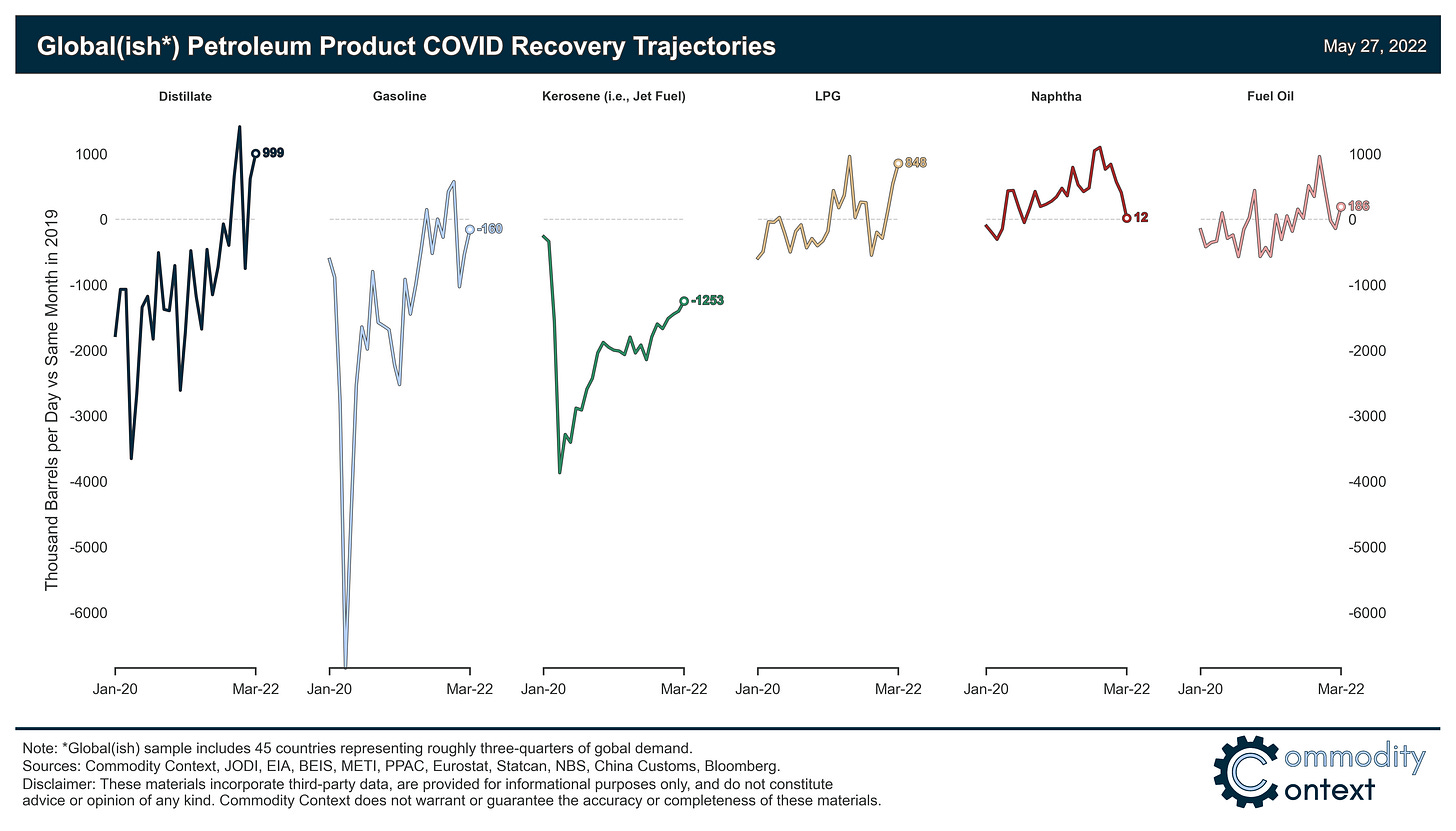

Certain products have faced more difficult trajectories than others: distillate (i.e., diesel) demand is the clear outperformer and while consumption of most refined fuels is at or above pre-COVID levels, jet fuel remains a sore spot, still nearly 25% below the norm.

Oil demand has been abnormally volatile in the COVID era, with the unprecedented collapse followed by a rapid but uneven recovery. There can be a tendency, in the oil market, to focus on the supply-side story—wildcatters, US shale, investable companies, OPEC, and now Russian intrigue—but supply and demand are equally important for global market balance, that’s just math. Demand is no less interesting, per se, but it’s nuanced and fragmented between different products and disparate, often-opaque industries. Not to mention the data is charitably terrible, a fact recently punctuated by the IEA’s announcement that it was chronically, structurally undercounting global demand for more than a decade.

So, where does demand stand today, more than two years into the pandemic? At the headline level, we’ve just about recovered to pre-COVID levels. And while the omicron variant over the winter momentarily took the market’s foot off the demand accelerator, global consumption looks set to reach fresh, definitive all-time highs later this year—if the world’s creaking refining infrastructure can sustain said flow.

