Current Context—Oil in August 2024

Assessing our current, fundamentally oversold position in the context of the short- and medium-term oil market cycle, with near-term price risks tilted to the upside.

Welcome to Current Context, where we occasionaly bring together our regular data, weekly tracking, and thematic deep dives to provide a point-in-time view of the oil market.

This is the type of data-driven narrative that I more regularly share with clients, media, and podcasts—most recently with Tracy Shuchart on the MicDropMarkets podcast (listen here) for an oil market conversation with Arjun Murti, and with Erik Townsend on the MacroVoices podcast (listen here).

If you’re already subscribed and/or appreciate the free summary, hitting the LIKE button is one of the best ways to support my ongoing research.

High transparency oil inventories (OECD and weekly US) continue to support current prices and indicate a fundamentally-justified fair price in the low-$80s per barrel on a Brent basis.

Near-term fundamental expectations are relatively bearish given slowing global demand growth driven by China’s contracting consumption and OPEC+’s [market-contingent] plans to normalize production beginning later this year, though the producer group is unlikely to ease cuts fully into such a weak market.

Speculative capital continues to add cyclical intrigue on top of these slower moving fundamental signals; these days, hot money flows have become crude’s primary anticipated tailwind after net managed money positions bottomed at exceptionally oversold levels early last week.

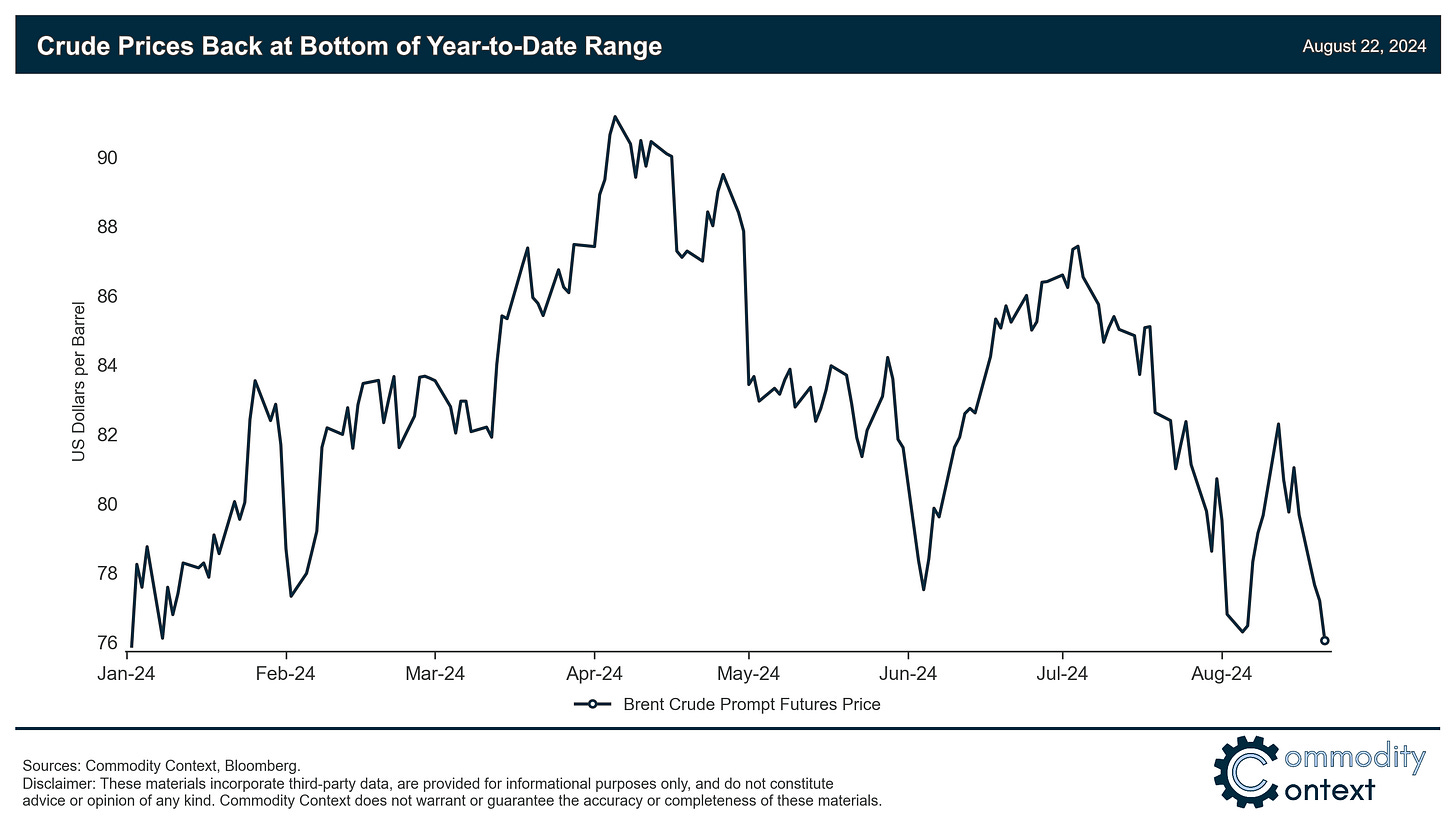

At roughly $76 per barrel, Brent crude prices are at the bottom of their year-to-date range and everyone is talking about how much further the barrel could fall from here. Contracts have been dragged lower by renewed recessionary demand concerns—and already outright contracting consumption in China—but that pullback has been punctuated by a flurry of geopolitical headlines that potentially threaten global oil supply. It’s a truism that price drives narrative; so, the constant snap of narrative whiplash has been understandably frustrating for market participants over the past year—without much in the way of payoff in either direction. Prices are up, then they’re down.

What’s actually happening in the oil market right now?

In brief, oil prices are fairly valued in the low-$80s (Brent) given prevailing high-visibility inventory levels. Prices are feeling steady downside pressure from deteriorating demand conditions that, when coupled with OPEC+’s current (“market-contingent”) stated plan to begin increasing production in October, paint a picture of building oil inventories and lower prices next year. Finally, momentum-driven speculative capital flowing into and out of crude futures and options contracts are now firmly a tailwind for prices after reaching steeply oversold levels as of last week.

Let’s dig in.