Canadian Barrel Goes [Further] Global

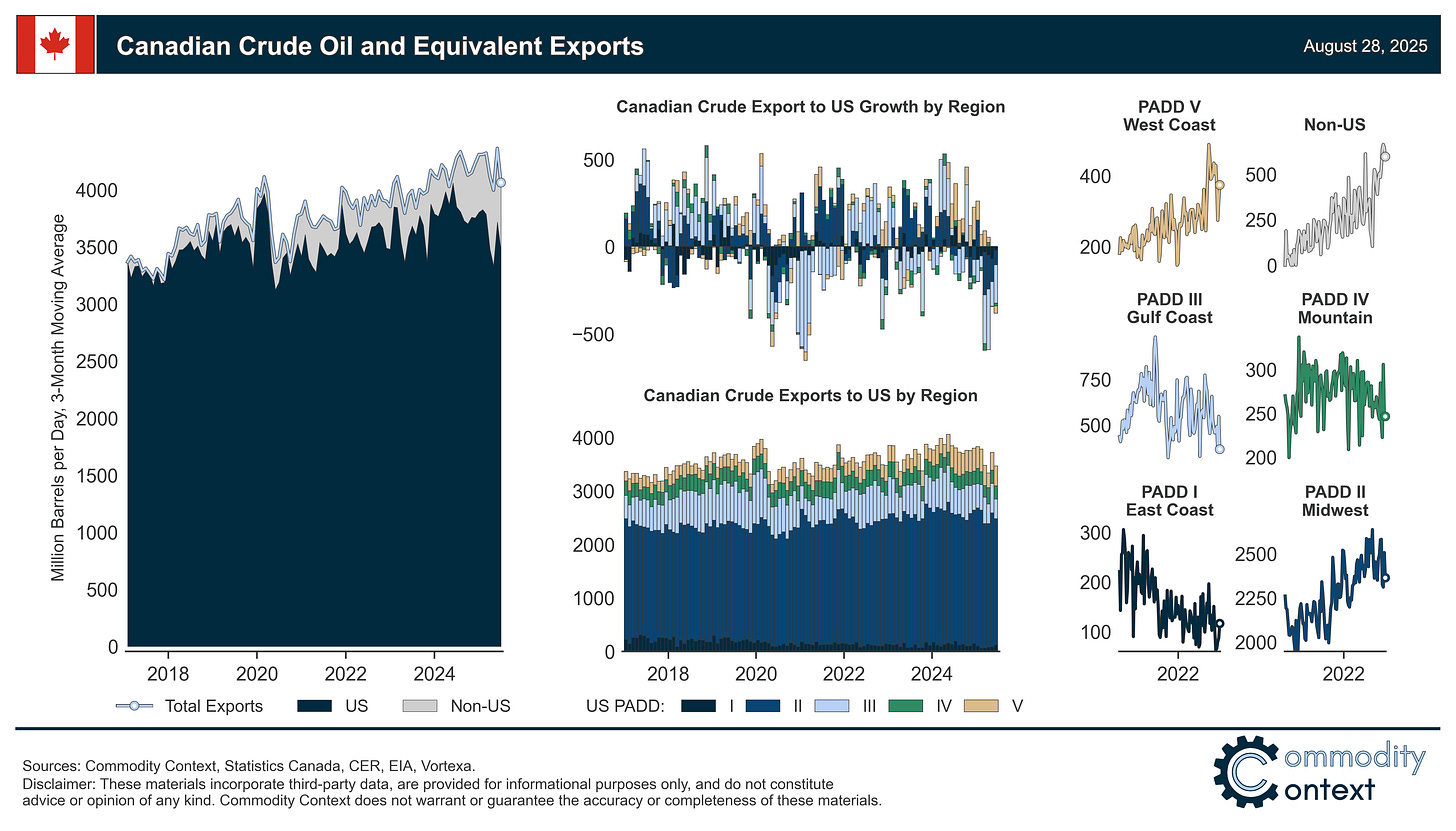

TMX has shifted Canadian crude flows west, entrenched China as Canada’s second-largest crude export market, and rerouted flows away from recent growth markets like USGC refineries and re-exports.

As part of my ongoing updates to the Canada-US oil model that drives the monthly North American Oil Data Deck, this week I explored the shifts in Canadian crude exports following the start-up of the Trans Mountain Expansion pipeline. These updated exhibits will be included in the newest edition of the North American Oil Data Deck (exclusive to paid subscribers) published next week and updated going forward.

If you’re already subscribed and/or appreciate the free summary, hitting the LIKE button is one of the best ways to support my ongoing research.

