China’s High Demand Bar

Chinese petroleum product demand grew more last year than any country in history, setting an impossibly high bar against which any pace of demand growth in 2024 will look far more modest.

If you’re already subscribed and/or appreciate the free summary, hitting the LIKE button is one of the best ways to support my ongoing research.

Chinese demand growth was incredibly strong last year, outpacing the experience of any country on record in absolute barrel terms.

Demand eased through the end of 2023 and into early 2024, but domestic refining activity is rallying again and signaling strong anticipated consumption coming out of Chinese New Year festivities.

However, 2023 set an impossibly high bar and even strong 2024 gains will look modest in comparison; ongoing data disputes between major statistical agencies regarding Chinese demand estimates will further muddy the discussion.

The recovery in domestic refinery activity is split between state-owned refineries and private so-called teapots, with the former revving back to high utilization rates in March while the latter continues to languish under rationalization pressure from Beijing.

All major outlooks see China leading the world in demand growth once again in 2024, rising 500-700 kbpd, though wide differentials in both growth forecasts and realized 2023 demand estimates will make apples-to-apples comparisons tricky and prone to misunderstanding—which is an issue given the importance China will play in setting the tone for global growth this year.

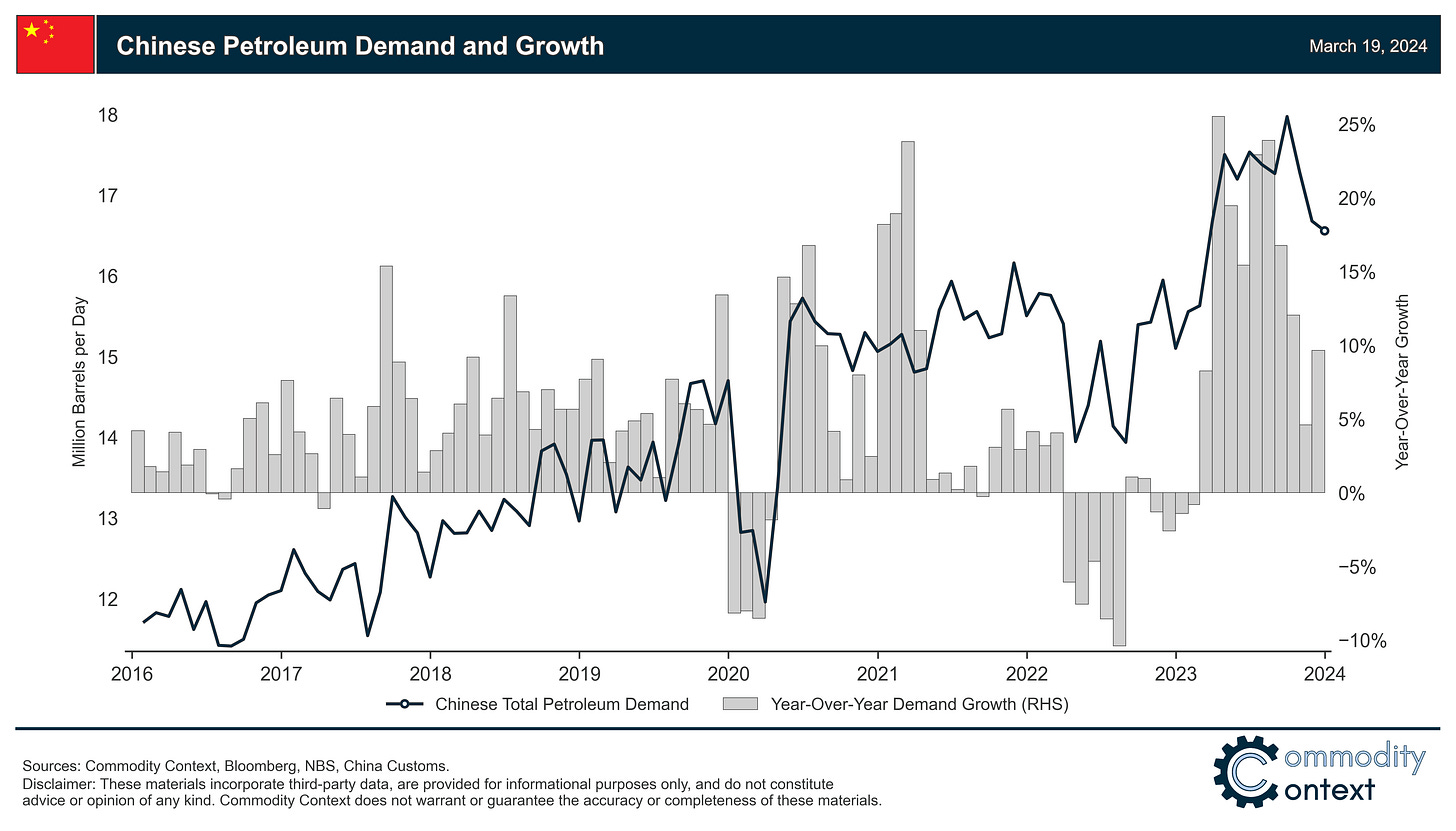

Chinese apparent petroleum demand was exceptionally strong in 2023, reaching a record annual average level of 16.9 MMbpd and a truly staggering all-time-high monthly average of 18 MMbpd in September according to Commodity Context calculations. This consumption record vaulted year-over-year growth in Chinese demand to nearly 2 MMbpd, the fastest volumetric gain of any country on record. China also accounted for the lion’s share of global demand growth, alone driving more than 80% of the global gain.

However, it is important to recognize that this remarkable demand growth comes off of the depressed base effects of Beijing’s draconian and demand obstructing COVID-zero policies through 2022. In fact, 2022 represented the first year in modern Chinese history—two to three decades, or more, depending on the data used—that annual average petroleum demand actually contracted, a stark departure from China’s typical role as the single-largest driver of incremental petroleum demand.

Now, the headlines are pinballing between proclaiming, alternatively, a slowdown or surge in Chinese demand; but, arguably, last year’s performance sets an impossibly high bar against which any growth is going to look far more modest. Chinese apparent consumption pulled back at the end 2023 from that high-water mark in September and continued to slide through early 2024. However, apparent demand is beginning to rebound in March and local economic reporting indicates that conditions remain supportive of robust petroleum product consumption this year.

What do we know so far and where could Chinese demand figures reasonably head this year?