Data Note: the “Global(ish)” demand sample assessed in this piece covers 45 countries that together account for roughly three-quarters of global consumption; data is sourced from national statistical agencies and blended with data maintained by JODI (which is fantastic resource you can play around with yourself here for free) and generally reflects surveyed/reported demand rather than a modeled result, is decomposed into consumption of major petroleum products, and provides a better picture of how things are going on the demand side than a global headline petroleum demand series alone. To benchmark demand recovery all periods are typically compared to the same month in 2019, which irons out some of the volatile pandemic wave base effects.

China Shifts from Pillar of Stability to Drag on Growth

The biggest demand story of 2022 by far has been China’s rolling lockdowns and mass quarantining pursued in an effort to maintain Beijing’s COVID-zero policy disposition. The COVID-zero policy helped the country serve as a rare source of relative demand resilience through the initial height of the pandemic, but has proved prohibitively costly to maintain amidst the more contagious recent COVID strains.

At the dawn of the pandemic, Beijing cracked down quickly, harshly, and—until recently—mostly effectively on domestic COVID spread, which, combined with tight border controls, facilitated a firm base of consumption compared to the rapid collapse across the rest of the world. Global demand outside of China fell to more than 15 MMbpd below 2019 levels in April 2020. Over that same period, China was only down 0.6 MMbpd, and by June 2020, Chinese demand was nearly 1.5 MMbpd above the pre-pandemic norm while the rest of the world continued to languish nearly 8 MMbpd below.

While China is the reason the current level of global demand has more or less recovered, it’s been a net drag on incremental demand growth since mid-2021 and the past few months of truly draconian lockdowns have added an anvil to that drag. Given China’s continued demand growth throughout COVID, the 2019 reference base isn’t as useful as it is for the rest of the world: for instance, consider that Chinese demand in March 2022 was nearly 2 MMbpd above March 2019 levels, but still 0.2 MMbpd below March 2021 levels.

Preliminary data indicates that the slowdown worsened further in April and into May as restrictions tightened, with demand falling another 1.2 MMbpd through April to the lowest level since March 2020. Holiday travel, especially, through May is anticipated to be well down compared to a year ago, exerting further drag on demand for transportation fuels like gasoline and jet fuel.

Rest of the World Picking Up China’s Demand Slack

Outside of China, the demand recovery has been relatively consistent over the past year-and-a-half. Three other major consuming regions—North America, Europe, and Asia ex-China—fell back sharply together in the spring of 2020, but have all spent the time since steadily regaining those prior heights. By the end of 2021, all three regions had more or less recovered to pre-COVID consumption levels–until the omicron variant depressed that demand once again, that is.

All else equal, global demand growth has been tepid through early 2022, but looks primed to set new records again during summer driving season. Indeed, Indian petroleum product demand hit a fresh all-time high of more than 5.1 MMbpd in February 2022 and remains high as of April at around 5.0 MMbpd. In addition to the now ever-present risk of new COVID variants, staggeringly high fuel prices caused by both tight crude markets and increasingly acute bottlenecks in global refining capacity threaten the ongoing demand recovery. Further price gains will very much try their best to weigh on consumption as we run thinner and thinner on inventories of diesel and gasoline.

Chad Diesel, Virgin Jet Fuel

A defining feature of this pandemic-era demand volatility has been product-level differences, which today can be summarized as: diesel good, jet fuel still bad.

Total petroleum product demand across this global sample saw growth of 1.2 MMbpd in March vs. the same period in 2019. This is only the second month of recovery above pre-COVID levels, and, to be honest, March 2019 was an abnormally/seasonally weak base of comparison. Putting that all together, I’d say that global oil demand has recovered to just less than the pre-COVID norm at this stage, and looks set to definitively break through once China’s lockdowns ease–at least barring a broader global macroeconomic slowdown.

Meanwhile, kerosene (most of which is jet fuel) demand remains roughly one-quarter lower in March 2022 than March 2019. The recovery has remained relatively steady, with the roughly 1.2 MMbpd kerosene deficit vs. pre-COVID levels looking set to close over the coming year if the recent pace is maintained. Gasoline was initially the largest contributor to global demand losses in early 2020, but rebounded quickly with demand more or less at pre-COVID levels now. Demand for distillates like diesel and gasoil, on the other hand, didn’t feel all that much of a COVID hit and today represents the single strongest source of total barrel growth at roughly 1 MMbpd above pre-COVID levels, which also goes a long way to explaining the seemingly ever-worsening diesel prices.

Conclusion

Global oil demand has roughly recovered to pre-COVID levels and—despite recent omicron-related sluggishness and China’s COVID-zero lockdowns—looks set to definitively move higher over the summer and into next year. It’s especially impressive that these demand heights are remaining so lofty despite sky-high prices, but those prices continue to drift higher and will persist in their attempt to tamp down consumption of increasingly scarce refined fuels.

Reminder that much of this enhanced product-level demand tracking capability will be added to my monthly Global Oil Data Deck to continue tracking going forward.

Enjoy this post? Curious what the rest of 2022 will yield for the already wild oil market? Please consider SUBSCRIBING to continue receiving my data-centric, chart-forward oil & gas market research directly to your inbox.

I'm long oil (basically just a play on the ascent of man) but I can't get the thought outa my head that if we get a proper recession then all bets are off, demand wise I mean across the entire commodity spectrum.