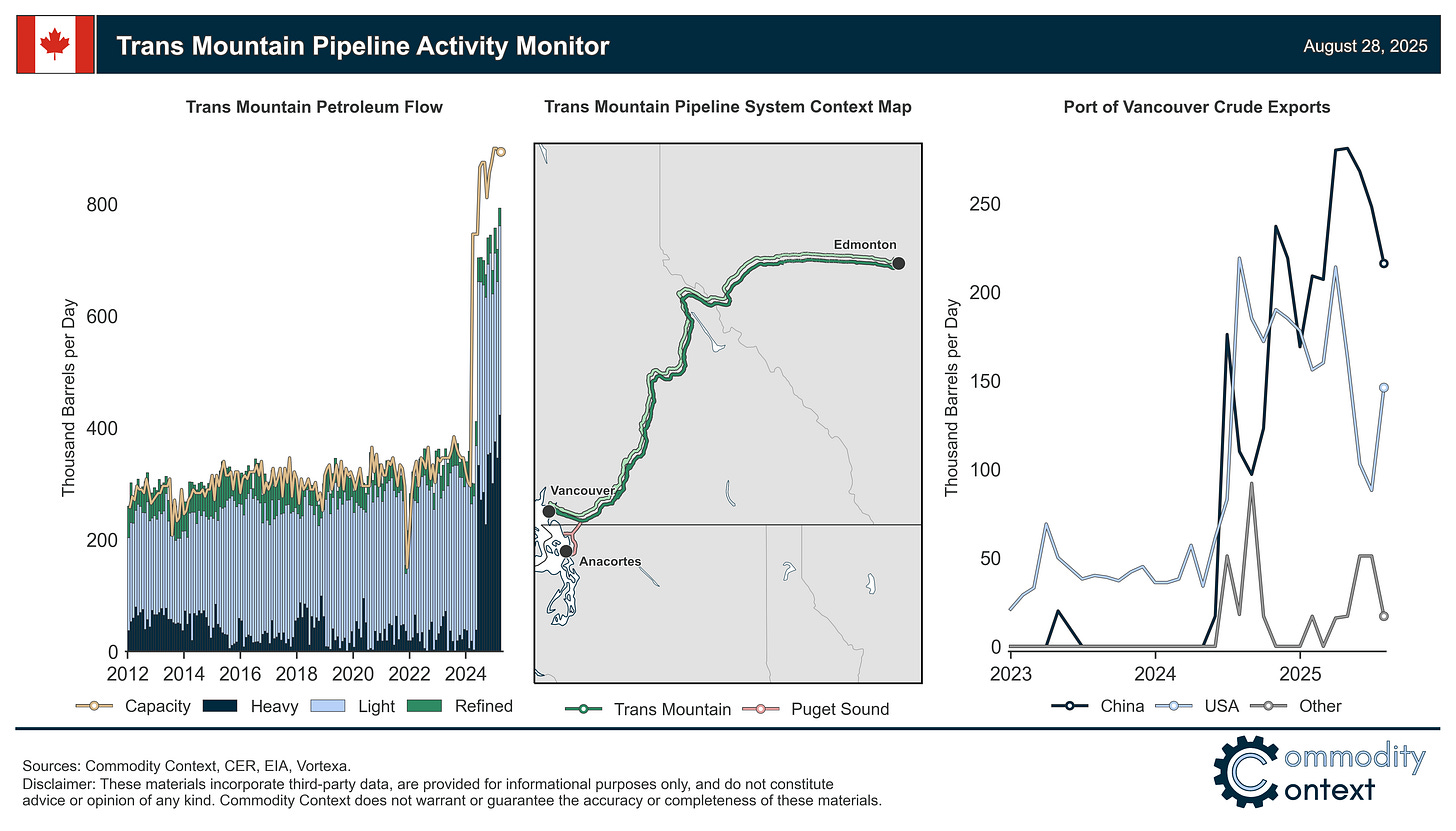

Canadian West Coast crude exports have surged higher over the past year (from previously-negligible levels) following the completion of TMX, with more than half headed to China and US refineries in the LA-area as the next largest buyer.

The rerouting of Canadian crude export flows through TMX to the West Coast diverted southbound Canadian pipeline flows into the US; the heaviest contraction has been in the US Gulf Coast given both reduced USGC refiner demand and the pullback in the USGC Canadian crude re-export trade.

US West Coast imports of Canadian crude rose as LA-area refineries, previously inaccessible to Canadian marketers, have taken just shy of half of ex-TMX crude.

Total Canadian crude exports to non-US destinations (including USGC reexports) have doubled, though official government data makes the increase look even larger due to a structural undercounting of USGC re-exported volumes to non-US markets.

Chinese buying of West Coast Canadian crude represented a shift from seasonal USGC re-export demand to more durable direct purchases of ex-TMX barrels, and builds off of an established trade history.

India has been notably absent from the ex-TMX market but remains the dominant offtaker of re-exports from the USGC, proving there isn’t an outright absence of Indian heavy oil demand.

Western Canadian crude is finally heading further west, durably reaching markets beyond the United States for the first time directly from Canadian shores. Canada is the world’s fourth-largest oil producer but, unique amongst its top-producing peers (like Saudi Arabia, Russia, and the United States), virtually every drop of Canadian hydrocarbon supplies have historically ended up in one country alone: the United States. Over the past year that began to change following the completion of the Trans Mountain Expansion Project (TMX).

The expansion project tripled westbound crude egress capacity to 890 kbpd from the legacy Trans Mountain system’s ~300 kbpd. The TMX pipeline’s journey to completion was an ordeal, to say the least. It took five times as long to build as initially expected 2-year construction timeline; at $35bn, cost nearly 7-times the original expected price tag; and needed to be nationalized by the then-Trudeau government to get it across the finish line following proponent Kinder Morgan’s announced intention to abandon the project given political and legal challenges. Still, the pipeline was, indeed, finally finished and began shipping crude to Canada’s west coast in May 2024.

Most remarkably, the expansion has dramatically grown access to Asian markets. Some Canadian crude was already making the incredibly circuitous voyage to Asia via re-exports out of the US Gulf Coast, but TMX wedged that initial market access crack into a full-blown trade route. China recently overtook the US as the main export destination for ex-TMX barrels, entrenching China as Canada’s second-largest crude export market. Of course, American consumptive gravity is enormous and, even with the option to bypass the States, roughly half of the expanded oil flows out of the Port of Vancouver are still destined for the US—but now to the LA-area, which was previously inaccessible.

So, how has the startup of TMX actually impacted the flows of Canadian crude? Let’s dig in.